Lydall, Inc. Just Missed Earnings; Here's What Analysts Are Forecasting Now

One of the biggest stories of last week was how Lydall, Inc. (NYSE:LDL) shares plunged 43% in the week since its latest yearly results, closing yesterday at US$12.47. Revenues came in at US$837m, in line with estimates, while Lydall reported a statutory loss of US$4.08 per share, well short of prior analyst forecasts for a profit. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Lydall

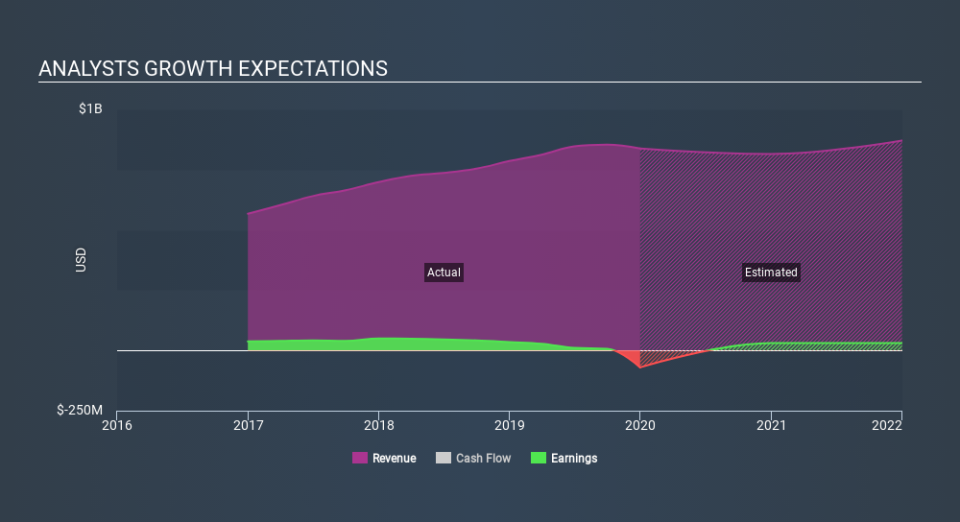

Taking into account the latest results, Lydall's dual analysts currently expect revenues in 2020 to be US$838.9m, approximately in line with the last 12 months. Earnings are expected to improve, with Lydall forecast to report a statutory profit of US$0.68 per share. In the lead-up to this report, analysts had been modelling revenues of US$867.8m and earnings per share (EPS) of US$1.57 in 2020. Analysts seem less optimistic after the recent results, reducing their sales forecasts and making a pretty serious reduction to earnings per share forecasts.

It'll come as no surprise then, to learn that analysts have cut their price target 7.4% to US$25.00.

It can also be useful to step back and take a broader view of how analyst forecasts compare to Lydall's performance in recent years. We would highlight that Lydall's revenue growth is expected to slow, with forecast 0.2% increase next year well below the historical 12%p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the market, which are in aggregate expected to see revenue growth of 2.0% next year. Factoring in the forecast slowdown in growth, it seems obvious that analysts still expect Lydall to grow slower than the wider market.

The Bottom Line

The biggest concern with the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Lydall. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by the latest results, leading to a lower estimate of Lydall's future valuation.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2021, which can be seen for free on our platform here.

It might also be worth considering whether Lydall's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.