How the Major Streamers Stack Up Right Now – in Subscribers and Revenue | Charts

The streaming industry has never been so crowded. And as Wall Street and cash-conscious consumers have begun to look at the business with a more critical eye, it’s time once again to round up the total subscriber and average revenue per user (ARPU) stats we learned about the major streamers from the most recent round of quarterly earnings results.

Despite the promise of a more lucrative tomorrow (emphasis on tomorrow) relentlessly pushed by media companies in recent quarterly earnings reports, Wall Street has been less than kind to Hollywood in 2022. All the major entertainment companies have seen shocking drops in stock prices this year including Netflix (59%), Disney (29%), Paramount Global (21%) and Warner Bros. Discovery (48%). This trend, and the fact that most streaming services will continue to lose money for years, raise concerns about the foundational future of the entertainment industry.

For years, Wall Street bet that Netflix’s all-in streaming model was that secure future — until the company reported subscriber losses in consecutive quarters this year for the first time as an original content provider. Streaming remains an integral strategy for Hollywood moving forward, of course. But the digital future that some envisioned buoyed by billions of subscribers has morphed into a corporate “Hunger Games.”

Let’s take a closer look at where the major streamers stand when it comes to subscribers and average revenue per user (ARPU), according to the companies’ most recent earnings reports.

Also Read:

‘The Great Shift to AVOD': Why Viewers Are Flocking to Ad-Supported Streaming | Video

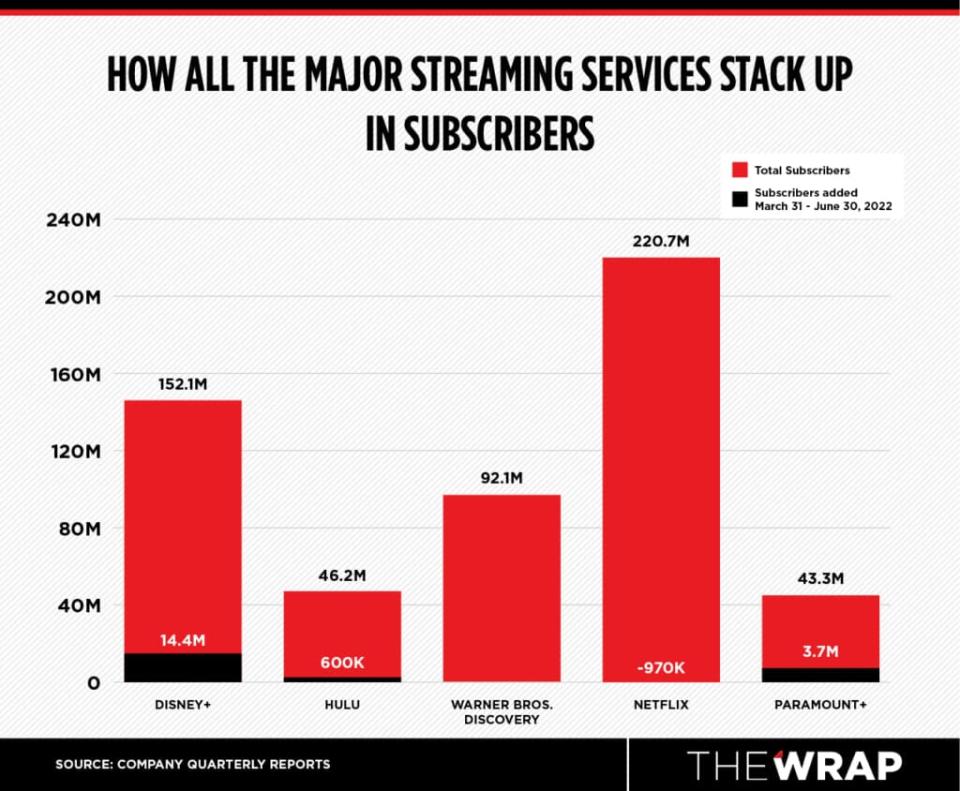

Total subscribers

Note: Amazon Prime Video doesn’t release subscriber numbers other than saying last year more than 200 million Prime members worldwide streamed content (though many sign up just for free Amazon shipping). Apple also doesn’t release subscriber numbers for its Apple TV+ platform — which comes free to purchasers of other Apple products like phones and computers.

Netflix

The cushion separating Netflix from its closest competitors has never been more important following a loss of 970,000 subscribers in its most recent quarter. Despite the decline, Netflix still leads the market in global subscribers with a hefty 220.67 million and is projecting an addition of 1 million worldwide customers in Q3.

Yet Netflix should still be worried that the truth behind famous Hollywood adage “content is king” may be waning. The success of “Squid Game,” “Red Notice” and “Don’t Look Up” didn’t prevent the company from missing growth projections in Q4 2021, while Netflix lost subs over the last two quarters despite hits such as “Bridgerton” Season 2, “Ozark” Season 4 Part II and “Stranger Things 4.”

If record breaking viewership for hugely popular titles isn’t making a difference, what will?

The company needs the introduction of a cheaper ad-supported tier in early 2023 to reignite its growth engine. If not, there may be a shiny new toy available on the M&A market.

Also Read:

When 10 Popular Netflix Series Are Set to Leave the Service – and Why It Matters (Exclusive)

Disney+

A vocal minority on film Twitter may complain that Disney+ is too focused on franchises such as Marvel and “Star Wars.” But a whopping 14.4 million new customers flocked to the service in the most recent quarter to bring its worldwide total up to a robust 152.1 million. Clearly, the strategy is working.

The real question for Disney+ is if it can turn the page from growth to profit. The streamer lost $1.1 billion this past quarter, up from an $887 million loss last quarter. Since 38% of its customer base is attributed to the inexpensive Hotstar tier, its global ARPU is a measly $4.35, the lowest of the major players. That’s the sort of math that keeps accountants up at night.

Disney is hoping that an ad-supported tier, price hikes and creative bundling can help address its glaring revenue problem. But lucky for the company, investors still have starry eyes for raw subscription growth and aren’t too concerned with losses just yet (Disney+ is projected to reach peak losses this year and become profitable in 2024).

Also Read:

Is Disney CEO Bob Chapek Finally Catching a Break? Wall Street Thinks So

HBO Max/Discovery+

Across all of its streaming endeavors (including HBO Max and Discovery+), Warner Bros. Discovery boasts 92.1 million global streaming subs. With plans to merge the two main streamers into a combined super service next summer, WBD CEO David Zaslav is eyeing a target of 130 million worldwide subscribers to turn a profit.

Yet uncertainty clouds the immediate future of HBO Max. Beyond vague hopes of a “10-year plan” to “reset” the DC property and emphasize monetization, WBD leadership didn’t provide many specifics as to how it plans to build its new content empire.

“Quality is what matters,” Zaslav said during the company’s earnings call. Sure, that’s true. But beyond the obvious goal of wanting to make good content, the company’s streaming future is marked by far more question marks than exclamations.

Also Read:

How Demand for the HBO Max-Discovery+ Combo Will Stack Up in the Streaming Wars | Charts

Hulu

Hulu, which is a domestic service that is largely not available as a standalone streamer internationally, added 600,000 new subscribers in the latest quarter to bring its total to 46.2 million. While speculation about the streamer’s future have loomed large amid lofty company subscriber target goals and changing macro-economics, Disney cemented Hulu’s importance to its overall ambitions with recent moves.

First, Disney is raising Hulu’s prices with its ad-supported tier increasing $1 to $7.99 per month and its ad-free tier jumping by $2 to $14.99 per month. Second, Disney is rolling out two new streaming bundle options for consumers: an ad-supported combination of Disney+ and Hulu for $9.99 per month and an ad-supported collection of Disney+, Hulu and ESPN+ for $12.99 per month.

Such moves are reflective of Hulu’s strategic importance to Disney’s overall streaming goals. The added value it provides, particularly with more adult-skewing content than the family-friendly Disney+, and the insight Disney gleans from Hulu’s prized ad-supported model are clearly viewed as key advantages.

Long story short: Don’t expect Disney to sell Hulu or fold it into Disney+ anytime soon.

Also Read:

Disney to Allow Political Issue Ads on Hulu After Democratic Outcry Over Claims of ‘Censorship’

Paramount+

Paramount+ launched in early 2021 and for far too long has been lumped in with the likes of streaming cellar dwellers such as Peacock. But the service has been quietly growing and improving over the last 18 months and now stands at a healthy 43.3 million global subscribers.

Parent company Paramount Global has strategically divvied up its main streaming service into key attraction arenas: linear hits driven by CBS, the ever-expanding “Star Trek” franchise, “Yellowstone” co-creator Taylor Sheridan’s growing stable of hit originals, and sports. The incoming arrival of blockbuster hit “Top Gun: Maverick” should only extend the streamer’s momentum.

“Paramount continues to build momentum with the assets, strategy and ability to compete — and win,” Paramount Global Chief Executive Bob Bakish said on the company’s recent earnings call.

When the company is finally able to reclaim the streaming rights to Sheridan’s “Yellowstone” (currently streaming on Peacock), Paramount+ will be ready to move up a weight class in the streaming wars.

Also Read:

Why Paramount+ Needs to Look for New Frontiers to Compete in the Streaming Wars | Charts

Average revenue per user

Raw subscription growth has been the primary focus of the streaming industry throughout its embryonic stages. But as the business grows and matures, particularly against the backdrop of an increasingly skeptical Wall Street, ARPU provides more insight into the financial health of each platform. ARPU helps determine how much money a streamer is generating from each subscriber minus content production and marketing costs.

ARPU is an especially key metric as streaming is an inherently costly endeavor with a long and winding runway to profitability. Netflix has struggled to consistently generate free cash flow for years while growing services such as Disney+ and HBO Max are not projected to be profitable until 2024 at the earliest. Growing ARPU over time enables a streamer to derive increasing value from its customer base.

Netflix led the industry in domestic ARPU this past quarter with $14.91 per sub following a price hike earlier this year. Hulu, with an ARPU of $12.92, generated the second-most among the premium streaming players while Warner Bros. Discovery ($9.00) rounded out the top three. Despite the mammoth growth of Disney+, it holds the lowest ARPU at $4.35.

Also Read:

Why Hollywood Is in a Mad Rush to Launch Ad-Supported Streaming Options | Video