Mario Gabelli's Top 5 Buys of the 4th Quarter

Mario Gabelli (Trades, Portfolio), founder and CEO of GAMCO Investors Inc. (NYSE:GBL), disclosed last week that his top five buys for the fourth quarter of 2019 were ViacomCBS Inc. (NASDAQ:VIACA)(NASDAQ:VIAC), Tiffany & Co. (NYSE:TIF), Tallgrass Energy LP (NYSE:TGE), ServiceMaster Global Holdings Inc. (NYSE:SERV) and Sinclair Broadcast Group Inc. (NASDAQ:SBGI).

Managing a portfolio of 890 stocks, Gabelli graduated summa con laude from Fordham University's College of Business Administration and earned an MBA from Columbia University Graduate School of Business. Gabelli seeks undervalued companies that have a growth catalyst.

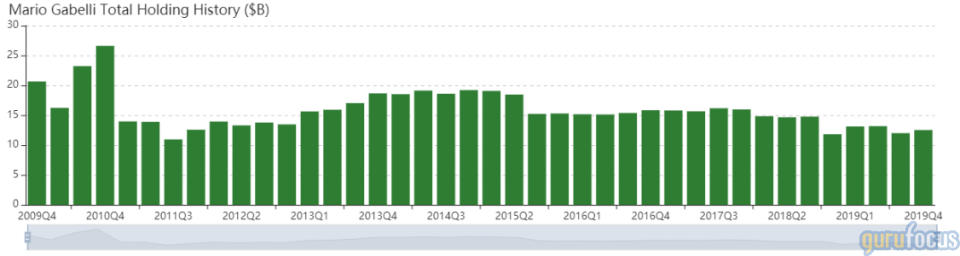

The $12.52 billion equity portfolio established 57 new holdings during the quarter, with a turnover ratio of 3%. The top three sectors in terms of weight are industrials, communication services and consumer cyclical, with weights of 31.47%, 15.39% and 10.72%.

ViacomCBS

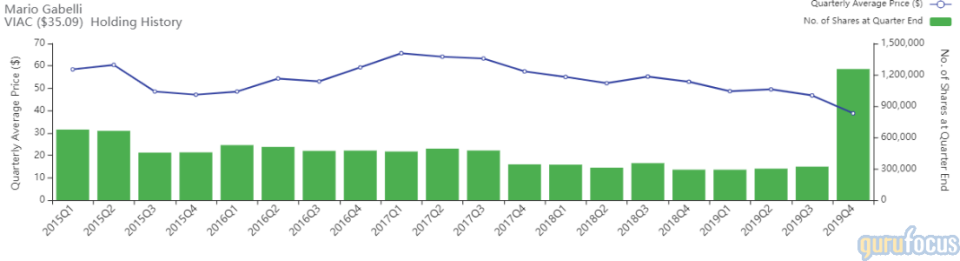

Gabelli gained 1,273,856 Class A shares and 934,259 Class B shares of ViacomCBS as the result of the merger between CBS Corp. and Viacom Inc. (NASDAQ:VIA)(NASDAQ:VIAB) on Dec. 4, 2019. Class A shares averaged $42.41 during the quarter, while Class B shares averaged $38.79.

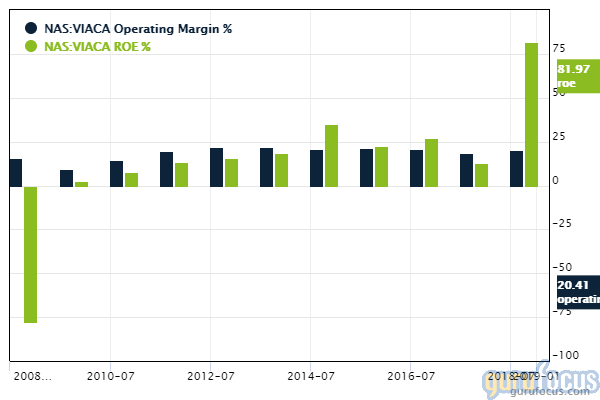

The New York-based company operates a wide range of brands, including CBS, Showtime Networks, Paramount Pictures, Nickelodeon and MTV. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include margins and returns outperforming over 87% of global competitors.

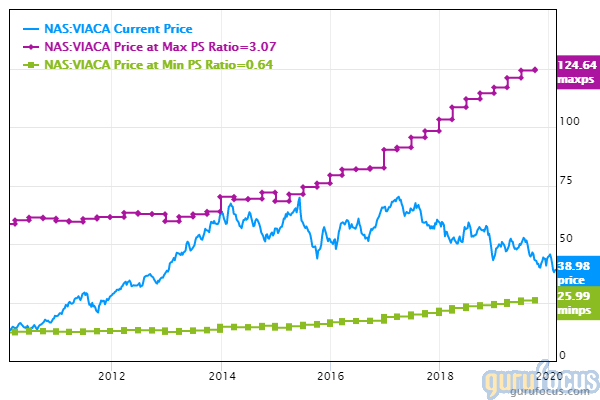

ViacomCBS's valuation ranks 8 out of 10 on several signs of undervaluation, which include a price-sales ratio and a price-book ratio both near a five-year low. Additionally, ViacomCBS's price-earnings ratio of 4.52 is near a 10-year low and outperforms 93.88% of global diversified media companies.

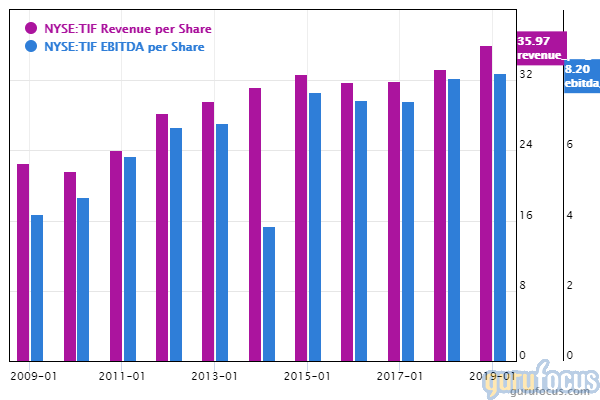

Tiffany

Gabelli purchased 252,966 shares of Tiffany, giving the position 0.27% weight in the equity portfolio. Shares averaged $119.09 during the quarter.

GuruFocus ranks the New York-based jeweler's profitability 8 out of 10 on several positive investing signs, which include operating margins that are outperforming over 93% of global competitors despite contracting over the past five years. The company's business predictability ranks two stars out of five, suggesting moderately consistent revenue and earnings growth over the past 10 years.

Jeremy Grantham (Trades, Portfolio)'s GMO and George Soros (Trades, Portfolio)' Soros Fund Management also purchased shares of Tiffany during the quarter.

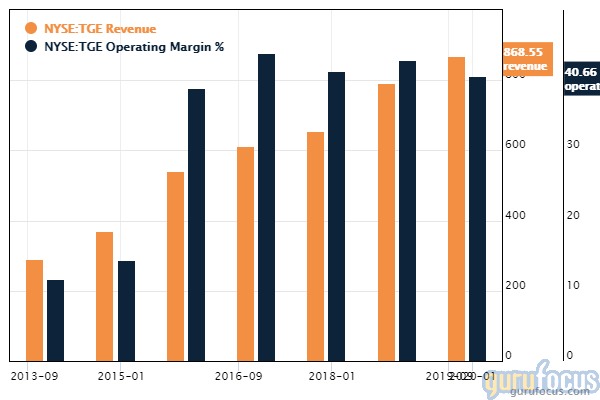

Tallgrass Energy

Gabelli purchased 730,598 shares of Tallgrass Energy, giving the position 0.13% weight in the equity portfolio. Shares averaged $19.20 during the quarter.

The Leawood, Kansas-based company owns, operates, acquires and develops midstream energy assets in North America. GuruFocus ranks the company's profitability 6 out of 10: Although the operating margin outperforms over 91% of global competitors, Tallgrass Energy's three-year revenue decline rate of 14% underperforms 82.67% of global midstream energy companies.

Jim Simons (Trades, Portfolio)' Renaissance Technologies and Pioneer Investments (Trades, Portfolio) also purchased shares of Tallgrass Energy during the quarter.

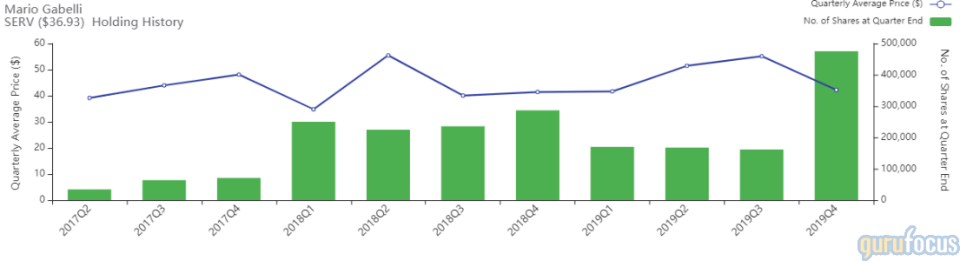

ServiceMaster

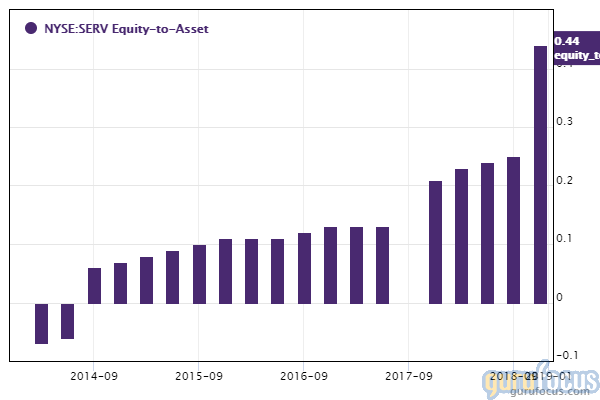

Gabelli added 313,628 shares of ServiceMaster, increasing the position 194.14% and the equity portfolio 0.10%. Shares averaged $42.22 during the quarter.

The Memphis, Tennessee-based company provides a wide range of residential and commercial real estate maintenance services, including termite and pest control, home warranties, disaster restoration, janitorial services, residential cleaning, furniture repair and home inspection. GuruFocus ranks ServiceMaster's financial strength 5 out of 10: Although the company's equity-to-asset ratio outperforms 64.08% of global competitors, ServiceMaster's debt ratios are underperforming over 62% of global personal service companies.

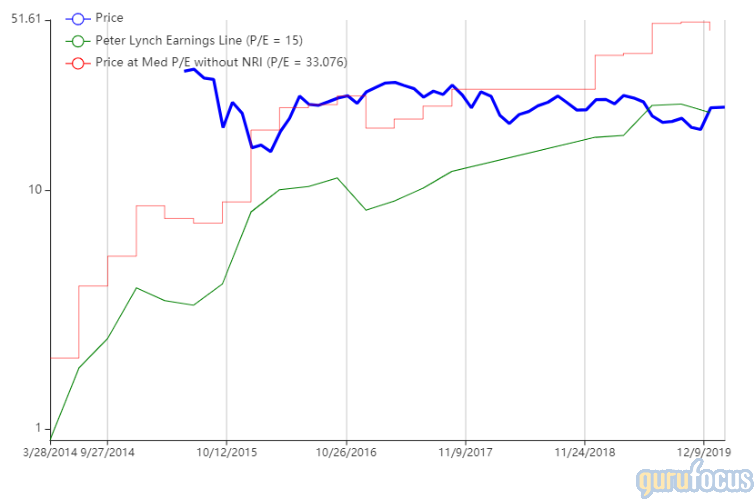

Sinclair

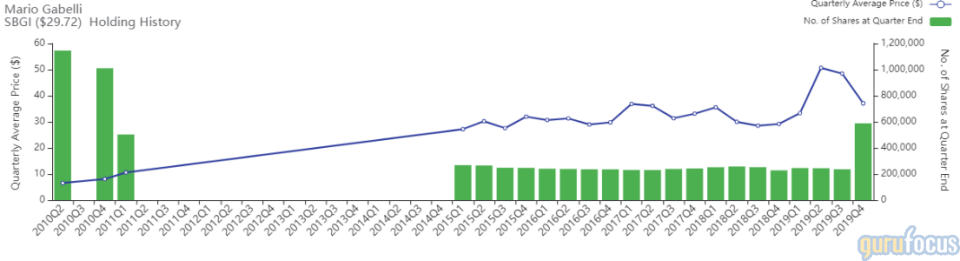

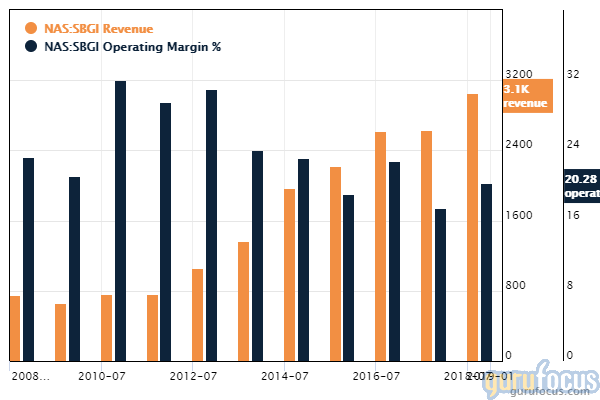

Gabelli added 351,965 shares of Sinclair, increasing the position 148.97% and the equity portfolio 0.10%. Shares averaged $37.07 during the quarter.

The Hunt Valley, Maryland-based company provides sales services to approximately 60 television stations in around 40 markets. According to GuruFocus, Sinclair's operating margin and three-year revenue growth rate are outperforming over 70% of global competitors, suggesting good profitability.

Disclosure: No positions.

Read more here:

Leon Cooperman's Top 6 Buys for the 4th Quarter

David Einhorn's Greenlight Buys DXC and Boosts 2 Holdings in the 4th Quarter

Andreas Halvorsen's Top 5 Buys in the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.