Many colleges hiked tuition for low-income students. Why did wealthier peers get more aid?

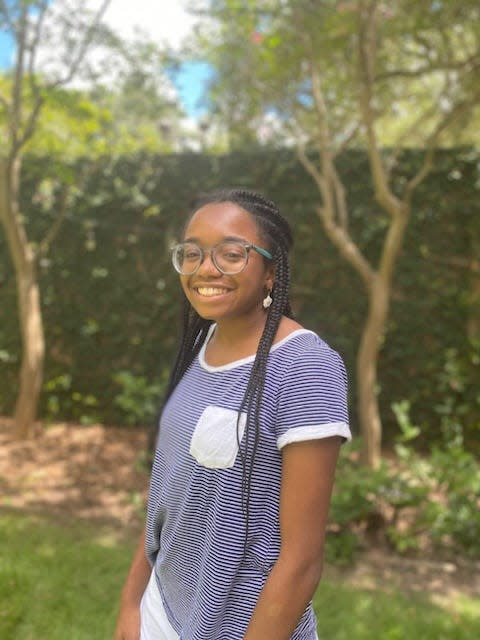

Even in high school, Miguel Agyei worried about how he’d pay for college.

The son of parents who work at a hospital and for UPS, Agyei wanted to go to a school away from his home state of Illinois, but that was too expensive. He instead picked close-by Bradley University and worked during the summer to pay the costs his financial aid didn’t cover.

An athlete who ran track and field, he set the university record in the 60-meter hurdles, but the conference meet that determined who would get athletic scholarships was canceled by Covid. He asked his coaches if there was money to help him buy textbooks, but they said there wasn’t. He had to get help from an advocacy group to pay his rent. To cover his other expenses, he took a job answering phones for a call center for people applying for unemployment benefits.

“It was very, very stressful,” said Agyei, who also borrowed $25,000 in student loans. “I would go to practice, go to class, work five or six hours, do my homework, go to bed and get up and do it again.”

Meanwhile, he noticed that his bills from the college kept going up.

Bradley is among nearly 700 universities and colleges that have over the last decade raised the prices paid by their lowest-income students more than the prices paid by their highest-income ones, according to federal data analyzed by The Hechinger Report. (Search the database; it's at the bottom of this article.)

Lower-income students generally still pay less than higher-income ones. But the increase in college costs is falling more heavily on families that are likely the least able to absorb it, as federal and state financial aid fails to keep up with rising prices and colleges shift institutional aid to wealthier families they know can pay at least a part of the tuition.

More: Student debt relief blocked, potentially hurting Black and Latino families the most

“Those increases can really make or break a student staying in college,” said Scott Del Rossi, vice president of college and career success at College Possible, which helps low-income and racial minority students go to and through college. “Do they put it on their credit card? Do they just give up?”

Historic trends in net price by income and other information about universities and colleges nationwide are available in The Hechinger Report’s newly updated Tuition Tracker tool.

At two out of three colleges and universities where the net price increased for both low- and high-income students over the last decade – that is, the amount paid after discounts and financial aid – it rose faster for the lowest-income ones, increasing by about 70% versus 27%, on average, the federal data show.

At 80 universities and colleges, net price more than doubled for the lowest-income students, while at 19 it more than tripled and at 10 it quintupled. At 90, including 14 public universities, net price went up for the lowest-income students while going down for the highest-income ones.

More: Dartmouth College eliminating loans from its financial aid packages

Bradley increased the net price for its students from families earning under $30,000 by 36%, more than three and a half times the rate of increase for its students from families that make $110,000 a year or more.

Asked about this, Justin Ball, Bradley’s vice president of enrollment management, said in a statement that “Filtering financial aid packages by a few key metrics alone does not paint the full picture of what can be offered to prospective students.” A university spokeswoman said Ball was not available to elaborate on what that meant.

“As low-income students, we’ve grown to know that this is just the way the system works, and we’ve had to figure out ways to navigate through it,” said Agyei, who ultimately graduated last year with a bachelor’s degree in sports communications and got a part-time internship with the Chicago Fire Major League Soccer team.

“You can’t keep raising the price of tuition for students who are barely making it. It’s just not fair,” he said.

Setting off a cycle of debt

As their costs rise, lower-income students become more reliant on student loans to pay for college, but struggle to repay their debt. Students who got federal Pell grants, which generally go to families earning $40,000 or less, are five times more likely to default on their loans within 12 years of entering college than their higher-income classmates, according to The Institute for College Access and Success. Black students and students who were the first in their families to go to college are also more likely to default.

‘We just keep getting hit’: Borrowers rally over Supreme Court case on student loan debt relief'

The most common reason cited for this trend of rising costs for poorer students – even by several of the colleges themselves – is the intensifying competition for students from high-income families who contribute badly needed revenue and who increasingly expect to receive scholarships and discounts that siphon financial aid away from students who meet the federal definition of financial need.

Colleges and universities depend on money coming in, said Justin Draeger, president of the National Association of Student Financial Aid Administrators, or NASFAA. That’s “the bottom line and the real challenge.” Sophisticated enrollment management strategies, he said, “are driving at one thing: staying afloat.”

Trying to attract students from one socioeconomic category “might decrease them [from] another,” Draeger said. “It would be natural, then, that in this enrollment-constrained environment, the people bearing a disproportionate impact of that would be needy students.”

Montreat College in North Carolina, for example, has “shifted to prioritize merit-based awarding,” said Sara Baughman, the college’s vice president of marketing and communications, using the term for the type of financial aid that goes to students who don’t meet the federal definition of financial need.

What happened to Biden's free college plan? Cutting cost of higher ed out of feds' reach

Montreat has increased its net price for its lowest-income students by 42% while lowering it by 16% for its highest-income students.

“There’s only so much money to spread around,” said Duane Bonifer, associate vice president for communications at Monmouth College in Illinois, a small, private liberal arts institution that has raised the net price for its lowest-income students by 57% while lowering it by 3% for its highest-income students.

“For every college in America that’s like Monmouth, which is a lot of them, they’re struggling to deal with the same issue,” Bonifer said. “Your heart breaks that you can’t do more, but there are certain economic realities. You have to be well in order to do good, and that’s a harsh reality for a lot of colleges.” Monmouth has just completed an $80 million fundraising campaign, $11 million of which will go to financial aid, he said.

A conscious shift

Some institutions, such as Wheaton College in Massachusetts, are also consciously trying to move more financial aid to middle- and upper-middle-income families who may also struggle to pay, said Jeff Cutting, Wheaton’s associate vice president for enrollment and strategic analyst. And small colleges’ resources, Cutting pointed out, are finite. Wheaton has increased the net price for its lowest-income students by 35% while lowering it by 17% for its highest-income students, federal figures show.

The proportion of financial aid awarded by Kalamazoo College in Michigan on the basis of merit, as opposed to need, “increase[s] yearly to keep up with market trends,” said Becca Murphy, its dean of financial aid.

Going to extremes to pay for college: A new reality for some families

Federal data show that the net price for Kalamazoo’s highest-income students fell 5% while rising 26% for its lowest-income students. But Murphy said that those figures do not account for money that goes to low-income students who qualify for the Kalamazoo Promise program, under which resident graduates of local public schools get all or part of their tuition paid for. If that money were included, Murphy said, the net price for students from families earning less than $30,000 would decrease by an average of $1,300.

Even after subtracting this amount, however, Kalamazoo’s average net price for its lowest-income students has still increased by about 15% since the Promise program started in the 2015-16 academic year, the federal figures show. Asked if Murphy would discuss this further, a spokesman did not respond.

The federal data shows that Beloit College in Wisconsin increased the net price for its lowest-income students by 82% while reducing it by 19% for its highest-income students. The college said the information it had submitted to the federal government was incorrect, but did not respond when asked to provide the correct figures.

The net price for the lowest-income students at Connecticut College rose 235% in the last decade, compared to 9% for the highest-income students. The lowest-income students at Oklahoma Wesleyan University saw their net price go up by 69% while it fell by 37% for their highest-income classmates. At Gustavus Adolphus College in Minnesota, the net price went up by 45% for the lowest-income and down by 27% for the highest-income students.

None of the schools responded to repeated requests for comment.

Can virtual advising make a difference? First gen students are missing from the nation's top colleges.

Some public universities did the same thing

Like these private universities, a few public universities have also raised the net price for their lowest-income students while lowering it for their highest-income ones. At Louisiana State University of Alexandria, for instance, net price fell for the highest-income students by 22% while rising 4% for the lowest-income students. After agreeing to speak about this, the university’s vice chancellor for finance and administration stopped responding to requests to schedule a conversation.

One more major reason lower-income students are seeing their net prices rise more quickly than higher-income students is that the principal federal grant meant to help them pay for college hasn’t kept up with the cost of it.

The federal Pell Grant, which mostly goes to families with annual incomes under $40,000, now covers about 25% of college costs, down from 69% in the 1970s, according to the Pell Institute for the Study of Opportunity in Higher Education and the Alliance for Higher Education and Democracy at the University of Pennsylvania.

The maximum Pell Grant this year is $6,895 per student. That’s up 15% since the mid-1970s, when adjusted for inflation, a period during which the inflation-adjusted cost of four-year public colleges rose 157%, the Pell Institute and University of Pennsylvania report. Advocacy and professional organizations including NASFAA have called for the maximum Pell Grant amount to be doubled.

How much will this help college students? The Pell Grant amount will rise by $500 in 2023.

“We’re largely just treading water,” NASFAA’s Draeger said. “Meanwhile, costs keep going up. And when the Pell Grant fails to keep up with inflationary costs, that’s often going to be felt by the neediest students. It’s doubly unfortunate because for those students, price sensitivity doesn’t just impact their choice of where they’ll go to college, it impacts whether they’ll go to college.”

Most states have financial aid programs, too, which in many cases also have not kept pace with the rising cost of college.

In Massachusetts, for example, state-funded financial aid has been cut by 47% in the last two decades, when adjusted for inflation, a period during which tuition and fees at public universities and colleges rose by 59%, a new study by the Hildreth Institute shows.

While the largest state grant was enough in 1988 to pay for 80% of the average recipient’s cost for public higher education in the state, the research and policy center says, today it covers only 12%. That leaves the overwhelming majority of students at public four-year universities with $12,000 or more per year in unmet financial need.

Other state financial aid has shifted to increasingly benefit higher-income more than lower-income families.

After an income cap was removed from the principal state scholarship for students in Louisiana, the Taylor Opportunity Program for Students, the money started flowing disproportionately to the children of higher-income families who are more likely than lower-income ones to live in places with well-resourced public schools whose graduates meet the scholarship’s academic requirements.

The number of recipients from families earning $150,000 or more has increased 56% since 2010, while the number from households with incomes under $15,000 fell by 11%, the Louisiana Board of Regents reported in late 2021. More than twice as many students whose parents make more than $100,000 get the money than students whose parents earn less than $35,000. The median household income in Louisiana is $53,571, the Census Bureau says.

More: With Biden's student loan debt forgiveness in limbo, lawmakers consider colleges' role

After criticism of this trend, the legislature and the governor imposed the solution last year of ordering that the state stop reporting the family income of the scholarship’s recipients.

Among the students who get the Arkansas Academic Challenge Scholarship, which is funded largely by state lottery proceeds, three out of four are from families that make $103,000 a year – nearly twice the state’s median household income – the Arkansas Times reports.

Higher-income students enjoy several other little-known advantages in the financial aid process.

The federal formula used to calculate financial aid, for example, does not take into account home equity and retirement savings, disproportionately benefiting higher-income families, who are increasingly more likely to have such assets. This reduces the amount the formula determines they can afford to pay, thereby awarding them more financial aid, according to researchers from Wellesley College and the Federal Reserve Bank of Philadelphia, resulting in a subsidy worth thousands of dollars annually for families earning above the national median income.

College junior Chase Brown has been watching her wealthier classmates enjoy advantages like that from the time she was in high school. While she was spending her free time searching for colleges with the most generous financial aid, for example, her friends would tell her, “We’re going to take a flight down to Florida and go on some campus tours.”

Brown ended up at Rice University, one of a minority of universities and colleges where federal data show the price for the lowest-income students has stayed flat while it’s gone up for the highest-income students. The university’s Rice Investment program guaranteed her free tuition, and she also got some financial aid toward room and board.

Even with that, however, Brown had to work at Target in the summer to cover the rest of her food and housing, plus her other expenses, and at one point balanced three jobs with her studies.

“All those costs pile onto you, while your peers have the resources to pay for them,” said Brown, whose parents are a teacher and a graphic designer and who is majoring in political science and Spanish with plans to get a graduate degree in public policy or political science.

“I used to think the education system was going to close the gaps between social levels. It’s supposed to be the great equalizer,” she said. But “it can put an even bigger divide between those groups.”

That this gap is getting wider “doesn’t entirely surprise me,” Brown said. “My entire life, my educational experience has been that the very privileged are always getting the benefits and getting a leg up. It reflects on what’s happening everywhere: The poor are getting poorer, and the rich are getting richer.”

More: As lawsuits pile up, Democrats make fresh push for student loan forgiveness

How we did this analysis

The Hechinger Report analyzed the net price by student family income for all 2,300 four-year public and private colleges and universities that participated in the federal financial aid program from 2010-11 through 2020-21 – the most recent academic year for which the figures are available. All of this data was supplied by the institutions directly to IPEDS, the Integrated Postsecondary Education Data System.

The information was further filtered to include only colleges and universities that reported their net prices for both the lowest and highest of five income categories in 2020-21 and had an average overall enrollment of at least 500 over the past decade. Colleges and universities were excluded if they did not report net price data for the lowest or highest income categories in any of the 2011-12 through 2013-14 academic years. That left 1,508 universities and colleges in the sample. For about 50 of those that were missing net price data for the lowest or highest income categories in 2010-11, the change in net price was calculated from the next year for which data was available.

This story about college costs was produced by The Hechinger Report, a nonprofit, independent news organization focused on inequality and innovation in education. Try their Tuition Tracker tool for more information on college prices.

This article originally appeared on USA TODAY: 'It's just not fair': Why college tuition hike aimed at low-income students is hitting hard