Markets seesaw after ECB unveils sweeping stimulus package: as it happened

European Central Bank cuts key rate and announces it will re-initiate quantitative easing

Euro and stocks both volatile as traders digest Mario Draghi’s calls for government spending

Changes are aimed at stimulating struggling currency bloc

Should you back European stocks amid change at the central bank?

Robin Pagnamenta: Confusion, queues and shoplifting: why we aren't yet ready for till-less supermarkets

Wrap-up: Draghi speaks, markets squirm

That’s one way to make an exit. Mario Draghi has pressed down on the accelerator, told Christine Lagarde to take the wheel, a rolled out of the side door. Markets were rattled, but ultimately ended strengthening— as did the euro.

Ms Lagarde, who must now keep the eurozone show on the road, has been handed aggressive monetary policy, hungry markets and — what may be her greatest challenge — an ECB demand that governments pay their own way through fiscal top-ups.

Today’s decision was tense — even as I write, Bloomberg is reporting that Mr Draghi faced an “unprecedented” revolt from policymakers as he moved to re-introduce QE. Those voices from the back may grow louder once Mr Draghi has gone.

Speaking of exits, that’s me done for the day. I’m off tomorrow, and in the absence of any major economics news on the schedule, so is the live blog. I’ll be back as usual on Monday, when we’ll begin looking forward to the latest clash in the war between Donald Trump and Fed chair Jerome Powell.

European blue chips hold gains to close

Phew — that could easily have gone the other way. With markets closed, European blue-chip indices managed to stay in the green, with the FTSE 100 hanging on by its fingertips.

ITV among FTSE’s biggest fallers after downgrade

ITV is one of the FTSE 100’s biggest fallers today (in second place to the reliably volatile NMC Health).

Shares are off 4.2pc currently, following a downgrade to hold by Shore Capital analyst Roddy Davidson.

Here’s what I wrote about the broadcaster yesterday: Market report: ITV hit by jitters as Apple changes tack

Stocks flip positive again

European stocks are back in the green after a whipsaw ride over the last hour — clearly traders are finding there’s a lot to digest in Mario Draghi’s statements and the ECB’s latest moves.

Over on Wall Street, where investors are reacting to the slightly clearer news of seemingly reduced tensions between the US and China, the S7P 500 and Dow are up about 0.4pc and 0.5pc apiece, and the Nasdaq is up about 0.8pc.

Full report: Draghi moves to battle economic slowdown

Here’s deputy economics editor Tim Wallace with full details on the ECB package:

The European Central Bank is cutting interest rates deeper into negative territory and will restart money printing in November as Mario Draghi moves to battle the eurozone’s economic slowdown.

Banks now face a rate of minus 0.5pc on their deposits held at the ECB in Frankfurt, down from minus 0.4pc previously.

However in an acknowledgement that this charge is painful for lenders and that negative rates potentially undermine efforts to boost the economy, they will be allowed to store some money at 0pc, with only excess deposits charged interest, in a bid to boost lending.

You can read his full report here: ‘Permanently negative rates’: Draghi cuts interest rates and reloads QE as ECB removes time limit on stimulus

Meals on wings: Grocers prepare to air lift food in event of Brexit problems

Some of the UK’s biggest supermarkets — Morrisons, Waitrose and the Co-op — are preparing to fly in food by plane in the event of a disorderly Brexit. Retail correspondent Laura Onita reports:

The comments come after the government officially admitted on Thursday that a disorderly Brexit could lead to food prices going up and a reduction in the choice of goods available to shoppers in supermarkets.

You can read her full report here: Grocers prepare to air lift food in case of no-deal Brexit shortages

European stocks now down

Stocks have taken a sharp downwards dip as Mario Draghi’s words sinks in: the ECB has done what it can, government have to take it from here.

Ronald Temple from Lazard Asset Management says:

Today the ECB used more of its dwindling ammunition to try to stimulate growth. Draghi rightly emphasized the imperative of fiscal stimulus and structural reforms. Unfortunately, Eurozone governments have failed to deliver on this count for a decade now, in spite of ever lower financing costs.

The ECB has done its job; now it’s time for the governments to step up.

Round-up: Topshop flop, Morrisons stays close to Amazon, unicorn Improbable buy game developer

Mario Draghi finished up speaking a few minutes ago — here are the stories you may have missed amid all the excitement:

Sir Philip Green’s Topshop plunges to £500m loss: Topshop and Topman, once the jewel in the crown of billionaire Sir Philip Green’s retail empire, slumped to a loss of almost half a billion pounds last year as sales collapsed.

Morrisons extends Amazon delivery tie-up to more cities: The FTSE 100 grocer is taking full advantage of its tie-up with Amazon to expand its swift grocery delivery service across the country.

British unicorn Improbable swoops on US game developer in push to revive growth: The SoftBank-backed video game technology company has bulked up its capacity to develop new games, buying its first established studio in a move expected to revive revenue growth.

Russell Lynch: Don’t expect a similar performance from the Bank of England

Economics editor Russell Lynch has given his snap take on the ECB’s decision and Mario Draghi’s statements. He writes:

The Italian’s latest monetary salvos - including open-ended money printing and bolstered forward guidance - have been telegraphed since the ECB's Sintra conference in June when he signalled to markets that “additional stimulus” would be required.

And the Fed has been in easing mode since the turn of the year, even if not at a quick enough pace to prevent Donald Trump delivering regular tongue-lashings to Fed chair Jay Powell on Twitter.

But the Bank of England won’t be joining the party. In Europe and the US the problem faced by central bankers is one of undershooting inflation and faltering growth. That’s particularly true of Germany after yet more disappointment for the eurozone’s economic engine, which is veering towards recession.

You can read his full thoughts here: Don’t expect the Bank of England to follow the ECB’s monetary fireworks

Chance of eurozone recession ‘small’

Draghi says the ECB still see the probability of a eurozone recession as “small”, but says “it has gone up”.

Looking at the specific case of Germany, he nods to this morning’s IFO Institute report and says the country is “a case for timely and effective fiscal action”

More reaction to the ECB’s decision...

Rosie McMellin of Fidelity International says:

While both the deposit cut and the amount of monthly purchases fall short of market expectations, this is more than outweighed by the changes to the forward guidance and open-endedness of the measures. Today’s package will likely reinvigorate the hunt for yield, and we would expect credit markets to rally.

Seema Shah of Principal Global Investors says:

Although Draghi may have disappointed the market with a smaller deposit rate cut than the market was hoping for, surely he has more than compensated for that by delivering open-ended QE. No wonder Italian bond yields have fallen to record lows. If asset purchases are focused on corporate debt, the market impact will be even more powerful.

Eurozone banks are the other clear winners from today’s ECB decision. The tiered deposit scheme, together with easier terms for TLTROS, should smooth the monetary transmission mechanism and support bank lending, permitting dovish central bank policy to impact the economy in the direction that is intended.

State Street’s Tim Graf says:

Draghi has also built a dovish platform upon which his successor, Christine Lagarde can build when she takes over in November. At this stage, it is hard to see much more policy innovation in the coming six months, but this is probably not a buy signal for the euro or a sell signal for European government bonds.

Draghi says disagreement over QE was overcome

The first day of the ECB’s meeting on Wednesday overran, with a publicly-split group of policymakers struggling to settle on the details of this package. Mr Draghi said initial divisions over re-introducing quantitative easing were overcome.

Note that the European Parliament’s new draft #Brexit resolution suggests “avoiding a no deal exit” is a good enough reason for granting an extension. So not just for an election, a referendum or a massive rethink then... pic.twitter.com/a2zpygl6tI

— Adam Fleming (@adamfleming) September 12, 2019

Unpacking the reasons behind the ECB’s decision, Mr Draghi says the ECB is reacting to the “continued prominence of downsides risk”, such as the US-China trade war, or Brexit. On that topic:

Note that the European Parliament’s new draft #Brexit resolution suggests “avoiding a no deal exit” is a good enough reason for granting an extension. So not just for an election, a referendum or a massive rethink then... pic.twitter.com/a2zpygl6tI

— Adam Fleming (@adamfleming) September 12, 2019

Draghi reacts to Trump

Mario Draghi has been asked about his react to Donald Trump’s tweet on rate cuts (see 1:18pm update).

He says: “We have a mandate: we pursue price stability, and we don’t target exchange rates, period.”

Explaining with the ECB has taken so many steps to protect lenders, Mr Draghi says it is attempting to “protect the smooth transmission of the lending channel”.

Draghi calls on governments to take action

Breaking News

Draghi goes out with mini-bang as ECB goes back to its toolbox and pulls out quantitative easing just nine months after ending the program.

+20 billion Euro QE for as long as needed

+Deposit rates -0.5 from -0.4

some were looking for even more draconian moves— Charles V Payne (@cvpayne) September 12, 2019

Draghi explains that three key factors spurred the ECB into action this afternoon.

A “protracted slowdown” in the eurozone has been “more marked than expected”.

Risks to the economy, such as the trade war and other geopolitical risks, have persisted.

And finally inflation expectations have slipped in recent months.

He says that there was complete agreement on the Governing Council that fiscal policy needs to play a much more active role in reviving growth.

“It is time for fiscal policy to take charge,” he argues.

Euro sinks after ECB slashes forecasts

Draghi introduces the GDP and inflation outlook for the euro area pic.twitter.com/ROiKrLQazO

— European Central Bank (@ecb) September 12, 2019

The euro is tumbling further on currency markets after ECB president Mario Draghi delivered a slew of big downgrades for growth and inflation in the coming years.

Growth will slow to 1.1pc this year and edge up to 1.2pc in 2020, down from June's forecasts of 1.2pc and 1.4pc, respectively. Inflation is seen at just 1pc next year, down from 1.4pc.

Mr Draghi said the risks to growth "remain tilted to the downside".

He explained:

"These risks mainly pertain to the prolonged presence of uncertainties related to geopolitical factors, the rising threat of protectionism, and vulnerabilities in emerging markets."

Trump tweets...

The US President has naturally used this opportunity to take a shot against the US Federal Reserve who (in case you have been under a rock) he really, really wants to slash rates.

European Central Bank, acting quickly, Cuts Rates 10 Basis Points. They are trying, and succeeding, in depreciating the Euro against the VERY strong Dollar, hurting U.S. exports.... And the Fed sits, and sits, and sits. They get paid to borrow money, while we are paying interest!

— Donald J. Trump (@realDonaldTrump) September 12, 2019

European stocks rise

The announcement has injected some life into languishing European markets, which were most flat before. The Europe-wide STOXX 600 is now up 0.43pc,

ING’s CarstenBrzeskisays:

The final showdown has started with a big bang. The ECB just announced a big policy package to revive the Eurozone economy and to bring inflation back to target. Here is what the ECB will do:

This is Mario Draghi’s final “whatever it takes”. Depsite all market excitement now, the question remains whether this will be enough to get growth and inflation back on track as the real elephant in the room is fiscal policy. It is clear that without fiscal stimulus, Draghi’s final stunt will not necessarily lead to a happy end.

TLTROs, by the way, are long-term loans to commercial banks, compensating them for negative rates in a bid to push up lending.

Reaction: ‘The ECB is all in; buckle up’

Pantheon Macroeconomics’ Claus Vistesen has offered his rapid take:

Markets initially reacted in a disappointing fashion to the news that the ECB has “only cut its deposit by 10bp, but as we type short-term yields and the euro are falling. That’s probably the right call. The details suggest that the central bank is going all in.

Euro drops, golds gains after ECB decision

The euro has fallen sharply following the ECB’s decision, hitting its lowest level in over a week, while gold has risen. We’ll have to wait and see how it performs during Mario Draghi’s press conference in just over 20 minutes.

Ranko Berich, an analyst at Monex Europe, says:

At first glance, the ECB has not quite thrown the kitchen sink at the eurozone economy. The QE package at 20bn/m is shy of market expectations, which were 30 billion a month. But the Bank is clearly back in the business of serious policy easing and more aggressive action could easily be taken in response to a worsening in conditions.

There are arguments for the ECB to hold back some of its ammunition. The current growth slowdown is focussed in the manufacturing sector, particularly in Germany, and there are as yet few signs of the slowdown hitting consumers. The Eurozone as a whole is now a “high beta” economy that is extremely sensitive to external demand, particularly from China. A sudden improvement in global conditions – for example, due to a US-China trade resolution - could easily see Eurozone growth pick up rapidly. In this context, it makes sense for the ECB to reserve some ammunition.

With the current pace of asset purchases at 20bn and tiered deposit rates in place, there is clearly room for the ECB to ease further – and depending on forward guidance from Draghi, and eventually Lagarde, markets may end up getting ahead of the curve and selling EUR pre-emptively.

Snap take: European Central Bank unveils extensive stimulus package

The European Central Bank has released a sweeping stimulus package as it tries to inject fresh life into the eurozone, which has been battered by Brexit uncertainty and a trade war slowdown.

The central announced it would cut its key deposit rate by 0.1pc — in line with expectations, but lower than some had hoped — and re-initiate a process of quantitative easing by buying €20bn of debt a month for an indefinite period of time: “as long as necessary”.

The changes are far-reaching, but are not as extreme as some analysts had predicted.

The announcement of looser policy is remarkable, given the ECB said it was done with its dovish approach as recently as nine months ago. But global events, which have weighed particularly on the bloc’s industrial champion, Germany, have forced policymakers to once again crack out the stimulus.

1 of 3@ECB President Mario #Draghi seems to have gotten most of what he wanted:

10 bps rate cut to minus 50 bps;

Two-tier system to help the #banks;

More aggressive forward guidance;

#QE restart at 20 billion per month; and

An open ended QE.

Absent a communication...— Mohamed A. El-Erian (@elerianm) September 12, 2019

Smaller than expected rate cut but interesting with open-ended QE - very strong signal in our view! $EUR weakens and $EUR yields are lower �� https://t.co/xoFjPP0ta5

— Danske Bank Research (@Danske_Research) September 12, 2019

Reaction from Twitter

Euro drops below $1.10 following ECB decision The ECB has cut the deposit facility rate by -10bps as expected to -0.50%. It has also changed guidance from calendar based to data based. QE has been reintroduced in open-ended format at a pace of €20bn/mth. https://t.co/l3TNOEsxMbpic.twitter.com/jfpgAV9Yki

— Holger Zschaepitz (@Schuldensuehner) September 12, 2019

reckon that's a minimum 2 yr QE programme - so EUR 480bn. But probably longer.

— econhedge (@econhedge) September 12, 2019

Outcome slightly underwhelming vs. consensus ("only" -10bps & "only" 20bn/m.) The rest seems spot on. https://t.co/HWOr7n2iG4

— JohannesBorgen (@jeuasommenulle) September 12, 2019

ECB re-initiates QE, will bring in a two-tier system for negative rates

The ECB says it will re-trigger a process of quantitative easing at a rate of €20bn per month, and introduce a two-tier negative ratings system to reduce the impact sub-zero rates have on lenders (who must give money to the central bank).

My colleague Tim Wallace writes:

Mario Draghi has underwhelmed a little here. Markets thought there was a decent chance of a 20 basis point cut in rates, so this is not going to impress anyone. Analysts also anticipated €30bn–€40bn of QE each month for around nine months, so €20bn is a little light. That said, the bond purchases will “run for as long as necessary”, so in the end this could amount to a bigger loosening of policy than it initially appears.

BREAK: Rate cuts land on expectations

Here are some breaking toplines from the ECB:

New asset purchases

Benchmark interest rate unchanges

Marginal lending rate unchanged

Deposit facility rate cut to -0.5pc, meeting expectations

ECB will buy bonds as long as needed

ECB The interest rate on the deposit facility will be decreased by 10 basis points to -0.50%.....

Net purchases will be restarted under the Governing Council’s asset purchase programme (APP) at a monthly pace of €20 billion as from 1 November. #QE— Shaun Richards (@notayesmansecon) September 12, 2019

BREAKING! The #ECB lowers the deposit rates to -0.5% and starts new round of open-ended #QEpic.twitter.com/qtO2h2em14

— jeroen blokland (@jsblokland) September 12, 2019

European stocks are still looking pretty flat, with just minutes to go until the ECB’s decision is announced

Wire reporters will have seen copies of the ECB’s plans, so I’ll try to get the gist of it all through to you as soon as possible after quarter to.

As ever, sound and fury is likely to follow the announcement, but myself and the brains on the economics desk will try to cut through with some clarity.

The live video of Mario Draghi’s press statements will run here:

What will Mario Draghi’s exit mean for European stocks?

With Mario Draghi’s time at the European Central Bank nearly up, what will happen to European stocks after his exit?

That’s the question our Money team has set out to answer. Investment editor Taha Lokhandwala writes:

The end of his tenure therefore leaves questions over whether investors should cut and run or hold out.

European shares have risen this week as investors expect more support for markets at the central bank’s meeting — Mr Draghi’s final act as governor. He is the man credited with saving the euro zone but will be replaced by Christine Lagarde come November.

Mr Draghi was behind the plan to pump nearly €3bn (£2.7bn) into European bond markets — which eventually filtered through to stock markets and pushed up share prices.

You can read more here: Should you back European stocks amid change at the central bank?

BP considers oil project closures to reduce environmental impact

BP is prepared to sell off some of its oil projects to help it meet its green ambitions, its chief executive has said. My colleague Julia Bradshaw reports:

Bob Dudley said one way to help reduce greenhouse gas emissions was to sell some of its most carbon-intensive projects, although he would not say which assets BP was targeting.

Earlier this year shareholders voted to force BP to explain how it is aligning its operations with the Paris climate change agreement of 2015 by issuing a report on the matter before its annual general meeting in May next year. This puts senior managers are under pressure to come up with solutions.

You can read her full report here: BP chief: We’ll sell oil projects to meet climate change goals

No-deal Brexit: What you need to know

In the spirit of the Operation Yellowhammer discussion that has spilled onto today, the Telegraph’s Money team have looked at the key things people need to know in order to prepare for a disorderly exit from the EU (should it occur):

How no-deal Brexit will affect travel bookings, currency exchange and duty free

What would a no-deal Brexit mean for your personal finances?

What will happen to house prices in a no-deal Brexit — and will it be a good time to buy?

You can follow the latest political updates here:

Tweet: Euro holds ahead of ECB decision, bucking trends

Looks as if #ECB's Draghi has lost his magic touch on the #Euro. The common currency fell on the day of the decision in 11 of the 16 meetings held in the last 2yrs. But the most recent ECB announcements delivered 3 of the 5 exceptions, BBG says. pic.twitter.com/vyRWW74kb1

— Holger Zschaepitz (@Schuldensuehner) September 12, 2019

Full report: German factory slump means country is in recession

Here’s a full report on this morning’s IFO Institute report, which offered some grim reading on the state of Germany’s economy. Tom Rees writes:

The research group cut its forecast for 2019 economic growth to 0.5pc, warning that the weakness in Germany's huge industrial sector is spilling over into the rest of the economy.

The Ifo expects GDP to contract by a further 0.1pc in the third quarter, a second consecutive quarter of falling output - meaning a technical recession.

“This downturn was triggered by a series of world political events that call into question a global economic order that has grown over decades,” warned Timo Wollmershaeuser, head of forecasts at Ifo.

You can read more here: Germany ‘in recession’ as factory output slumps

ECB preview: What the experts say, in detail

With just over an hour and a half until the ECB announces its rate plans, here’s what some analysts are predicting.

OANDA’s Craig Erlam sets our scene:

The big event today is undoubtedly the ECB and whether Draghi is going to go out with a bang or a whimper. Everyone is convinced Draghi means business today and is packing the bazooka for one last showdown. Investors have high expectations with a rate cut, QE and tiered deposit rates expected, combined with all the technical adjustments that makes it all possible.

I can't help but fear that investors have got a little ahead of themselves here. There are hawks on the board that have repeatedly questioned the need for stimulus and I question whether Draghi's penultimate meeting as President is appropriate for such a huge package. Draghi isn’t shy of bold policy decisions though, as we've seen over the last eight years so who knows.

Later today: watch live as ECB President Mario Draghi explains today’s monetary policy decisions. pic.twitter.com/ttfJFV1TVA

— European Central Bank (@ecb) September 12, 2019

Royal Bank of Canada analysts say:

They add:

The most contentious part of the ‘package’ to be announced today surrounds the restarting of QE, where we remain in the minority in calling for no announcement today. With the market priced in for the restart of QE in the magnitude of EUR 30-40bln/month, even if QE is announced, we think it will likely be less aggressive and hence there is still room for the ECB to disappoint the market in this scenario.

Saxo Bank’s John Hardy says:

First we are most likely to see an implementation of tiering of interest rates assessed on bank reserves akin to the Bank of Japan’s system in an effort to reduce the pain on EU banks affected by negative interest rates on their reserves (particularly an issue for German and French banks).

Second, we will get a rate cut. Rate cuts are so futile I don’t understand why the ECB bothers, but that won’t stop them from delivering one. Given that Draghi is running out of time and will want to impress, a 20-bps cut might be a bit more likely than the market odds are pricing it at (about 40/60 for 20 vs. 10 bps).

The area where the ECB can surprise most is on the QE front, as renewed QE is clearly controversial on the ECB governing council and where estimates vary from EUR 20B to EUR 60B per month (consensus somewhere in the middle). Beyond these measures, however, it will be important to draw a signal during the press conference on whether Draghi gives the impression that the ECB is shooting its last bullets here or maintains the ability to continue to act. We think not – from here the power is in the hands of the EU and its political leadership as the central bank put has almost entirely lost its potency.

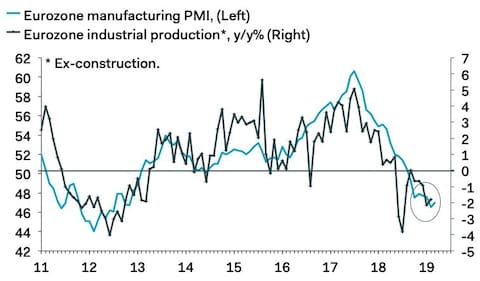

Eurozone on track for poor performance in third quarter

Reacting to those eurozone industrial production figures, Pantheon Macroeconomics’ Claus Vistesen writes:

Manufacturing in the Eurozone remained under pressure at the start of Q3, even as the headlines improved slightly from the poor finish to the second quarter. Output of capital and durable consumer goods rebounded from sharp drops in June, but falling production in energy, intermediate and non-durable consumer goods were enough to drive the overall headline down.

Across the major economies, only France stood out to the upside, while output fell on the month elsewhere. It is too soon to make any firm conclusions about Q3 as a whole, but the outlook isn’t pretty. Assuming that production will decline 2pc year-over-year through the quarter, which is what the surveys suggest, the quarter-on-quarter rate will dip by 0.2pp, to -0.8%.

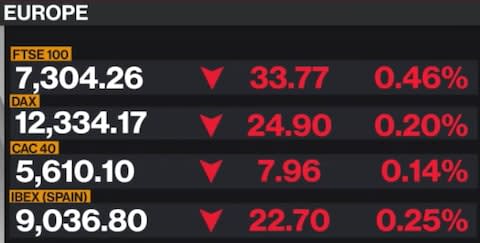

Stocks now looking more mixed...

Those early gains don’t appear to have stuck, and the broad picture across Europe’s top indices now very flat, with several bourses trending slightly downwards.

IFO: German will enter technical recession

Germany’s IFO Institute think-tank predicts Europe’s largest economy will slide into a recession this year, predicting its economy will shrink during the third quarter (two consecutive quarters of contraction = technical recession).

IFO reduced its overall German growth forecast for 2019 to 0.5pc, from 0.6pc, saying: “While employment in manufacturing has been falling since the spring, the previously strong growth at private service providers and in the construction industry came to a standstill this summer.”

Timo Wollmershaeuser, IFO’s head of forecasting, said:

The German economy is at risk of falling into recession. Like an oil slick, the weakness in industry is gradually spreading to other sectors of the economy, such as logistics, one of the service providers. This outlook is associated with high uncertainties. For example, we are assuming that there will be no hard Brexit or escalation of the US trade war.

He added:

This downturn was triggered by a series of world political events that call into question a global economic order that has grown over decades... Meanwhile, the weakness of the economy has left its mark on the labor market

Adding to the sense of gloom, industrial production across the eurozone slipped 2.0pc year-on-year in July, a worse fall than expected.

Euro area #IndustrialProduction -0.4% in July over June, -2.0% over July 2018 https://t.co/XpWqxOtyprpic.twitter.com/sWhWsxcbfb

— EU_Eurostat (@EU_Eurostat) September 12, 2019

Apologies for the slight delay in bringing this IFO update to you, I was trying to get hold of an English version.

Full report: Babcock named preferred bidder for frigate contract

My colleague Mason Boycott-Owen has a full report on this morning’s announcement that a Babcock-led consortium has won the contract to build a fleet of stripped-down frigates for the Royal Navy. He reports:

In addition to securing jobs for the assembly site at Rosyth in Fife, construction work will be spread across the UK up until 2027, with work expected to begin this year.

The vessels, which have an average cost of £250m each, were commissioned to maintain the Navy's fleet size as well as generate money from orders overseas, as the design can be re-sold to other navies.

The cut-price ships are a smaller and cheaper than the Type 26 frigate, which was announced late last year.

You can read his full report here: Babcock confirmed as preferred bidder for Type 31 naval frigate

N Brown shares slip after PPI hit

Shares in N Brown, the small-cap plus-size clothing company, have slipped this morning after it announced it will need to set aside up to £30m for PPi repayments.

In an update to the City this morning, it said:

The Group has paid out £108m in financial redress to date which incorporates the additional provision the Group made of £22.6m in the second half of the previous financial year to cover claims up to the 29th August 2019 deadline.

The Group is currently working through all additional PIRs now received, and although it is not possible to be precise about the final outcome, the Group now believes it will be necessary to make an additional provision in the range of £20m to £30m in its half year results for the six months to 31st August 2019. As a result, our full year net debt guidance is anticipated to increase from £440m–£460m to £460m–£490m.

The retailer said it will work through the requests it has received and attempt to give firmer figures in its half-year update on October 10.

Morrisons extends deal with Amazon, but reveals second quarter loss

Morrisons has posted its first quarterly loss since 2016, but announced its delivery partnership with Amazon Prime has been extended.

Sales rose 5.3pc overall across the six months to June, but the company was weighed down in the second quarter, which saw the first dip after 14 quarters of successive growth amid poor comparatives (2018 was boosted by good weather, the football World Cup and the Royal Wedding).

The retailer said like-for-like sales would increase in the second half, and said it would swap to a multi-year contract with Amazon Prime rather than rely on the rolling contract it currently uses.

Jefferies analysts said the results “confirm a resilient business”, saying:

An EBITDA margin increase of 20bps despite challenging industry conditions highlights the considerable self-help available. And a 2p special dividend underlines management confidence on outlook. It also highlights the rewards of ownership, under-appreciated at current levels.

The supermarket is currently the biggest riser on the FTSE 100.

Co-op says it is stockpiling for Brexit, as funeral business revenue drags on results

The Co-operative Group’s half-year profits fell to £25m in the six months to June from £44m during the same period last year.

The group’s funeral business dragged on earnings, with revenue falling 6pc. The company said this was “driven by an unexpected 10pc fall in the death rate and our conscious decision to hold prices in a changing and competitive market”.

Chief executive Steve Murrells has been doing the media rounds today, warning over the potential disruption of a no-deal Brexit. He said that the company has been stockpiling goods including toilet paper and water, telling BBC Radio 4’s Today programme:

We have taken on extra space. For challenges in fresh areas we’ve bulked up on some ambient grocery goods. That should put us in good stead.

Concerns about retailer preparedness have been ramped up again, following publication of the Government’s Yellowhammer documents, detailing the possible impact of a disorderly Brexit. Here’s the document in full if you haven’t already read it (it’s only five pages long): Operation Yellowhammer

Here’s more details from the Sunday Times reporter who first obtained a copy of the report last month:

"15. Facing EU tariffs makes petrol exports to the EU uncompetitive. Industry had plans to mitigate the impact on refinery margins and profitability but UK Government policy to set petrol import tariffs at 0% inadvertently undermines these plans." [More to come]

— Rosamund Urwin (@RosamundUrwin) September 11, 2019

That Co-op Funerals drop may well put pressures on peers in the sector. Peel Hunt analyst Charles Hall cut his target price for rival Dignity to 500p, giving it a ‘sell’ rating.

Babcock wins order for Type 31 navy frigate

A consortium spearheaded by defence supplier Babcock has won the contract to produce a fleet of cut-price frigates for the Royal Navy.

The announcement, which Telegraph industry editor Alan Tovey reported last month was on its way, secures hundreds of jobs in Fife, with design work set to begin by the end of the year and deliveries set to begin from 2023.

The Arrowhead 140 design was chosen for the £1.25bn contract.

Babcock boss Archie Bethel said:

Driven by innovation and backed by experience and heritage, Arrowhead 140 is a modern warship that will meet the maritime threats of today and tomorrow, with British ingenuity and engineering at its core. It provides a flexible, adaptable platform that delivers value for money and supports the UK's National Shipbuilding Strategy.

Arrowhead 140 will offer the Royal Navy a new class of ship with a proven ability to deliver a range of peacekeeping, humanitarian and warfighting capabilities whilst offering communities and supply chains throughout the UK a wide range of economic and employment opportunities.

The Type 31e is a stripped-down warship, suitable for general duties rather then intensive warfare, lowering costs to an average £250m apiece.

Here’s more (from last month):Babcock set to build new cut-price frigates and weaken BAE shipbuilding monopoly

Prime Minister Boris Johnson hailed the decision as one that would “bring shipbuilding home”. He said:

I look forward to the restoration of British influence and excellence across the world’s oceans. I am convinced that by working together we will see a renaissance in this industry which is so much part of our island story

LSE shares hold flat on day after takeover bid

London Stock Exchange Group shares are pretty much flat this morning, the day after a shock-and-awe bid by the Hong Kong exchange operator to take over the group was unveiled.

Given shares settled fairly below the stated bid price yesterday, it appears HKEX did not to enough in their offer — which included a stipulation that LSE give up on its plans to merge with data giant Refinitiv — to win over LSE investors.

Here’s a comparison of the two exchange groups:

Sunday Telegraph editor Allister Heath said the offer is about “weaponising commerce”. He writes:

If we do somehow end up leaving the EU, we will need to decide what kind of capitalism and globalisation we wish to nail our colours to. It would be apposite, therefore, were the Hong Kong Stock Exchange’s stunning £32 billion hostile takeover bid for the London Stock Exchange to turn out to be an early test of Britain’s post-Brexit economic policy.

As it happens, I doubt it will ever come to that: the bid is likely to collapse of its own accord. Not only does it undervalue the LSE but two-thirds of the payment would come from printing more Hong Kong Stock Exchange shares. This would tie LSE shareholders into a financial centre in probable terminal decline, thanks to China’s repression and the prospect of never ending turmoil. Its shareholders, if they have any sense, will send the Hong Kongers packing.

You can read his full piece here: Post-Brexit, we need real capitalism — not stealth foreign nationalisation

John Lewis warns on Brexit as it slips to half-year loss for first time

If a fresh sign of weakness on the UK’s struggling high streets, department store John Lewis has slip to a first-half lost for the first time ever. Retail correspondent Laura Onita reports:

John Lewis Partnership made a loss of £25.9m in the half year to 27 July blaming “difficult” trading conditions.

Outgoing Sir Charlie Mayfield said a disorderly Brexit would substantially dent its growth.

“We have historically made the majority of our profits in the second half of the year,” he said.

She adds:

Waitrose fared better, making £110m profits, while the department store chain made a £61m loss.

Here’s Laura’s in-depth read on John Lewis’s future, from last weekend: Can John Lewis struggle through the retail storm battering the UK high street?

What to expect from the European Central Bank meeting

Ahead of today’s policy announcements from the European Central Bank, economics editor Russell Lynch has laid out the key things to look for as ECB president Mario Draghi makes his farewell. He writes:

The former Goldman Sachs banker’s more sure-footed approach to policy contrasts with the errors of predecessor Jean-Claude Trichet’s over-hasty interest rate rises in 2008 and 2011 in response to a spike in prices.

The opposite problem has confronted Draghi through much of his tenure, as inflation falls consistently short of the ECB’s targets of ‘close to 2pc’ amid moribund growth.

The central banking chief has tried almost everything: interest rates went negative in 2014, and were cut to the current -0.4pc in March 2016. Draghi has also employed forward guidance on rates, which he says won’t rise until mid-2020.

You can read his full piece here: Has ECB boss Mario Draghi got anything left in his box of tricks?

Here’s what the ECB’s schedule looks like:

12:45pm: Rates are announced

1pm: Press conference

If you fancy yourself as up to Mr Draghi’s job (Christine Lagrade many have already pipped you to it), try our interactive game:

The ECB is all-but-guaranteed to make cuts, but the extent and nature of them may vary. Markets.com’s Neil Wilson says:

All eyes are on the ECB which provides the major event risk today. As detailed in our preview, there’s a strong sense that whatever the central bank comes up with it will fall short of market expectations. Expectations for the meeting are running very high. Whilst it seems the ECB will throw the kitchen sink at slow growth and persistently lacklustre inflation, markets seem to want the taps, the plug and the plumbing thrown in for good measure too. We should caution that the market has already slightly repriced for disappointment though as bunds have since September 3rd come back towards the zero line from their recent all-time lows.

CMC Markets’ David Madden adds:

Today’s ECB meeting has been at the forefront of traders’ minds all week. The ECB are expected to loosening monetary policy. The base rate is expected to be kept on hold at 0.0pc, and the deposit rate is currently -0.4pc, and there is speculation it will be cut even further, in a bid to encourage banks to increase lending. There is also talk of a government bond buying scheme being announced too, but traders remain divided over what the central might reveal.

Inflation in the currency bloc is 1pc — nowhere near the ECB’s target rate, and it is considerably lower than the CPI rate in the UK and the US, and that underlines the weakness in the region. Germany is the engine room of Europe, and the economy contracted in the second-quarter, and there is fear it is heading for a recession. The ECB have a justification for loosening monetary policy, but it might be a staggered process.

ECB cheat sheet.#Ready#NoMoreBetspic.twitter.com/tskGp3A3KC

— Frederik Ducrozet (@fwred) September 12, 2019

European stocks advance at open

Traders are looking forward to the European Central Banks decision, which will land with us just before 1pm.

British American Tobacco plans job cuts

British American Tobacco plans to make job cuts as it shifts towards “next-generation” products to offset a decline in smoking. Jon Yeomans reports:

The FTSE 100 tobacco giant announced it would shed layers of management, reorganise its business units and simplify its structure to create a “more efficient, agile and focused” company.

The moves are the first key decision by new boss Jack Bowles, who took the top job earlier this year. The restructuring will be complete by January and will affect 20pc of senior jobs in the company, or around 2,300 roles.

Read more here: Tobacco giant BAT to axe 2,300 jobs in shake-up

What happened overnight

Donald Trump has said the planned increase in China tariffs next month has been delayed two weeks “as a gesture of good will”.

The President said the United States had agreed to delay increasing tariffs on $250bn worth of Chinese imports from October 1 to October 15.

Mr Trump said the postponement came “at the request of the Vice Premier of China, Liu He, and due to the fact that the People’s Republic of China will be celebrating their 70th Anniversary”.

....on October 1st, we have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th.

— Donald J. Trump (@realDonaldTrump) September 11, 2019

The tariffs were set to increase to 30pc from 25pc on the goods.

Asian investors cheered the news on Thursday.

Tokyo ended the day 0.75pc higher and Shanghai added 0.5pc while Sydney climbed 0.25pc. But in Hong Kong, the Hang Seng Index eased 0.3pc.

Agenda: ECB day

Good morning. The European Central Bank is scheduled to meet today and is expected to enact new stimulus measures in response to economic slowdown.

Possible steps by the ECB include mass bond-buying, further interest rate cuts and a fresh round of cheap loans to banks.

Markets have risen ahead of the ECB's move while investors have also been buoyed by Donald Trump delaying an increase in China tariffs next month.

5 things to start your day

1) Struggling town centres should shift away from a reliance on shops and try to open more cafes and restaurants, to match changing shopping patterns and give locals a reason to visit the high street, according to a new report. Amenities offering services are more attractive to visitors and lift the high street’s prosperity, the Centre for Cities said, while areas which remain heavily reliant on retail typically have more empty units.

2) Home sales are set to slump in the coming months as buyers and sellers freeze their plans amid political paralysis over Brexit. Surveyors and estate agents anticipate a sharp fall with the proportion predicting a drop in sales over the coming three months outnumbering those who expect an increase by a margin of 23pc.

3) Donald Trump has urged the US Federal Reserve to slash interest rates to zeroor even into negative territory as he lashed out ahead of the central bank’s crucial decision next week. The US president called the Fed’s rate-setters “boneheads” in another online barrage targeting its policymakers, warning they are missing out on “a once-in-a-lifetime opportunity”.

4) The Hong Kong stock exchange could come under scrutiny in Washington as it attempts to get its biggest deal across the finish line amid political turmoil in Hong Kong and escalating trade tensions between China and the US.

5) Sports Direct tycoon Mike Ashley faced a backlash from investors at its annual meeting over his role at the helm of the company amid fresh uncertainty about the retailer’s auditor. Almost a quarter of investors voted against Mr Ashley as chief executive after the billionaire’s own 62pc stake in the business is stripped out. He was nevertheless re-elected to the board.

Coming up today

Morrisons has struggled in recent years, caught between general retail gloom and pressure from discounter rivals Aldi and Lidl, so its results may be a mixed picture.

“It is to be hoped that its cooperation with Amazon will help augment its numbers in the coming months after the announcement in the summer that the two counterparties are set to expand their same day delivery service across the UK,” said CMC Markets’ Michael Hewson.

Interim results: Amerisur Resources, Energean Oil & Gas, Morrisons

Full-year: Brooks Macdonald, Haynes

Trading statement: Safestore

Economics: RICS house price (UK), inflation and jobless claims (US), ECB rates meeting