Some Marksans Pharma (NSE:MARKSANS) Shareholders Are Down 46%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Marksans Pharma Limited (NSE:MARKSANS) shareholders have had that experience, with the share price dropping 46% in three years, versus a market return of about 48%. And the ride hasn't got any smoother in recent times over the last year, with the price 25% lower in that time. Unhappily, the share price slid 1.2% in the last week.

View our latest analysis for Marksans Pharma

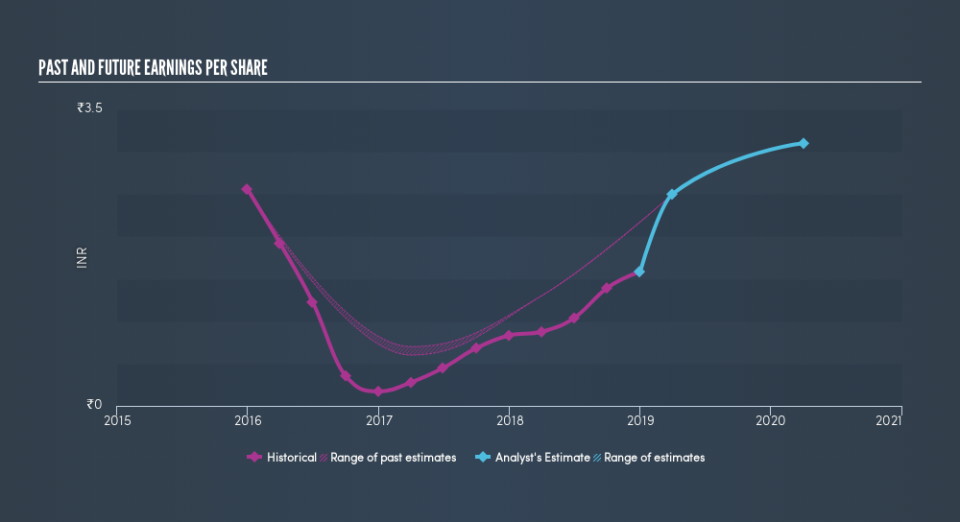

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Marksans Pharma saw its EPS decline at a compound rate of 15% per year, over the last three years. The share price decline of 19% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Marksans Pharma's key metrics by checking this interactive graph of Marksans Pharma's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 1.7% in the last year, Marksans Pharma shareholders lost 25% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2.0% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Marksans Pharma cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Marksans Pharma may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.