Main Street (MAIN) Q1 Earnings Beat Estimates, Expenses Up

Main Street Capital Corporation’s MAIN first-quarter 2021 net investment income of 58 cents per share surpassed the Zacks Consensus Estimate of 55 cents. Also, the bottom line rose 2% from the year-ago figure.

Results benefited from higher total investment income. Also, the liquidity position remained strong in the quarter. However, rise in operating expenses posed a headwind.

Distributable net investment income was $42.1 million, up 7% from the prior-year quarter.

Total Investment Income Increases, Expenses Rise

Total investment income was $62.8 million, up 12% from the year-ago quarter. Higher dividend income resulted in the upside. The top line also beat the Zacks Consensus Estimate of $58.7 million.

Total expenses increased 18% year over year to $23.1 million. Higher compensation led to the rise.

Strong Balance Sheet Position

As of Mar 31, 2021, Main Street’s net asset value was $22.65 per share compared with $22.35 on Dec 31, 2020.

As of Mar 31, 2021, the company had $65 million in cash and cash equivalents, $693 million of unused capacity under credit facility, with which it seeks to support investment and operating activities. Also, it had $60 million of remaining SBIC debenture capacity.

Our Take

Steady improvements in total investment income and strong origination volume are anticipated to support the company’s bottom line. Moreover, strong liquidity position keeps it well poised for growth. However, elevated costs remain a concern.

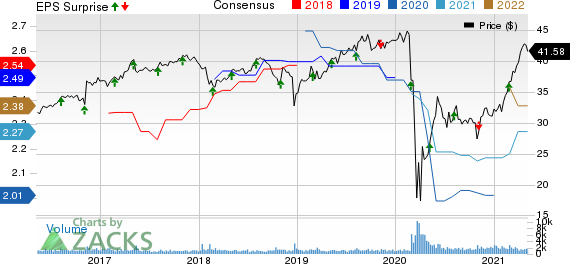

Main Street Capital Corporation Price, Consensus and EPS Surprise

Main Street Capital Corporation price-consensus-eps-surprise-chart | Main Street Capital Corporation Quote

Currently, Main Street carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Ares Capital Corporation’s ARCC first-quarter 2021 core earnings of 43 cents per share surpassed the Zacks Consensus Estimate of 42 cents. Moreover, the bottom line reflects a rise of 4.9% from the prior-year quarter’s reported number.

Hercules Capital Inc.’s HTGC first-quarter 2021 net investment income of 30 cents per share beat the Zacks Consensus Estimate by a penny. However, the bottom line declined 18.9% year over year.

TriplePoint Venture Growth BDC Corp. TPVG first-quarter 2021 net investment income was came in at 29 cents per share. The bottom line plunged 29.3% from the year-ago quarter.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

TriplePoint Venture Growth BDC Corp. (TPVG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research