Marilyn Clark: AARP Foundation seeks volunteers for free tax preparation program

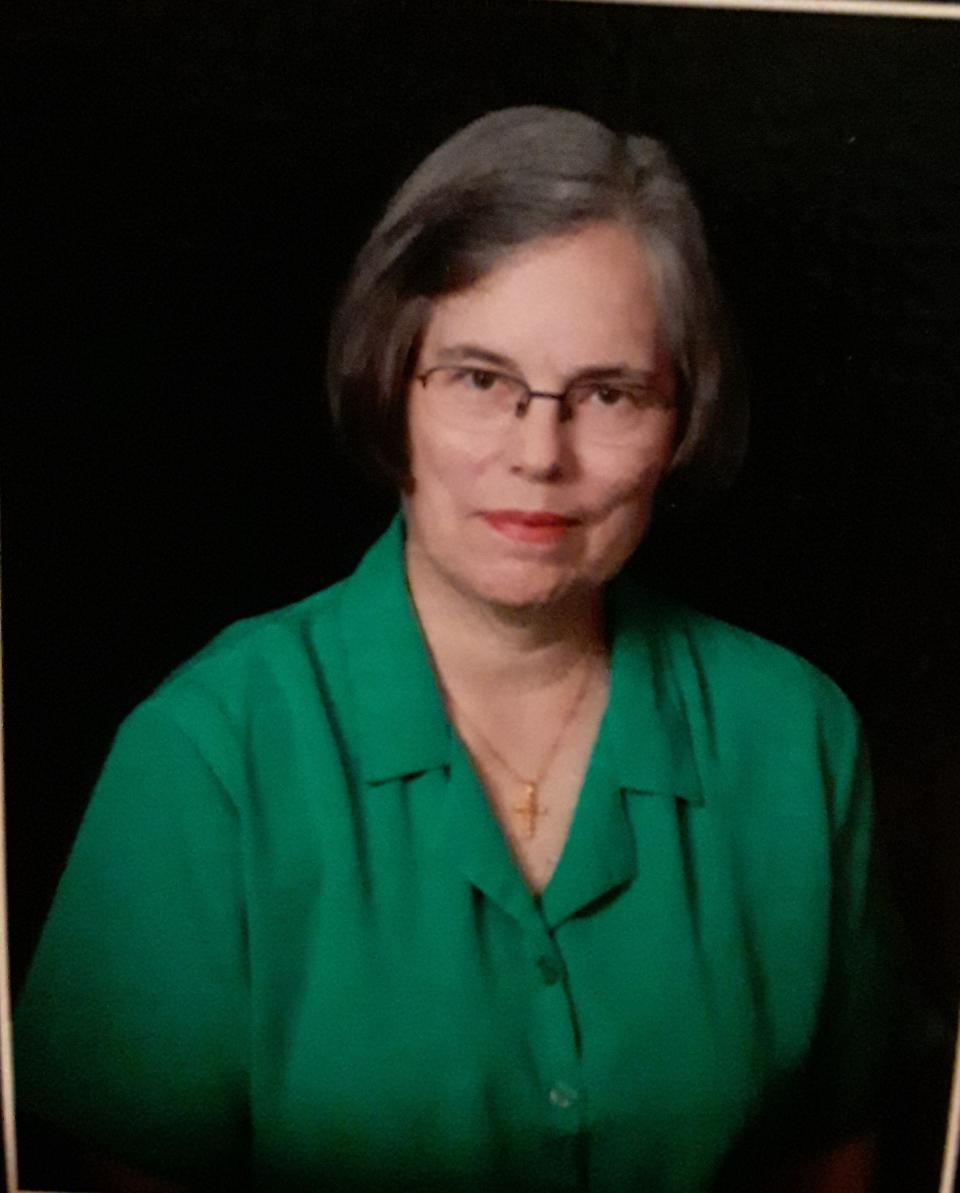

In 2009 “sitting on the beach” at my consulting job (and bored), I saw an article about AARP Foundation Tax-Aide and began what is now 13 years of volunteering each tax season. I have never regretted this decision.

Tax-Aide provides tax preparation help for anyone free of charge. Neither volunteers nor taxpayers need to be members of AARP and there is no sales pitch for other services. Tax volunteers study online in November and December and formal training classes are scheduled for January 2023.

Many taxpayers overpay their taxes or turn to paid tax services they cannot afford. Some may forgo filing their taxes and miss out on the credits and deductions they’ve earned because they are unable to pay for assistance. Tax-Aide volunteers can help by providing necessary services in communities where there is the greatest need.

AARP Foundation Tax-Aide has grown since its inaugural team of just four volunteers in 1968 and has served more than 68 million taxpayers since its inception. The program has volunteers in every state who typically number more than 30,000. AARP Foundation Tax-Aide is offered in coordination with the IRS Tax Counseling for the Elderly program.

Changing lives: Who are this year's Jacksonville health care volunteer champions?

Stand against ageism: Treat older people with the kindness, respect they deserve

Letters: Patient code of conduct needed to protect health care workers from violence

We are looking for compassionate and friendly people to join our volunteer team. We’ll provide the training and support to help you learn new skills and you’ll get a great feeling from helping those in need. The program is looking for individuals to volunteer in person — with physical distancing measures in place.

Volunteers come from a variety of industries and range from retirees to college students. All levels and types of experience are welcome for a variety of roles:

Counselors work with taxpayers directly by filling out tax returns. If you have no previous experience, you’ll get the training you need and will also receive IRS certification.

Client facilitators welcome taxpayers, help organize their paperwork and manage the overall flow of service.

Technology coordinators manage computer equipment, ensure taxpayer data is secure and provide technical assistance to volunteers.

Leadership and administrative volunteers make sure program operations run smoothly, manage volunteers and maintain quality control.

Also for tax professionals, the IRS offers Continuing Education (CE) credits for those who volunteer to serve as counselors, instructors and/or quality reviewers.

Last year, in Duval County, AARP Foundation Tax-Aide volunteers completed 2,881 returns with refunds totaling $3,239,478 and we applied for $506,443 in credits. This would not be possible without our volunteers, who make an indelible mark on the taxpayers we work with and the communities where they live.

To learn more about our volunteer opportunities, visit AARPFoundation.org/taxaide or call 1-888-OUR-AARP (1-888-687-2277).

Marilyn Clark, district coordinator, AARP Foundation Tax-Aide

This guest column is the opinion of the author and does not necessarily represent the views of the Times-Union. We welcome a diversity of opinions.

This article originally appeared on Florida Times-Union: Marilyn Clark: AARP seeks volunteers for free tax prep program