Malaysia Stocks Pare Losses Amid Deepening Political Instability

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Malaysia’s stocks pared declines after Saturday’s election produced the country’s first-ever hung parliament and amid a broader slump in Asia.

Most Read from Bloomberg

Malaysia Latest: Muhyiddin Turns Down King on Unity Government

Crypto Brokerage Genesis Is Said to Warn of Bankruptcy Without Funding

Elon Musk's 2022 Wealth Loss Exceeds $100 Billion for First Time

Beyond Meat Plant’s Dirty Conditions Revealed in Photos, Documents

The benchmark KLCI Index closed little changed after briefly falling as much as 1.5%. Gaming and alcohol-related stocks took a hit after the Islamic party PAS, known for pushing the sharia law, garnered the most seats at the polls. The ringgit was 0.5% lower against the dollar while the 10-year yield remained steady.

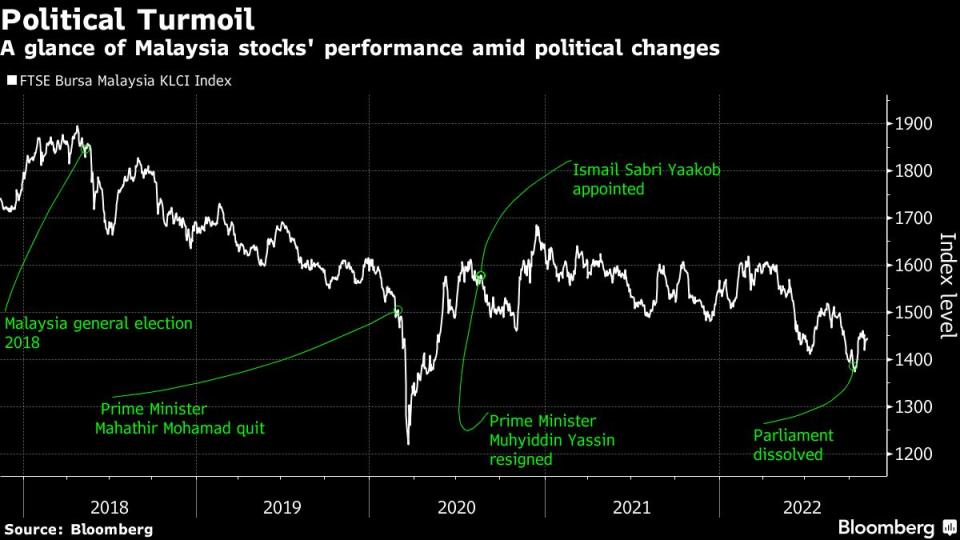

The deadlock extends the political crisis that has weighed on local markets for the past four years and comes at a time when the economy is on a fragile rebound, with rising living costs stirring discontent. Malaysia’s benchmark stock index remains 24% below its April 2018 record, reflecting the political uncertainty.

Veteran opposition leader Anwar Ibrahim’s reformist Pakatan Harapan and a pro-Malay rival grouping led by ex-premier Muhyiddin Yassin are competing to form the next government. Both are trying to cobble together a majority by persuading other parties to join their alliance, as each seeks to become the fourth prime minister in as many years.

Malaysia’s king has granted party leaders another 24 hours to firm up their alliances and decide on their choice of prime minister. They have until 2 p.m. Tuesday to present to the monarch their plans on forming the new government.

A Yassin-led coalition government would put more scrutiny on gaming, brewery and tobacco companies as PAS would be the single party with the largest number of parliamentarians in the block.

READ: Gaming, Alcohol Stocks Fall on Islamic Party Malaysia Poll Gains

Still, investors may overlook the vote’s result as a hung parliament was the “default position for most participants,” said Stephen Innes, managing partner at SPI Asset Management. “The market will take the result in its stride as the political landscape is unlikely to change too much from the present murky situation.”

Innes said Malaysia’s markets could benefit from the recent rally in global equities fueled by bets that the Federal Reserve could signal a slowdown in the pace of rate hikes and by China’s plans to reopen its economy.

Investor sentiment toward Malaysia could also “change dramatically” once the shape of the new coalition becomes clearer, said Nirgunan Tiruchelvam, an analyst at Aletheia Capital (Singapore) Pte. He recommends that investors focus on travel and tourism-related companies, the consumer sector and producers of commodities including palm oil, rubber and tin.

The market is expected to stay volatile in the near-term as the main coalitions race to form a government. Traders will also keep an eye on the composition of the cabinet and the potential policies that will be pushed forward.

“I would say that either one will have some policies that will be market friendly in the short-term,” Lee Peng Ng, head of investment at Opus Asset Management, said in a Bloomberg TV interview Monday.

READ: Malaysia’s Hung Parliament Clouds Market Outlook, Analysts Say

While the formation of a new government will reduce uncertainty over the next year, investors will “need to play it by ear” beyond that, said Danny Wong, chief executive officer of Areca Capital.

--With assistance from Abhishek Vishnoi and Anders Melin.

(Updates with closing prices and extension of deadline to form alliances.)

Most Read from Bloomberg Businessweek

US Is Focused on Regulating Private Equity Like Never Before

A Nation in the Crosshairs of Climate Change Is Ready to Get Rich on Oil

©2022 Bloomberg L.P.