The LVGEM (China) Real Estate Investment (HKG:95) Share Price Is Down 24% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by LVGEM (China) Real Estate Investment Company Limited (HKG:95) shareholders over the last year, as the share price declined 24%. That falls noticeably short of the market return of around -11%. On the bright side, the stock is actually up 8.0% in the last three years. On top of that, the share price has dropped a further 8.7% in a month. However, we note the price may have been impacted by the broader market, which is down 6.1% in the same time period.

View our latest analysis for LVGEM (China) Real Estate Investment

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the LVGEM (China) Real Estate Investment share price fell, it actually saw its earnings per share (EPS) improve by 14%. It's quite possible that growth expectations may have been unreasonable in the past. It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

LVGEM (China) Real Estate Investment's revenue is actually up 52% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

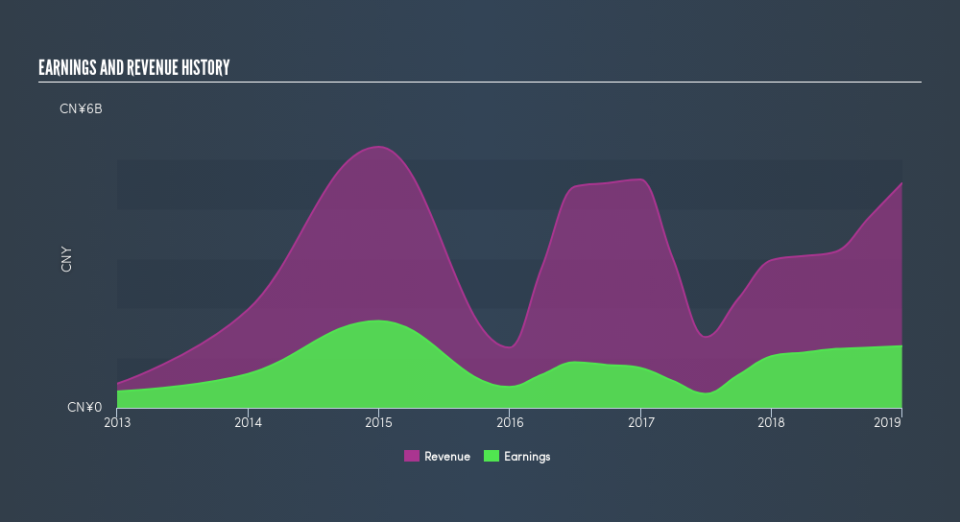

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of LVGEM (China) Real Estate Investment's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between LVGEM (China) Real Estate Investment's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that LVGEM (China) Real Estate Investment's TSR, which was a 22% drop over the last year, was not as bad as the share price return.

A Different Perspective

The last twelve months weren't great for LVGEM (China) Real Estate Investment shares, which performed worse than the market, costing holders 22%, including dividends. Meanwhile, the broader market slid about 11%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 4.2% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

LVGEM (China) Real Estate Investment is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.