The Man Enforcing Texas’ Crackdown on Wall Street Over ESG

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- The crackdown started last year with a letter from a little-known Texas politician. Sent to more than 100 of the world’s largest financial firms, the missive demanded they make clear whether they restrict business with the fossil-fuel industry. If so, they’d risk getting shut out of working with the fastest-growing US state.

Most Read from Bloomberg

Prince Andrew and Virginia Giuffre Photo Is Fake: Ghislaine Maxwell

Citadel Makes $16 Billion to Top Paulson’s ‘Greatest Trade Ever’

China Says Covid Deaths Top 12,600 and More Than 1 Billion Infected

Holmes Belongs in Prison, Not $13,000-a-Month Manor, US Says

The responses pushing back poured in from BlackRock Inc., the Vanguard Group and other industry titans, addressed to someone who’d likely never crossed their desks before: Texas Comptroller of Public Accounts Glenn Hegar, the chief financial officer for the world’s ninth-largest economy.

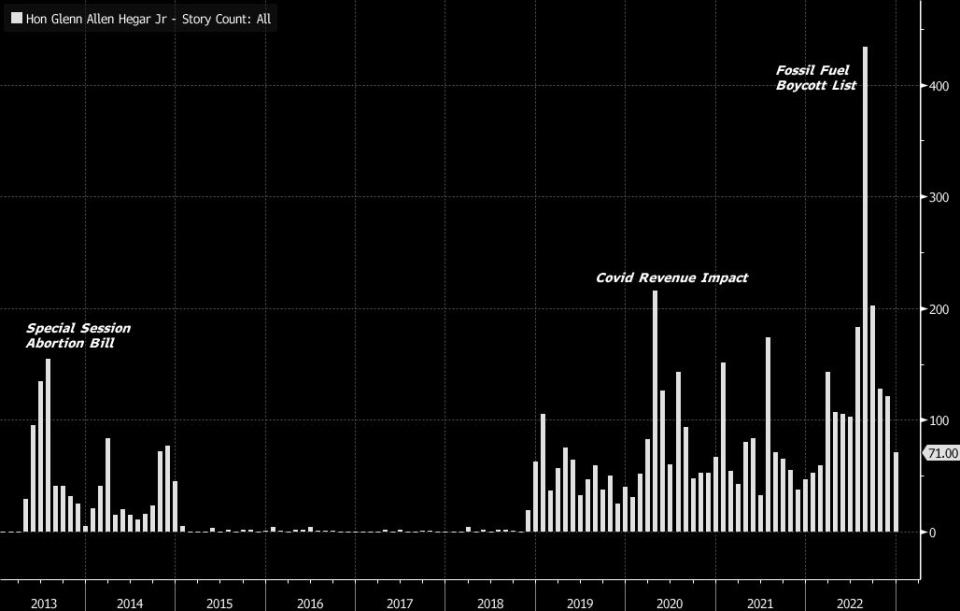

The showdown with Wall Street has lifted the 52-year-old Republican from relative anonymity and made him a gatekeeper to the state’s roughly $330 billion of investment assets. He’s been thrust into the center of one of the most divisive issues in American politics as GOP officials from Florida Governor Ron DeSantis to former Vice President Mike Pence reject efforts to align investment policies with social and environmental goals.

As Hegar has gained in prominence, observers see an opening for him to run for higher office in 2026 when there may be a vacancy in the governor’s mansion.

Hegar is pragmatic and methodical, speaking often in a combination of economic jargon and homespun anecdotes about his family, which goes back six generations in Texas. He has a reputation for being well-prepared and thoughtful when it comes to setting policy, a steady hand in the often tumultuous world of Texas politics.

It’s a personality well suited to his role as the stern but sober enforcer of Texas Republicans’ fight with financial giants over so-called ESG investing.

In August, at the end of the months-long inquiry ordered by Texas lawmakers seeking to protect the state’s massive oil and gas industry, Hegar listed 10 firms and more than 340 individual funds that “boycott energy companies.” That designation compels state-run entities like pension managers to sell their holdings in the firms or the offending funds. It could restrict what business the companies can do with the state and its local governments, including barring them from lucrative contracts like underwriting debt in the municipal bond market.

Those companies included investment giant BlackRock and one of the world’s largest private banks, UBS Group AG, which have both said they don’t boycott energy companies, plus lesser names such as Svenska Handelsbanken AB and Nordea Bank Abp.

The list shows Hegar navigating the tricky politics of satisfying the far-right’s anger over ESG — which consider environmental, social and governance factors — while not damaging the state’s finances with an overly broad ban, according to Jim Henson, the director of the Texas Politics Project at the University of Texas at Austin.

“By hitting a couple of prominent actors, it makes it harder to accuse him of playing it too soft, but at the same time he doesn’t look extreme,” said Henson, who has been following Texas politics for 22 years. “That is right on brand for him – a measured conservative.”

Hegar was deliberate in compiling the list, laying out the criteria he and his staff spent months developing in an 11-page document published alongside the names of the offenders. “We had to tear into it layer by layer,” he said.

While some GOP officials speak of ESG as if it’s a Communist plot to subvert America, Hegar says he isn’t a culture warrior, and isn’t looking to settle scores or capriciously punish financial firms. He says that energy diversity is imperative as is a clean environment for his three children. His primary objective is to keep Wall Street accountable and force an honest conversation about investment practices.

The Texas GOP is especially focused on the risk that policies limiting investment in oil and gas will starve the industry of capital, undermining the businesses and resulting in higher costs for energy to heat homes and power cars.

On the other side of the political spectrum, finance companies are coming under pressure to bolster their ESG bona fides. New York City’s Democratic Comptroller Brad Lander has said he’s “reassessing” the state’s business with asset managers, including BlackRock, because of concerns the firm isn’t doing enough to promote sustainable investment practices.

Amid the rancor, Hegar is wary about over-politicizing money managed by states.

“If Texas says you have to invest in oil and gas, and New York says you can’t invest in oil and gas, I have a very serious concern about that,” he said in an interview while driving through the pastures of his family’s farm in December. “Then we get into red and blue states on investment policies, and I think that’s bad for all of us.”

Family Farm

Being at the center of Texas’ war with Wall Street is a far cry from where Hegar grew up in Hockley – a community about 40 miles northwest of Houston, the center of American energy. Located on a road that bears his surname, abutting Houston Oaks, an exclusive golf club catering to the region’s wealthiest residents, the 4,000 acres (1,600 hectares) owned by Hegar’s family has spawned generations of farmers.

Born to teenage parents, Hegar spent his first years living with his grandparents in a small ranch house nestled among oak trees covered with Spanish moss.

He played football before switching to theater in high school, moving comfortably among the cliques and working the farm on weekends and school breaks. He still has an encyclopedic knowledge of farm equipment, easily able to describe the workings of a combine harvester, a massive piece of machinery used to pick corn.

After high school, Hegar went to Texas A&M University in College Station. Following a gap year, he enrolled in law school at St. Mary’s University in San Antonio, where he met his wife Dara, who is now an attorney. After getting his law degree in 1997, he added a master’s degree in Arkansas before returning to the farm.

He always felt drawn to public service and in 2002, when statewide redistricting opened up a new seat where he lived in Waller County, he ran for the Texas House of Representatives. He was recently married but didn’t have children, the farm was turning a profit and a sale of a equipment dealership he helped broker for his grandfather had just closed.

Hegar topped the five-candidate Republican primary, bolstered by name recognition in his home county, where his grandfather served as a Baptist preacher. In a state where Republicans dominate most contests, he ran unopposed in the general election.

Hegar was elected to the state Senate in 2006 and in 2013 had his most high-profile political moment before the ESG debate. That’s when he led the charge during a special session on legislation to severely restrict abortion.

Amid criticism that he and his GOP colleagues were trying to jam through the measure without a full public debate, the legislation caused widespread backlash among pro-choice Texans. Democratic lawmaker Wendy Davis drew national media coverage when she filibustered for 11 hours to block the passage before a midnight deadline.

All the attention pushed Hegar closer to the upper echelon of Texas politics. And when the legislation passed during a second special legislative session that year, Hegar stood aside then Governor Rick Perry for the signing. Photos from that day in July 2013 still adorn his campaign website even though the legislation was struck down by the US Supreme Court in 2016.

Building on the momentum from the bill’s passage, Hegar was elected as comptroller in 2014 after the Republican incumbent decided not to seek another term.

Senate Bill 13

Being comptroller is a decidedly non-glamorous role, a natural fit for the low-key Hegar. His core job is managing the state’s money but he also has ancillary responsibilities like expanding broadband access and improving water infrastructure – duties that are crucial to Texans but are out of the limelight.

Jane Nelson, who had been the longest serving Republican in the Texas Senate before becoming Governor Greg Abbott’s secretary of state this year, said the role fits him well. She called Hegar a “workhorse” during their time in the Senate together.

“He’s all about the numbers — and he genuinely doesn’t care about getting the credit, which is very unusual in our business,” she said.

Keeping a low profile became harder for Hegar after lawmakers passed Senate Bill 13, the legislation that compelled his office to come up with a list of energy-boycotting companies. Oil, gas, mining and quarrying makes up about 11% of the state’s economic output, according to data from the Bureau of Economic Analysis.

Beyond the economic issues, Hegar points out that petroleum is vital to modern life for reasons other than energy, serving as a key component of plastics and other products, everything from toothbrushes to tires.

“I don’t think people realize how important the petroleum industry is to their lives,” Hegar said. “That’s not trying to say we shouldn’t tend to the environment.”

Generally, he refrains from lambasting the ESG investing industry the way some of his colleagues do. That’s partly because he tries to see both sides of any debate and consider the merits of opposing views.

“There’s a lot of things in life that there is no simple yes or no,” he said. “You can be 95% sure of something, but that 5% gives you room to see the other side.”

That pragmatism has opened him up to critiques that he doesn’t have strong beliefs.

“I don’t know what his true convictions are,” said Janet Dudding, a Democrat who ran against Hegar for comptroller in November. She said that Hegar often “talks around” the ESG issues in a way that suggests he doesn’t really believe in the legislation.

Leadership Vacuum

Brandon Rottinghaus, a political scientist at the University of Houston, said Hegar can be thought of as “an ideologically-moderate bean counter.”

“When every other statewide elected Republican has been climbing all over themselves to try and be as conservative as possible, Hegar seems to keep things quiet,” Rottinghaus said.

There are consequences that come with flying under the radar. A December poll conducted by the Texas Politics Project found that almost three-quarters of voters couldn’t properly identify him as the current comptroller, even though he won his most recent election by more than 15 points, the widest margin of victory among the major statewide races.

The ESG debate provides Hegar a chance to raise his political profile.

And there is no indication the issue will go away anytime soon. Hegar is required to update his oil- and gas- boycott list each year and his staff is already preparing to send out another round of letters for the 2023 inquiry.

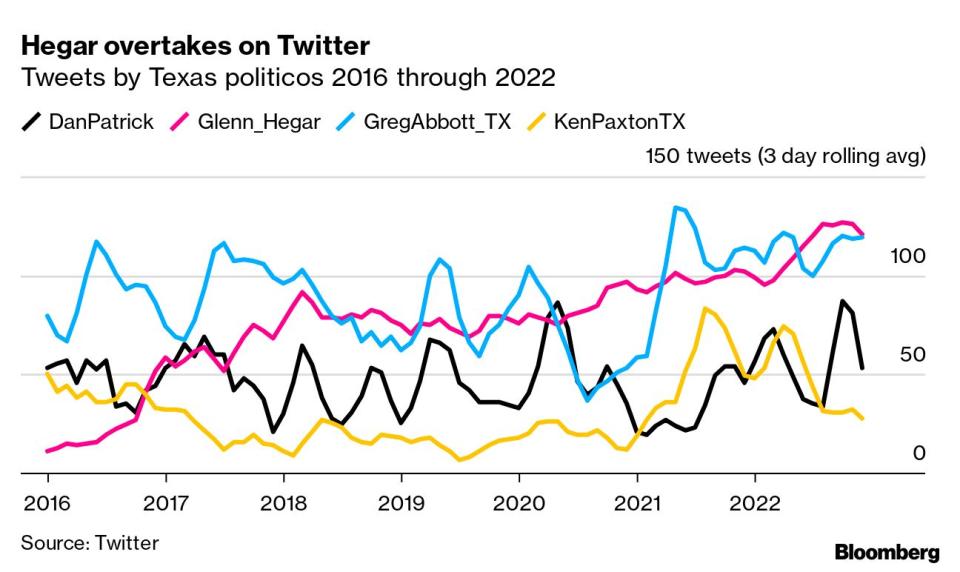

He also seems to be branching out rhetorically. He opines on immigration, policing and drug trafficking on Twitter, and has blasted President Joe Biden for sky-high inflation. To some it appears to be a strategic move to position himself to run for higher office in 2026 when there’s likely to be a “leadership vacuum at the top,” according to Rottinghaus.

Hegar says this term will be his last as comptroller, but also maintains he isn’t finished with public service. He says the decision about whether to run for a higher office lies primarily with his wife and kids.

“I have never run for one office just to run for another,” he said in the bleachers of his daughter’s eighth-grade basketball game on a Monday night in December. “Whatever is next for me, it has to be right for my family.”

He’s concerned about what a bigger platform would mean for his kids — they see social media posts about his politics, ones that will only get harsher on a larger stage.

But perhaps Texas is on the precipice of a transition — where a folksy farmer with a knack for economics could win statewide.

“Most people are just exhausted by the polarization,” said James Riddlesperger, a political scientist at Texas Christian University. “It’s a possibility that someone who has just been competent and quiet and good at their job can be really appealing.”

--With assistance from Madeline Campbell.

Most Read from Bloomberg Businessweek

Fake Meat Was Supposed to Save the World. It Became Just Another Fad

The Coyotes Working the US Side of the Border Are Often Highly Vulnerable, Too

What Tech Job Cuts Say About Silicon Valley—and the Rest of the Economy

©2023 Bloomberg L.P.