Mairs and Power Sells UPS, Abbott Labs

The investment firm Mairs and Power (Trades, Portfolio) sold shares of the following stocks during the third quarter.

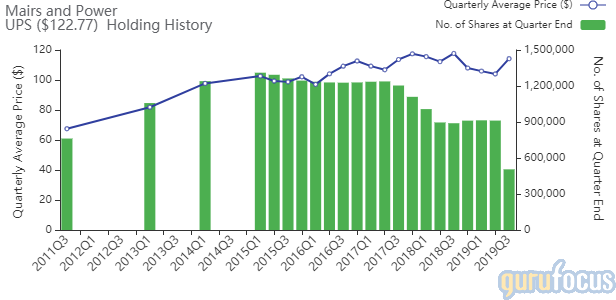

United Parcel Service Inc.

During the quarter, the firm trimmed its United Parcel Service Inc. (UPS) stake by 44.57%. The portfolio was impacted by -0.50%.

The parcel delivery company has a market cap of $105.31 billion and an enterprise value of $127.26 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 127.86% and return on assets of 9.81% are outperforming 88% of companies in the Transportation industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.17 is below the industry median of 0.28.

The largest guru shareholder of the company is Bill Gates (Trades, Portfolio)' foundation with 0.53% of outstanding shares, followed by T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.29%.

Schlumberger Ltd.

The investment firm trimmed its Schlumberger Ltd. (SLB) holding by 42.56%. The portfolio was impacted by -0.46%.

The company, which operates in the oil and gas industry, has a market cap of $48.02 billion and an enterprise value of $62.82 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -29.46% and return on assets of -14.63% are underperforming 77% of industry competitors. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.14.

The largest guru shareholder of the company is Dodge & Cox with 4.27% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 2.06% and Barrow, Hanley, Mewhinney & Strauss with 1.18%.

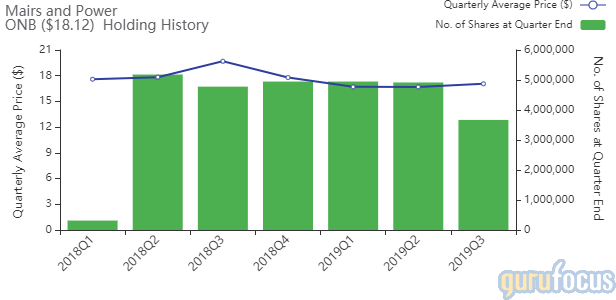

Old National Bancorp

The Old National Bancorp (ONB) position was reduced by 25.38%, impacting the portfolio by -0.25%.

The financial services bank holding company has a market cap of $3.08 billion and an enterprise value of $104.74 million.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity of 8.89% is underperforming the sector, return on assets of 1.21% is outperforming 66% of companies in the bankking industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.18 is below the industry median of 1.14.

The largest guru shareholder of the company is Mairs and Power (Trades, Portfolio) with 2.16% of outstanding shares, followed by Private Capital (Trades, Portfolio) with 0.10% and HOTCHKIS & WILEY with 0.05%.

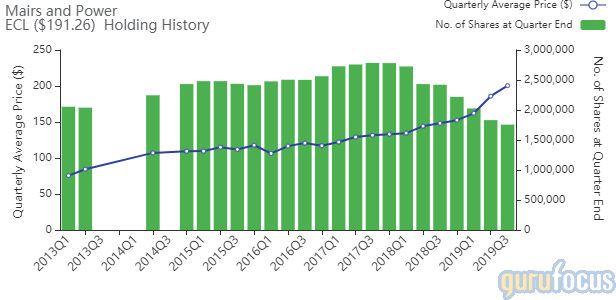

Ecolab Inc.

The firm cut its Ecolab Inc. (ECL) position by 4.11%. The trade had an impact of -0.18% on the portfolio.

The cleaning and sanitation products manufacturer has a market cap of $55.13 billion and an enterprise value of $62.36 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 18.61% and return on assets of 7.43% are outperforming 70% of companies in the chemicals industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.62.

The largest guru shareholder of the company is Gates with 1.51% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.61% and Tom Gayner (Trades, Portfolio) with 0.10%.

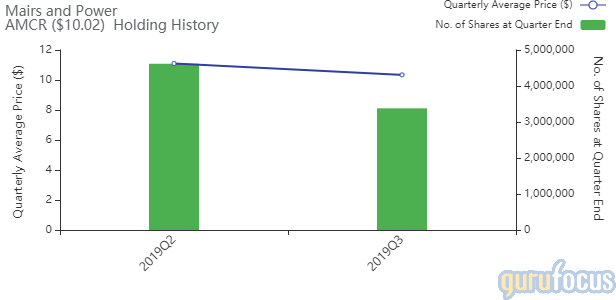

Amcor PLC.

The firm trimmed the Amcor PLC. (AMCR) holding by 26.81%. The portfolio was impacted by -0.17%.

The packaging solutions provider has a market cap of $16.23 billion and an enterprise value of $20.31 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 16.92% and return on assets of 3.69% are outperforming 54% of companies in the packaging and containers industry. Its financial strength is rated 4 out of 10, with a cash-debt ratio of 0.1 that is below the industry median of 0.34.

Another notable guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.10% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.03%.

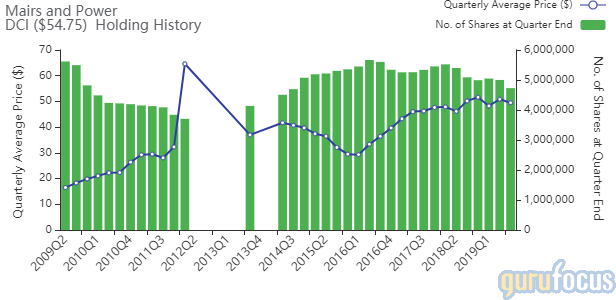

Donaldson Co. Inc.

The Donaldson Co. Inc. (DCI) stake was reduced by 5.45%. The portfolio was impacted by -0.17%.

The company, which manufactures filtration systems and replacement parts, has a market cap of $6.91 billion and an enterprise value of $7.37 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 30.38% and return on assets of 12.56% are outperforming 92% of companies in the industrial products industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.28 is below the industry median of 0.89.

Another notable guru shareholder of the company is Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.62% of outstanding shares, followed by Simons with 0.05%.

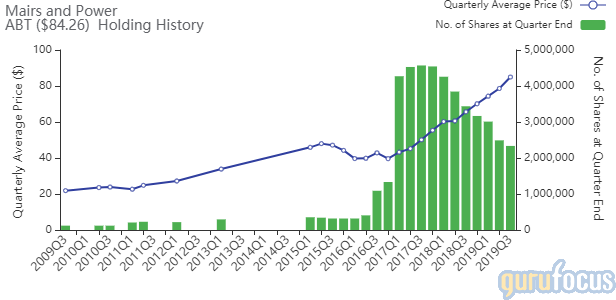

Abbott Laboratories

The Abbott Laboratories (ABT) holding was reduced by 6.22%. The portfolio was impacted by -0.16%.

The manufacturer and marketer of medical devices has a market cap of $149.01 billion and an enterprise value of $163.97 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 10.57% and return on assets of 4.79% are outperforming 70% of companies in the medical devices and instruments industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.23 is below the industry median of 1.48.

The largest guru shareholder of the company is Vanguard Health Care Fund (Trades, Portfolio) with 0.81% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.54% and Diamond Hill Capital (Trades, Portfolio) with 0.36%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Mason Hawkins Sells Alphabet, General Electric

8 Stocks Donald Smith Continues to Buy

Largest Insider Trades of the Week

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.