Mainfreight Limited (NZSE:MFT): The Yield That Matters The Most

Two important questions to ask before you buy Mainfreight Limited (NZSE:MFT) is, how it makes money and how it spends its cash. After investment, what’s left over is what belongs to you, the investor. This also determines how much the stock is worth. Today we will examine MFT’s ability to generate cash flows, as well as the level of capital expenditure it is expected to incur over the next couple of years, which will result in how much money goes to you.

See our latest analysis for Mainfreight

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

What is free cash flow?

Mainfreight’s free cash flow (FCF) is the level of cash flow the business generates from its operational activities, after it reinvests in the company as capital expenditure. This type of expense is needed for Mainfreight to continue to grow, or at least, maintain its current operations.

The two ways to assess whether Mainfreight’s FCF is sufficient, is to compare the FCF yield to the market index yield, as well as determine whether the top-line operating cash flows will continue to grow.

Free Cash Flow = Operating Cash Flows – Net Capital Expenditure

Free Cash Flow Yield = Free Cash Flow / Enterprise Value

where Enterprise Value = Market Capitalisation + Net Debt

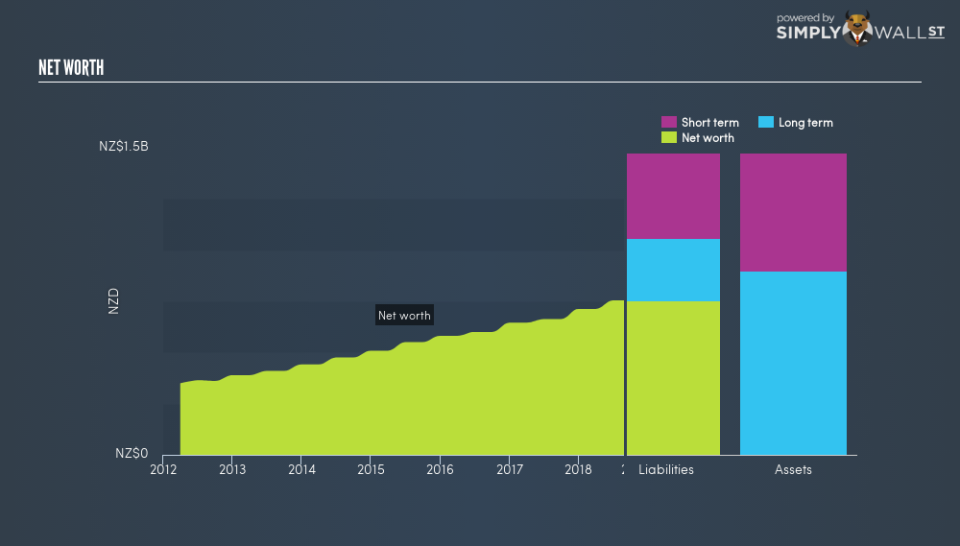

Mainfreight’s yield of 1.36% indicates its sub-standard capacity to generate cash, compared to the stock market index as a whole, accounting for the size differential. This means investors are taking on more concentrated risk on Mainfreight but are not being adequately rewarded for doing so.

Does Mainfreight have a favourable cash flow trend?

Can MFT improve its operating cash production in the future? Let’s take a quick look at the cash flow trend the company is expected to deliver over time. In the next few years, the company is expected to grow its cash from operations at a double-digit rate of 42%, ramping up from its current levels of NZ$154m to NZ$219m in two years’ time. Although this seems impressive, breaking down into year-on-year growth rates, MFT’s operating cash flow growth is expected to decline from a rate of 28% next year, to 11% in the following year. But the overall future outlook seems buoyant if MFT can maintain its levels of capital expenditure as well.

Next Steps:

The company’s low yield relative to the market index means you are taking on more risk holding the single-stock Mainfreight as opposed to the diversified market portfolio, and being compensated for less. Though the high operating cash flow growth in the future could change this. Now you know to keep cash flows in mind, You should continue to research Mainfreight to get a more holistic view of the company by looking at:

Valuation: What is MFT worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MFT is currently mispriced by the market.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Mainfreight’s board and the CEO’s back ground.

Other High-Performing Stocks: If you believe you should cushion your portfolio with something less risky, scroll through our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.