Many Student Borrowers Played By The Rules, But Their Debts Only Grew

- Oops!Something went wrong.Please try again later.

WASHINGTON — Opponents of President Joe Biden’s plan to cancel up to $20,000 of student debt for millions of borrowers say it’s unfair to people diligently paying off their college loans.

Sen. Joe Manchin (D-W.Va.), for example, called the relief “excessive” and said people should have to “earn it.”

But for many, making regular payments hasn’t guaranteed that a loan would ever get paid off.

Research published last month by the New York Federal Reserve Bank shows that every year since 2004, millions of student borrowers who were current on their loans nevertheless had flat or even growing balances. Fewer current borrowers had shrinking balances.

At the end of 2019, for instance — before then-President Donald Trump paused student loan payments — only 37.1% of borrowers had a decreasing balance, while 48% had a flat or increasing balance, according to the New York Fed data. An additional 15% were delinquent or defaulted. (The pause pushed more borrowers into the flat or increasing balance category at the end of last year, while fewer were in default.)

Reasons for rising balances include forbearance periods, in which a borrower isn’t required to make payments, and income-based payment plans with low monthly payments that don’t cover interest. In both cases, interest still accrues and gets tacked on to the loan’s principal. The federal government has encouraged struggling borrowers to pursue both options.

As many as 20 million student debtors could see their loan balances completely vanish under Biden’s initiative. Altogether, as many as 43 million could at least partially benefit. The program hasn’t started yet, but the administration has told borrowers to sign up for email notifications.

But even before the president announced the debt relief, a significant number of student borrowers were on repayment plans that not only limit monthly payments to a percentage of their income, but also automatically forgive any remaining debt after 20 or 25 years — meaning millions of people would have had their debt canceled eventually, even if Biden had done nothing.

“Student loans aren’t going to be paid back anyway, so all of this talk about cancellation is out of touch with reality,” said Marshall Steinbaum, a student loan expert and associate professor at The University of Utah.

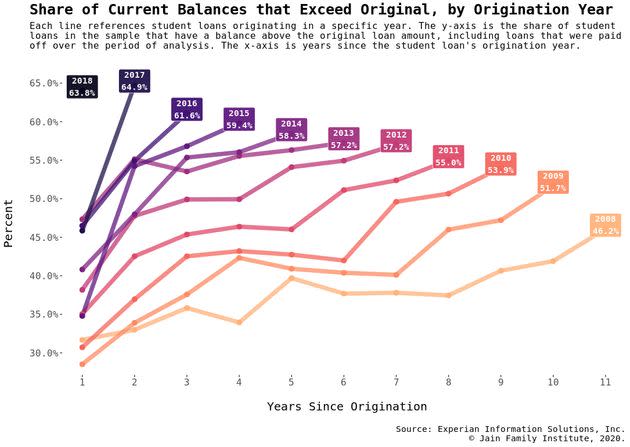

The economist’s own research from 2020 showed that in each year since 2008, majorities of borrowers who took out loans had wound up with larger balances than they started with.

The share of loans with a higher current balance than initial balance rose each year from 2009 to 2019. (Photo: Marshall Steinbaum)

Steinbaum has likened the combined $1.6 trillion in student loan debt to water filling a bathtub. The faucet’s running as students take out more and more loans, but the tub’s not draining as too few pay them back.

Sen. Elizabeth Warren (D-Mass.), an advocate for debt cancellation, described the situation in a similar way.

“Every year, some number of people go to college for the first time. And some number of people finish paying off their debts that they incurred while they were in college. And overall, you might predict that those numbers would stay in balance,” Warren told HuffPost.

“The economy stayed about the same. Family income has stayed roughly the same. And yet, the balance on student loan debt outstanding has gone up by nearly $100 billion a year.”

In other words, the bathtub is overflowing, and the water spilling out represents debt that borrowers have no ability to repay, and that in many cases the government already intends to forgive when income-driven payment plans reach the end of their 20-year durations. Biden’s plan, meanwhile, will partially drain the tub right away.

Steinbaum said Biden should cancel all the debt immediately to force a reckoning with the unsustainable costs of the higher education system. “The student loan experiment has been a mistake,” he said.

Republicans and even some Democrats have criticized the president’s forgiveness plan as unfairly benefiting students who don’t deserve it while also exacerbating inflation.

“It’s a slap in the face to people who have worked hard to have their loans paid off,” Sen. John Thune (R-S.D.) said this week.

Sen. Ted Cruz (R-Texas) told HuffPost he’s confident that conservative legal groups will successfully sue to block Biden’s debt cancellation program, which relies on a 9/11-era statute designed to help members of the armed services deal with their loans. Any court, Cruz said, “will find Biden lacks the legal authority to engage in this unfair and foolish policy.”

Sally Dressel of Pittsburgh had a career handling computer operations for an industrial paint company when she got tired of working shifts and decided to go back to school in the late 1990s. She took out a $35,000 Stafford loan at a 6% interest rate to pay for a bachelor’s degree in business. Stafford loans are typically advertised as taking 10 years to repay.

Dressel soon landed a position as a claim manager for an insurance company — a job that required her new degree. But the interest she didn’t pay during an initial deferral period pushed her loan balance up to $41,630, according to a transaction history she shared with HuffPost.

She has paid $400 every month for the past decade. Dressel started a new job for a different insurance company in 2020, and since then her employer has chipped in an additional $170 per month. In total, her figures suggest she’s paid more than $35,000 toward the principal and $33,000 in interest. A recent statement indicates that she still owes $4,374.

“I am 65 years old and this has been around my neck for more than 20 years.” Dressel said in an email. “So wiping out this last $4,387 would mean the world to me.”

She doesn’t mind if other borrowers get a bigger break than she does under the Biden plan.

“To think that the Republicans would fight this in court when I finally think someone is helping me would anger me more than I can say,” she wrote.

This article originally appeared on HuffPost and has been updated.