The Market is Rightfully Skeptical about the AT&T (NYSE:T) Turnaround

This article first appeared on Simply Wall St News.

After touching the levels not seen since the Great Recession, AT&T Inc. (NYSE: T) is looking for a merger-propelled turnaround.

While institutions are optimistic about the opportunities, the public rightfully remains uncertain about the future.

See our latest analysis for AT&T.

Institutional Optimism, Public Skepticism

UBS is leading the ranks of the AT&T bulls, as they see the WarnerMedia – Discovery merger as a positive catalyst. UBS analyst John Hodulik considers the deal an opportunity for AT&T to transform into a leaner business, better suited to focus on its core businesses. Mr. Hodulik sees the upside target at US$35, around 25% above the current trading price.

However, Citi is staying slightly more cautious. Although seeing opportunities in AT&T, their analyst Michael Rollins keeps a Buy rating, with a US$29 price target.

Meanwhile, the general public is less optimistic, pointing out the history of AT&T deals that failed to move the needle.

For example, consider the 3 of the latest significant acquisitions

BellSouth – US$67b (2006)

DirecTV – US$49b (2015)

Warner Media – US$85b (2016)

Just these 3 deals (done within the last 15 years) exceed the current market cap of AT&T (US$194.1b), and this is unadjusted for the inflation. With the inflation, the value of those deals would have been US$247b.

Although shareholders should be happy to see the share price up 14% in the last month, that doesn't change the fact that the returns over the previous five years have been less than pleasing. You would have done a lot better buying an index fund since the stock has dropped 34% in that half-decade.

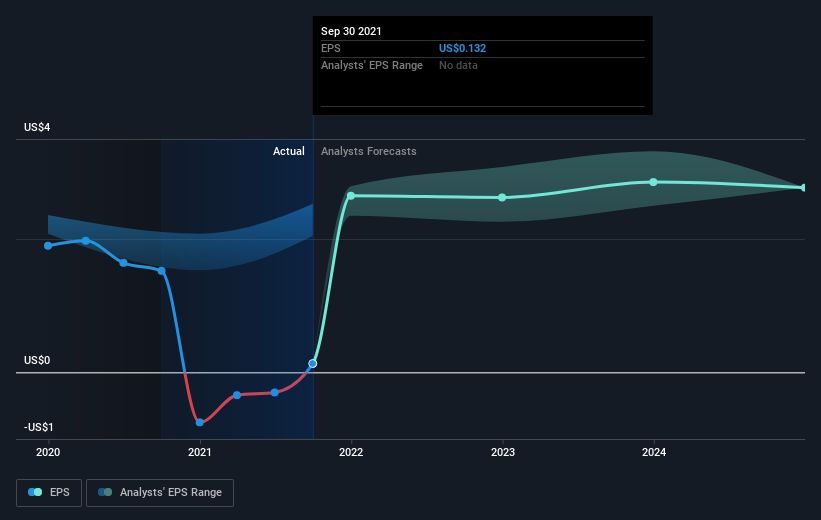

Looking back five years, both AT&T's share price and EPS declined, the latter at a rate of 44% per year. This fall in the EPS is worse than the 8% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into the earnings by checking this interactive graph of AT&T's earnings, revenue and cash flow.

AT&T Insider Transactions Over The Last Year

The Independent Director Stephen Luczo made the biggest insider purchase in the last 12 months. That single transaction was for US$3.0m worth of shares for US$29.80 each. That means that an insider was happy to buy shares above the current price of US$27.18. While their view may have changed since the purchase was made, this suggests they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. It is generally more encouraging if they paid above the current price, suggesting they saw value, even at higher levels.

You can see the insider transactions (companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a complete picture for stocks that pay a dividend. As it happens, AT&T's TSR for the last 5 years was -10%, which exceeds the share price return mentioned earlier. The dividends paid by the company have boosted the total shareholder return.

A Different Perspective

Over the last few years, AT&T delivered underwhelming returns. While the company still pays a very high dividend (7.65% at the moment), this is just about outpacing the highest inflation in the last 4 decades. While it is admirable to see insider buying and institutional optimism, it is impossible to deny the public criticism, as the acquisition numbers tell the story - even before the adjustment for inflation.

To truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for AT&T that you should be aware of before investing here.

AT&T is not the only stock that insiders are buying. For those who like to find winning investments, this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.