Pound weakens further as Brexit crisis intensifies: as it happened

Sterling falls for second day on Brexit news — markets fear the worst is yet to come

Europe joins strong relief rally as China calms the tone on trade tariffs

US stocks join the rally as investors make tentative return to risk

Ambrose Evans-Pritchard: Italy’s Matteo Salvini is a more dangerous threat to the EU outside government

Wrap-up: Investors see the upside as China calls for calm

A degree of calm returned to global markets today, as China’s move to calm trade tensions push investors to dip their toes into equities once again.

The FTSE 100 dragged its feet slightly, with a big weight from Micro Focus offset by a slightly fall in the pound’s value. If the blue-chip index can pull off a strong enough performance tomorrow, it will avoid leaving August behind as it worst month in four years.

As for Micro Focus, it has a big battle ahead to drag itself off the bottom of the index, where its sudden could be — but on current numbers, will not be — enough to rescue Marks & Spencer from relegation.

That’s all from me today. Join us again tomorrow for the final day of trading in what we can certainly say has been a dramatic August. Have a good evening!

FTSE and IBEX underperform despite solid gains across Europe

Markets are now closed across Europe. It’s a pretty picture by recent standards, with end-of-summer quietness and trade optimism proving a recipe for stock success.

The FTSE 100 closed up 0.98pc, or 69.61 points, at 7,184.32

The FTSE 250 closed up 0.47pc, or 89.51 points, at 19,292.50

France’s CAC 40 closed up 1.51pc, or 81.17 points, at 5,449.97

Germany’s DAX closed up 1.21pc, or 132 points, at 11,838.88

Spain’s IBEX closed up 0.54pc, or 47.2 points, at 8,794.30

Italy’s FTSE MiB closed up 1.94pc, or 407.46 points, at 21,398.17

JP Morgan raises predicted likelihood of no-deal Brexit

JP Morgan has joined several other banks in adjusting its Brexit outlook in light of recent events. From Reuters:

There is now a more than one-in-three chance that Britain leaves the European Union on Oct. 31 without a deal in light of Prime Minister Boris Johnson's move to suspend parliament, economists at U.S. investment bank JPMorgan said on Thursday.

“We have pushed the probability of a no-deal Brexit up from 25pc to 35pc,” economists Allan Monks and Malcolm Barr said in a note to clients.

“The prorogation decision, if it withstands legal and political challenges, has constrained the time available to (lawmakers) to force a different path.”

Silver doesn’t have to mean second

Amid a boost in price of gold in recent weeks as investors moved to shed risk, another precious metal has also been shining: silver. Jon Yeoman reports:

Silver is now worth $18.51 an ounce, a level it last touched in April 2017. It has risen 14pc in August alone and a fifth this year, matching gold's gains.

The yellow metal, typically a safe asset for investors, has surged since June on the back of geopolitical tensions and fears the global economy is slowing down.

An interest rate cut by the US Federal Reserve last month and hints that central banks may pursue looser monetary policy generally act as stimulus on precious metal prices.

You can read his full report on silver’s surge here: Silver shines as prices hit two-year high

Quote of the day goes to London bullion trader Sharps Pixley’s Ross Norman, who says of silver’s weight disadvantage compared to gold:

I suppose it could be used as a doorstop. Gold on the other hand is convenient — a kilo is about the size of a smartphone and is equivalent to about 1.5 years of the average UK wage… that’s portable wealth.

ECB package divides central bankers

Signs of a potential brouhaha are brewing over the European Central Bank’s much-trailed stimulus plans, expected to be unveiled next month.

Investors were strongly encouraged by comments from Bank of Finland President Olli Rehn, who earlier this month said it would be better for policymakers to “overshoot” on stimulus.

Speculation on what the central bank might do has been mixed: ECB President Mario Draghi has strongly suggested that a package of measures is coming. That has been interpreted as likely to include rates cuts and a resumption of quantitative easing (QE).

All may not be quite so simple, however: follow ratesetter Klaas Knot, governor of the Dutch central bank, has said today that he thinks it is too early for further QE, saying: “there is no need for it in my reading of the inflation outlook right now.”

It looks like Christine Lagarde may have to smash some heads together when she takes over from Mr Draghi in October.

PLAY TIME: If you think you could pull off the job of a ratesetter, try our game:

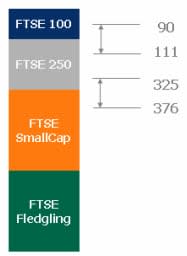

Micro Focus drop puts FTSE 100 spot at risk

Micro Focus’s bumper drop today — the software and IT firm’s shares are more than 30pc down — puts the firm suddenly deep in the danger zone ahead of the FTSE reshuffle next week.

Its market cap has actually fallen below that of stricken Marks & Spencer, making it the 111th most-valuable London-listed company. That puts it in the zone for a demotion to the FTSE 250 during the reshuffle after trading closes on Tuesday.

The shake-up may not be enough to save M&S, however: several FTSE 250 firms are in a position to climb and take its place.

Here’s how the reshuffle works:

For a movement to occur, either a non-FTSE 100 company must surpass the market cap of the 90th-placed blue-chip OR a current FTSE 100 company must drop below the 111th-ranked company by the deadline.

M&S is currently valued at £3.64bn by market capitalisation, after shares shed over a fifth of their value in recent months as it battles high-street headaches and internal issues. Its place would likely go to FTSE 250 leader Polymetal, a Russian gold and silver miner that is worth £5.24bn — having risen nearly 40pc since the start of May.

There is a chance that more mid-caps might push their way up: at the close of trading on Friday: these are Hikma Pharmaceuticals, and engineering firm Meggitt. Both could jump the 90th place barrier, with Meggitt big enough to push into the high 80s even if M&S’s relegation raises the barrier higher.

Manufacturing slump

Data firm Factset has put together these neat graph of G7 nations’ manufacturing sector purchasing managers’ index data, showing how the sector has struggled over recent years.

Many countries’ manufacturing PMI readings have fallen over the last 18 months signaling a dramatic slowdown in global manufacturing activity. Read more: https://t.co/l2jzH3E5tp#investing#portfoliomangementpic.twitter.com/amOLXpJ7TL

— FactSet (@FactSet) August 29, 2019

Here’s more on that, from deputy economics editor Tim Wallace:

Wall Street joins rally on China relief

Following the emollient tone struck by Beijing this morning (see 10:07am update), US shares have joined the global relief rally.

A spokesperson for the Chinese Ministry of Finance said it would no immediately respond to Donald Trump’s latest tariff escalation, aiming to raise the issue in talks instead. The S&P 500 and Dow are both up around 1.2pc, while the Nasdaq is up about 1.5pc.

Across Europe, sentiment is still high, with Italy’s FTSE MiB holding gains of 2pc.

Garry White: Donald Trump is losing the trade war with China

Donald Trump has a major problem. He uses the stock market as a proxy for his own presidential prowess, but his trade war could put the gains seen since he won the Oval Office at risk.

So writes Telegraph columnist Garry White, who thinks Mr Trump’s mixture of economic braggadocio and trade brinkmanship could come back to bite the US president. Garry looks at recent drops in US equities, and asks:

Has the president now overstretched himself and put his own re-election at risk?

Read his full piece here

And here’s a reminder of just how much damage a Trump tweet can do to the markets:

Black gold comes to Hull

There’s been unexpected good news for a set of small drilling companies, who have struck oil in Hull. My colleague Julia Bradshaw reports:

Hull has become the unlikely location for a potential black gold bonanza after a trio of companies drilling for what they thought was gas struck oil instead.

Reabold Resources, Union Jack Oil and Rathlin Energy said a recent testing had revealed their jointly owned field in West Newton, just a few miles north east of Hull, is now thought the be made up of mostly oil, which is more valuable than gas and easier to extract and transport.

If correct, if would mark the biggest onshore hydrocarbon discovery in the UK since the 1970s.

Trump tweets...

The President says the US economy is “GREAT”, despite that slowdown in the second quarter. He’s repeated his call for Federal Reserve interest rates cuts to stimulate the economy.

The Economy is doing GREAT, with tremendous upside potential! If the Fed would do what they should, we are a Rocket upward!

— Donald J. Trump (@realDonaldTrump) August 29, 2019

Argentina begs for reprieve as debt deadlines loom

While slowdown fears and trade pressures leave much of the global economy on edge, Argentina is already firmly in crisis territory. Economics reporter Tom Rees reports:

Argentina has begged the International Monetary Fund and bondholders to push back debt payments and extend maturities on its bonds as its new finance minister looks to contain an escalating economic crisis.

Hernán Lacunza, the embattled country’s finance minister, said the government wants to restructure its debt amid rising fears that it will default ahead of elections in October.

The country has defaulted on its debt eight time, and the latest tumult has put severe pressure on stricken President Mauricio Macri.

Read Tom’s full piece here: Argentina’s plea over $100bn debt mountain is ‘tantamount to default’

Full report: Amigo shares plunge after growth warning

Amigo shares have gone off a cliff today, currently about 50pc down after the lending company reported a weak economic outlook would hurt its growth. Lucy Burton’s full report is now out:

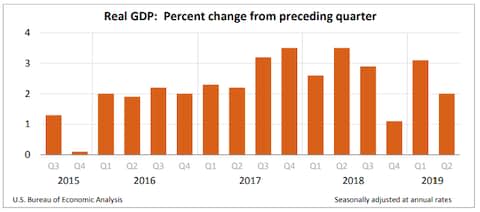

Correction

In the heat of the moment, it looks like I misread the previous estimated figure for Q2 growth as the Q1 figure. The correct numbers are 2pc GDP growth in Q2 (down from a first estimate of 2.1pc), a fall from the 3.1pc growth in the first free months. Apologies for the error — I have updated my earlier posts to reflect the correction, so please refresh the page if the figures are incorrect.

State and government spending slowdown drags on US growth

The Bureau of Economic Analysis has released its full report on the figures, which shows how real GDP has moved. It said:

The revision primarily reflected downward revisions to state and local government spending, exports, private inventory investment, and residential investment that were partly offset by an upward revision to personal consumption expenditures

The U.S. economy grew at a 2.0% pace in the second quarter, slightly less than the 2.1% growth rate first estimated a month ago. https://t.co/dZQYed7p8x

— BEA News (@BEA_News) August 29, 2019

Breaking: US GDP slows in second quarter

The US economy’s growth slowed in the second quarter, falling to 2pc growth quarter-on-quarter from 3.1pc in the previous quarter, in line with expectations.

More follows...

US GDP figures incoming...

We’re set to get US quarter-on-quarter GDP growth figures at half past. The expectation (as polled by Bloomberg) is for a figure of 2pc, down from 3.1pc in the first quarter. Any big miss is likely to worry investors.

Germany inflation grows less than expected

Germany inflation was weaker than expected in August, with its CPI figure at 1.4pc year-on-year — down from 1.7pc y-o-y in July, and below a 1.5pc estimate.

Harmonised with figures across the EU, that makes for a 1pc change, significantly short of the 2pc target set by the European Central Bank. Combined with an increase in joblessness figures this morning, it means signs are mounting that Europe’s biggest economy may be heading towards a recession.

German CPI/HICP inflation numbers as volatile as ever, not least due to methodology changes, but overall it's another slight disappointment likely to weigh on euro area core HICP tomorrow. pic.twitter.com/JTnp3lMtYg

— Frederik Ducrozet (@fwred) August 29, 2019

Full report: Recruiter Hays struggles amid uncertainty

Despite a big drop this morning, recruitment firm Hays has clawed back some losses after reporting it has faced challenges from a UK jobs market shaken by Brexit uncertainty. Mason Boycott-Owen reports:

The FTSE 250 company said “increased economic uncertainty” had “reduced client confidence” in the UK, with a particular slowdown in the last quarter, as companies braced for Britain’s departure from the EU.

Fees from private sector clients, who make up the lion’s share of Hays’ business in the UK, fell 1pc in the year to June. Public sector fees remained strong, jumping 11pc during the year. This helped overall income in the UK arm to climb 2pc.

You can read his full report here: Recruiter Hays finds UK market tough going as uncertainty reigns

Danske Bank: 30pc likelihood of no-deal, 40pc of general election

Danish lender Danske Bank has released its latest Brexit monitor report. Its analysts say the latest moves in Westminster make it harder for MPs to block no-deal, but not impossible. They write:

On the back of the recent development, we change our view and now think the two most likely scenarios are (1) a no-confidence vote leading to an extension (and later a general election) (40pc probability) and (2) a no-deal Brexit (30pc probability).

They add:

Our new base case is that a small majority in the House of Commons will eventually bring the Johnson government down, form a temporary government, ask the EU 27 for an extension and call for election when the extension is granted.

Their full predictions are as follows:

40pc: Extension and General Election

30pc: No-deal

20pc: Deal reached with EU

10pc: Extension without election (which could presumably entail a new referendum)

John McDonnell: We’ll find a way to block no-deal

Shadow chancellor John McDonnell has spoken out on the push-back against Boris Johnson’s plan to suspend Parliament. He said experts are “working through a range of options”, adding: “I think we’ll be able to find a way that’s effective”.

You can follow the latest updates on our politics live blog: Brexit news latest: Ruth Davidson resigns, citing ‘conflict over Brexit’ and saying the thought of fighting two elections fills her with dread

Italian markets surge on Conte confirmation

Italy’s blue-chip FTSE MiB is up around 2pc currently, with investors rushing for equities after an apparent resolution to the country’s latest political crisis. Here’s an extract from our full report:

Italy’s president asked Giuseppe Conte to head a coalition of the 5-Star Movement and opposition Democratic Party (PD) on Thursday, a move could that could mark a turning point in Italy’s frayed relations with the European Union.

Sergio Mattarella handed Conte a fresh mandate to form a cabinet barely a week after the low-key lawyer had resigned following a decision by the far-right League party to pull out of its coalition with 5-Star.

Speaking outside the presidential palace this morning, Mr Conte, who now has about a week to form a government, said:

In the coming days I will return to the president of the republic... and submit my proposals for ministers... We must immediately get to work and draw up a budget to avert the VAT hike, protects savers and offers solid prospects for economic growth and social development

The country’s VAT is set to rise from the start of 2020, unless it can find €23bn for its budget.

Eurozone confidence boost ‘does not provide much reason to become more hawkish’

ING’s Bert Colijn has taken a look at this morning’s eurozone confidence figures, which beat expectations (see 10:18am update). He has picked out some key points

The sentiment turnaround from July’s drop was mainly driven by an improvement in Germany

News orders and export orders both improved

The service sector became marginally less positive, with hiring expectations also slowing

Mr Colijn writes:

With selling price expectations more or less steady this month compared to the last, the ECB has not received many indications of an improving core inflation outlook.

The modest gain in the headline ESI suggests some stabilisation, but with downside risks aplenty, it does not provide much reason to become more hawkish ahead of the big September decision on stimulus.

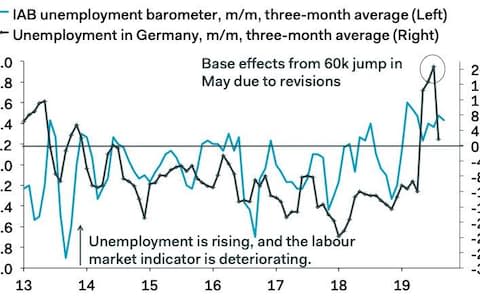

Meanwhile, his colleague Carsten Brzeski has looked at the German jobs figures (see 9:29am update), writing:

In unadjusted terms, this is the worst August performance of the German labour market since reunification...

...All of this only means that the protection shield against the industrial slowdown and external woes is getting thinner if not wearing out. This is a stagnation and not a crisis.

Total unemployment is still historically low but the trend is clearly not a friend for the German economy these days.

Here are some charts on the figures from Nadia Gharbi, economist at Pictet Wealth Management:

Across the major economies, sentiment rose in Germany, France and Spain, while it slipped in Italy. Overall, it is still to early to draw a conclusion, but recent surveys are defying further slowdown concerns, and point to a stabilisation in economic activity (2/n). pic.twitter.com/Dx7vG0zoJM

— Nadia Gharbi (@nghrbi) August 29, 2019

Goals Soccer Centres up for sale

Goals Soccer Centres announced it is up for sale in a market filing this morning, after suspending trading in its shares in March.

The five-a-side football operator is hurtling towards being delisted from London’s junior market, after unveiling unpaid taxes of at least £12m earlier this year.

It said in a filing this morning:

The Company confirms it has today commenced a process to invite offers for the business and assets of the Company. This process is being conducted by Deloitte LLP, and follows their previous appointment as advisors to assess future corporate options for the Company, announced on 18 June 2019.

There is no certainty as to the timetable or outcome of this process. Shareholders will continue to be kept informed of developments as appropriate.

Here’s our report on the company’s woes, from earlier this month:

HomeServe jumps on UBS upgrade

Amid strong performances for London-listed companies that earn in dollars, home repairs and insurance firm HomeServe is one of the FTSE 250’s top climbers today following an analyst upgrade.

UBS’s Nicole Manion upgraded the stock to a buy rating, with a target price of £13.05, up from £10.88. It is currently trading at £11.32. She wrote:

We believe HomeServe can deliver best-in-class earnings growth, led by a membership business with underappreciated potential to combine greenfield and product expansion with increasing operating leverage, and supported by a Home Experts platform disrupting the UK market for home services and improvements

Ms Manion added the company had plenty of scope for international growth:

We find more levers to pull in each market to support overall profit growth: the US remains a greenfield growth story with >70% of the market underserved today (we expect to see the new $230m profit target achieved by FY25e), the UK is enriching its offer, and France/Spain can find balanced customer growth.

Scottish Tory leader Ruth Davidson quits

This was widely expected, but Ruth Davidson, leader of the Scottish Convervatives, has quit over PM Boris Johnson’s plan to suspend parliament:

It has been the privilege of my life to serve as @ScotTories leader. This morning I wrote to the Scottish party chairman to tender my resignation. pic.twitter.com/CJ9EjW2RqN

— Ruth Davidson (@RuthDavidsonMSP) August 29, 2019

Interestingly, she seems not to barely mentioned Mr Johnson at all, instead focusing on wanting to spend more time with family and friends.

‘Fair bit of bad news’ already priced in to pound

Analysts at trading platform XTB have taken a look at the pound’s drop over the past 24 hours or so. As a reminder, the currency drop sharply after news of plans to prorogue Parliament got out, but it’s still several cents above the lows it stood at earlier this month — when every day seemed to bring fresh recent nadirs. They write:

The simple fact remains that the threat of a no-deal remains large and is likely to stay that way for the foreseeable future. Recent developments don’t really materially change the chances of this scenario playing out, but they have certainly focused minds and applied pressure on the opposition to get their act together pretty swiftly if they want to be anything more than interested observers going forward.

It is perhaps telling that after the knee-jerk move lower as the news dropped there was a lack of follow through to the downside for the pound and it’s becoming ever more apparent that a fair bit of bad news is already priced-in to the currency.

If the pattern of earlier this month is anything to go by, the pound is likely to follow a path of steady decline if nothing significant shifts elsewhere. That ought to have the usual impacts: exporters benefit, while more UK-focused companies suffer as they have to pay more for goods.

Amigo shares plummet after conditions prove unfriendly

There’s a big, blinking red spot at the bottom of the FTSE 250 today: loan company Amigo is down nearly 40pc after it warned about economic conditions. Banking editor Lucy Burton reports:

Shares in lending business Amigo have crashed 37pc after it warned the “deteriorating economic outlook” has caused it to increase impairments and be more cautious around lending.

The FTSE 250 lender, which lends to those who nominate a friend or relative to promise to make the scheduled payments if they fail to do so, told investors in its first quarter results this morning that “the change in economic outlook, and the potential for regulatory change, means we are taking a more cautious approach to lending and have increased provisioning”.

The warning sent shares in the Bournemouth-based business crashing.

“In short, it is not a pretty update – with a material miss on impairments and operating costs as well as the new CEO, Hamish Paton, taking out the red pen to current year guidance,” said Goodbody analyst John Cronin.

We’ll have a full report up later.

Smiths Group leads FTSE risers after upbeat Goldman note

Engineering firm Smiths Group is up nearly 4pc currently, placing it top among risers on the FTSE 100.

It’s feeling the afterglow from a Goldman Sachs note which upgraded its shares from neutral to ‘buy’, citing its strong revenue profile and better cash flow.

86 of the blue-chip index’s constituents are currently up, with the pound’s descent giving its usual boost to export-reliant companies.

UK government grants Orsted £500,000 to study green hydrogen

Danish energy firm Orsted has been granted just under £500,000 by the UK government to conduct a study into whether there is potential to make affordable fuel in large quantities from hydrogen.

The study, carried out wiht ITM Power and Element Energy, will focus on the potential advantages of scale.

Orsted (formerly known as Danish Oil and Natural Gas), it’s worth noting, was not as winner in the offshore wind site grants announced yesterday:

Eurozone economic confidence rises unexpectedly

Economic sentiment among business and consumers in the eurozone rose unexpectedly in August, reaching a rating of 103.1 — beating July’s figure of 102.7 and outperforming expectations of 10.23.

That’s only enough of a climb to take things to a two-month high, however, and a big jump in May was quick overwhelmed.

Danske Bank has measured the figures, from the European Commission, against UK sentiment:

����#UK economic sentiment fell further in August and is now at the lowest level since 2012 during the European Debt Crisis#Brexit is taking its toll on British companies due to elevated uncertainty (why invest in the current environment?).

Consumers more upbeat pic.twitter.com/MMXCPhl0Sx— Danske Bank Research (@Danske_Research) August 29, 2019

China says it won’t immediately retaliate to latest tariff escalation

Calmer heads seem to be prevailing in Beijing, with a Chinese Ministry of Finance spokesperson saying this morning that it would rather discuss removing the latest ramped-up duties promised by Donald Trump than continue the countries’ tit-for-tat. Gao Feng said:

China has ample means for retaliation, but thinks the question that should be discussed now is removing the new tariffs to prevent escalation.

He added that both sides are currently discussing the situation over trade talks next month. The negotiations are currently in doubt after China suggested earlier this week it didn’t recognise statements by Mr Trump, who said calls had occurred between Beijing and Washington.

Here’s how tariffs currently stand:

The optimism from China’s latest statements, combined with an expectations-beating French GDP figure and apparent breakthrough in Italian political negotiations, has put some fire under European stocks, with the continent-wide STOXX 600 up around 0.75pc.

Stocks spike as #China indicates it won't retaliate 'immediately' against latest US #tariffs. For the record it took #China three weeks to retaliate against the tariffs imposed by #Trump early August. If anything new tariffs and retaliation have followed each other closer. pic.twitter.com/SNHjehbzbY

— jeroen blokland (@jsblokland) August 29, 2019

Not for those of a weak constitution...

If you feel like gazing into the eye of the storm, you can, as ever, follow the latest Brexit news on our political live blog, with my colleague Danielle Sheridan:

German inflation figures trickle through

Consumer price index (CPI) figures for Germany are due out later today: this morning, we’re getting a slow trickle of region-by-region figures.

I’m going to take a punt and assume blog readers don’t need blow-by-blow figures from Baden Wuerttemberg and North Rhine Westphalia (let me know if I’m wrong down in the comments), but the overall picture currently suggests an expected drop from will occur.

A survey of economists by Bloomberg predicts a CPI fall from 1.7pc to 1.5pc year-on-year.

Here’s what Tom Rees and I wrote on the topic earlier this week:

Expectations for inflation in the eurozone have hit record lows amid fears that the European Central Bank will struggle to lift already subdued CPI as growth stutters.

Investors will be paying close attention to Germany’s consumer price index inflation figures, due for release on Thursday. Inflation in the country has recovered from deflationary lows hit in 2016, but fallen again slightly this year.

Tweet: Climate activists plan Heathrow drone disruption next month

Adam Vaughan, chief reporter at New Scientist, tweets:

New climate activism group called @HeathrowPause says it will fly drones at Heathrow from 13 September, in move likely to ground flights. Says due to govt inaction on climate change and airport expansion pic.twitter.com/stqxD0IKyg

— Adam Vaughan (@adamvaughan_uk) August 29, 2019

German jobless claims rise to 4,000

The German unemployment rate stayed steady at 5pc during August, as jobless claims rose to 4,000 — with both figures in line with consensus.

Those figures continue a trend of rising uncertainty, with a fall in openings suggesting the private sector is feeling the impact of economic woes in the country, which may be headed for a recession.

Paetheon Macroeconomics’ Claus Vistesen said:

The relatively modest increase in jobless claims is still not enough drive headline unemployment higher, but these data are clear evidence that the German labour market is now deteriorating, as a lagged response to the slump in GDP growth since the middle of last year...

...The big question is whether these data will prompt the pressure on the government to increase spending and investment. We think it will, eventually, though this is probably a story for 2020.

Firstgroup confirms West Coast award

Firstgroup and partner Trenitalia have formally signed the agreement for their 70:30 joint venture to operate the UK’s West Coast rail services, according to a filing this morning.

A review of the award, which will form the First Trenitalia West Coast Rail Limited, will be carried out by the Competition and Markets Authority.

Here’s our story for when the award was granted, by my colleague Michael O’Dwyer:

The pound: What happens now?

Sterling looked at one point like it would steal the show yesterday, dropping up to 1.1pc against the dollar as reports of Boris Johnson’s plan to suspend parliament came to light.

It had pared back around half those losses by the end of the day, however, and against the backdrop of a fortnight of gains the drop seemed less striking.

Spreadex’s Connor Campbell says:

The currency is now going to be watching those opposed to the Prime Minister’s plans to see if they can come up with a cohesive, effective way of trying to avert disaster.

Here’s how the pound’s performance has looked so far this year.

Jefferies stays bullish on FTSE 100

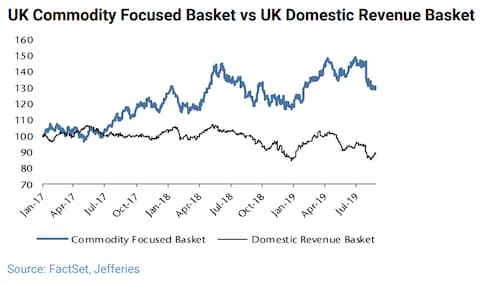

In a note this morning, analysts at American investment bank Jefferies said they remained ‘moderately bullish’ on the FTSE 100’s performance prospects in the context of the global market.

Looking at current positions on the pound, analysts predicted a continued weakening for sterling would help the exporter heavy index, noting:

UK equity markets deliver some of the highest payouts globally while the bulk of the revenues are international

Jefferies highlighted the dramatic difference in performance between domestically-focused FTSE 100 stocks and their internationally-slanted peers:

FTSE 100 holds gains despite Micro Focus weight

The FTSE 100 managed to eke out gains yesterday, thanks in large part to a powerful double-act by energy giants BP and Shell, as well as some solid performances among supermarkets and pharma firms.

Read more: Market report: Supermarkets are not a Brexit basket case, says bullish analyst

The blue-chip index is up again today, despite a big weight from software firm Micro Focus, which is down an eye-watering 30pc currently, after warning its trading had been weaker than expected.

Stephen Murdoch, Micro Focus’s chief executive, said:

Following the recent disappointing trading performance, we have determined that it is appropriate to accelerate the undertaking of a strategic review of the Group's operations with a view to determining where performance can be improved and how the business can be better positioned to optimise shareholder value.

Even a stellar performance today might not be enough to rescue the index from marking August as its worst month in four years.

European markets find a groove after slow open

Europe’s blue-chip stock markets, despite a slightly stumbling start, have found their groove, and are all up this morning. Italy’s FTSe MiB is outperforming as expected, currently up over 1pc.

The FTSE 250, London’s mid-cap index, is down slightly, with big weights from Amigo and Hays following announcements this morning. Consumer credit company Amigo missed expectations, and has cut its forecasts.

Sterling is slightly off, falling against other major currencies for the second day in a row amid a growing crisis in Westminster.

Oanda’s Craig Erlam said:

Naturally, the more convincing Boris is, the faster the pound falls. Put simply, no-deal is the most severe form of Brexit and until we better understand how it will be handled, worst case scenarios will continue to be priced in. Brexit may have already taken a heavy toll on sterling but darker days probably lie ahead for the currency.

Italian set for relief rally with elections (probably) averted

Italian futures trading is is alone in looking positive this morning, with events in Rome likely to spill into a relief rally.

After days of talks, leftist Five Star (MS5) and Democratic Party (PD) lawmakers agreed to form a coalition, which will maintain the theoretically neutral figure of Giuseppe Conte as Prime Minister. The decision is expected to get the go-ahead soon.

That puts paid to right-wing populist Matteo Salvini’s ambitions for the job, for now. More importantly for markets, it dispels the uncertainty that a fresh general election would have entailed.

Read more: Ambrose Evans-Pritchard: Italy’s Matteo Salvini is a more dangerous threat to the EU outside government

Agenda: Pound plunge and car industry stuck in reverse

Good morning. The pound suffered one of its sharpest tumbles of the year yesterday as City analysts warned that Boris Johnson’s plan to suspend Parliament will send the currency even lower in the coming weeks. It later recovered some ground, while the FTSE 100 seemed unhinged from sterling's movements.

5 things to start your day

1) Car production in the UK is stuck in reverse, falling 10.6pc in July —the 14th consecutive month of decline as Brexit and global economic uncertainties weigh. A total of 108,239 cars rolled off British production lines during the month, taking the year to date output to 774,760, almost a fifth down on the same point in 2018.

2) Running out of puff: the merger of tobacco giants Philip Morris and Altria faces uphill battle. Falling income. Hankering after faded glory days. An effort to stay relevant amid changing trends. In the music industry, getting the band’s original line-up back together is one of the oldest tricks in the book but often it says more about the absence of fresh ideas than the promise of renewed success.

3) Britain's offshore wind farms are about to get bigger after the Crown Estate decided that seven sites could comfortably expand their operations without posing any threat to the environment. The expansion will add 2.85 GW to the UK’s wind farm capacity, equating to an extra 10pc in the UK’s offshore wind farm capacity.

4) WH Smith is making more money from its shops in hospitals than from those in train stations as it told the City it expects to meet its profit targets. The retailer has been increasingly focusing on lucrative travel locations such as airports and railways stations, while its high street shops have seen sales dwindle in recent years.

5) Toyota is taking a 5pc slice of its smaller Japanese rival Suzuki in the latest tie-up in the global car industry. It will pay 96bn yen (£740m) for the stake, while Suzuki will fork out 46bn yen for 0.2pc of Toyota.

What happened overnight

Asian markets sank again on Thursday as investors grow increasingly pessimistic about the outlook for China-US trade talks, while a closely watched recession indicator hit a level not seen since just before the financial crisis.

The pound remained under pressure after Prime Minister Boris Johnson forced an extended suspension of parliament, heightening the prospect of a no-deal Brexit and leading to speculation of a snap no-confidence vote.

Wall Street provided a healthy lead but investors in Asia remain on edge after the weekend's face-off between China and the US that saw each side impose tariffs on hundreds of billions of goods, and Donald Trump label Xi Jinping at one point an “enemy”.

Hong Kong's Hang Seng is down 0.4pc, the Shanghai Composite retreated 0.1pc and Tokyo was flat.

Coming up today

Haulage firm Eddie Stobart had been due to report half-year results today, but has pushed the date back to an expected date of “early September” after its shares were suspended on Friday. Recruitment firm Hays, something of a bellwether for the wider economy, will report its full-year results.

Full-year results: Hays

Interim results: Chesnara, Hunting, the Gym Group, Knot Offshore

Trading statement: Amigo, McColl’s Retail

Economics: GDP (US), trade balance (US)