Madewell's web traffic is exploding – and that's good news for its forthcoming IPO

When it comes to growth, Madewell has topped its parent company J. Crew on nearly every measure in recent years.

According to exclusive new data from web analytics firm SimilarWeb, the on-trend retailer can add yet another metric to that list.

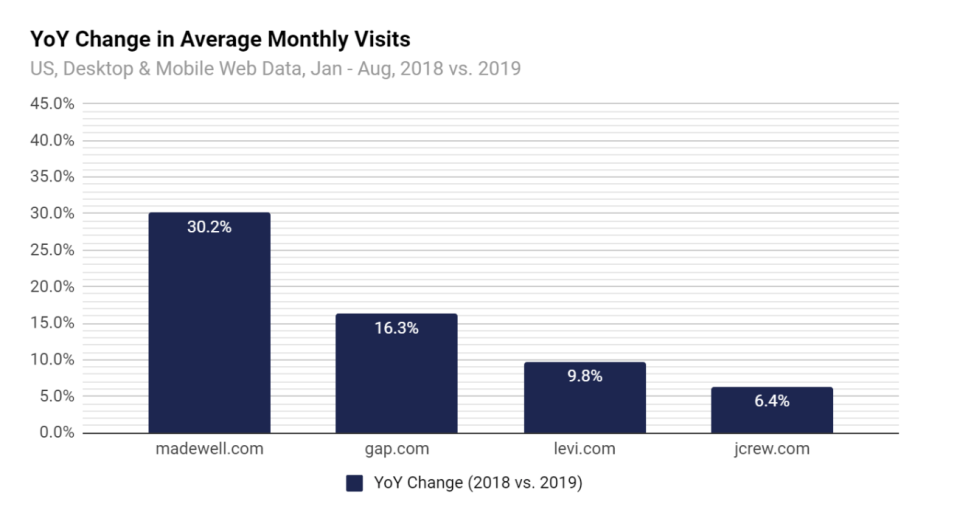

In the first eight months of this year, U.S. web traffic to Madewell.com surged by 30.2% over the comparable period last year, and by 90.3% over the same period in 2017, totaling 3.89 million total views.

While the absolute number of visits came in short of J. Crew’s 9.23 million over the same period this year, J. Crew’s web traffic growth rate clocked in at just 6.4%.

“You don’t really see a lot of retailers at this size grow at this rate,” SimilarWeb analyst Ilana Marks told Yahoo Finance of Madewell’s results. “Sometimes we’ll see a site that maybe just launched or is on the smaller side and it grows by 100%, but that’s increasing from 100,000 to 200,000.”

“This type of volume and this type of growth is significant,” she said.

Madewell’s web traffic growth also surpassed that of peer retailers. Anthropologie.com – the next closest competitor by web traffic to Madewell, based on SimilarWeb’s analysis – saw traffic grow 18.2% in the eight months ending in August. Urbanoutfitters.com’s traffic increased by 7.5%, and Freepeople.com decreased by 6.1% during that period this year. Each of these brands is owned by parent-company URBN (URBN).

Madewell’s web traffic data serves as another promising sign of growth for the company as it paces toward an initial public offering, especially given the digital dependence of its business. Madewell derived 40% of sales from e-commerce channels in the first six months of this year and had a brick-and-mortar footprint of just 132 locations as of August, the company said in its S-1 prospectus.

Other data on Madewell’s web traffic also underscored an opportunity for further online growth in the brand.

The share of Madewell’s traffic from non-branded web searches increased to 8.3% in 2019 from 7.4% a year prior, according to SimilarWeb data. The increase, albeit slim, suggested a growing number of browsers came to Madewell’s website simply by searching for generic retail terms like “work sandals” or “denim skirt,” as opposed to searching with a variation of the company name in the query. The balance – and vast majority – of web visits still came from branded searches.

“The fact that they’re getting traffic now from these retail related keywords like ‘A-line skirt’ or ‘sandals’ is actually a good thing,” Marks said. “They already have the brand awareness. Ninety-two percent of their traffic is branded. So in order to grow beyond the people that already know about Madewell, this increase in non-branded traffic is actually very good.”

Some of this search growth has been a function of Madewell’s own investment, Marks noted. Madewell said in its prospectus that its marketing costs rose by $23 million in the first half of the year over 2018, due largely to higher spend on digital marketing.

But these extra dollars did generate a return, with paid search driving 10.5% of Madewell’s desktop traffic from 2% last year, and display ads accounting for 12.3% of desktop traffic, from 2.8% last year, according to SimilarWeb data.

‘Billion-dollar business’

J. Crew in September filed for an IPO for Madewell, grooming it for a public debut as growth at the flagship brand slumped.

Revenue from the J. Crew brand has fallen on a year-over-year basis every year starting in fiscal 2015, and most recently decreased 4% to $1.78 billion for the fiscal year ending February. But Madewell’s net sales grew by double-digit percentages every year for at least the past five years, most recently climbing 26% to $529 million.

“It’s going to scale to a billion-dollar business over the next, let’s say three years,” Janet Kloppenburg, retail analyst at JJK Research, told Yahoo Finance.

Madewell’s performance diverges both from its parent company and some of its retail competitors, which have fought to stay relevant amid a trend toward casualization and digitalization in fashion.

“When the brand is right and has attractive iconic pillars – that Madewell has – it works,” Kloppenburg said. “The apparel customer is always there. But they’re not going to buy something they don’t like or something that doesn’t resonate with their lifestyle or their ethics.”

Those struggles have appeared both in many peer retailers’ financial results and in SimilarWeb’s web traffic analyses.

Gap (GPS), which has previously announced plans to spin off Old Navy as a standalone company, saw web traffic rise 16.3% from 2018 to 2019, putting it nearly 14 percentage points behind Madewell’s growth rate. This came as Gap’s overall net sales during the first half of this year sank 2% over the year-ago period, with closely watched comparable same-store sales at each of its major brands posting declines.

“Gap has had a hard time identifying who their customer base is,” Kloppenburg said. “And I think Madewell went right into that 18-30 year old target market and identified it early.”

For Madewell, “it’s a millennial brand ... it really identified its core customer – someone who’s casual, but alternative at the same time. It’s a customer who wants versatility in their wardrobe and wants quality and value at the same time. I think all of those attributes are what made Madewell resonate and also made Madewell cool,” Kloppenburg said.

At least one other retailer this year has ridden the wave of recent growth to the public market – and in doing so, avoided some of the stock volatility seen by other recently public consumer-facing companies. In March, blue-jean inventor Levi Strauss (LEVI) listed on the New York Stock Exchange in its return to the public market, just after nearly doubling its revenue growth rate to 14% in the last full fiscal year.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

FedEx CEO: ‘Whistling past the graveyard’ on the U.S. consumer belies a broader slowdown

There won’t be ‘billion-dollar beverage brands’ in the future: Iris Nova CEO

Iris Nova CEO calls his company the ‘Netflix’ of the beverage space

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read the latest stock and stock market news from Yahoo Finance