Maryland sees other significant increase in reassessed property values

Once again, Western Maryland and Lower Eastern Shore counties top residential property value growth, according to state property reassessments issued at the end of 2023.

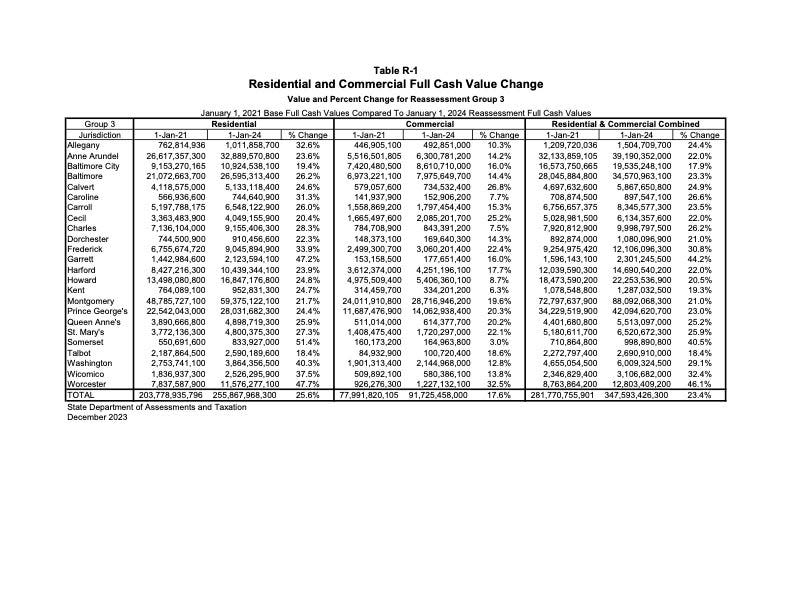

Across Maryland, residential and commercial property values jumped 23.4% since the same Group 3 properties were reassessed three years ago, according to the Maryland Department of Assessments and Taxation.

That's the highest increase in assessed property values, at least in several recent years, topping the 20.6% increase a year ago for properties in Group 2.

The state agency divides each county and Baltimore City into three groups, reassessing each group every three years. There has been double-digit percentage growth in property values statewide the last time each group was re-evaluated.

Snow on the way: How much snow could Hagerstown, Chambersburg, Martinsburg get Saturday?

'Good investment,' check your tax bills

The streak of increasing assessment values indicates "that owning a home or business in Maryland continues to be a good investment," Assessments and Taxation Director Michael Higgs said in a news release.

The state agency mailed reassessment notices to Group 3 property owners on Dec. 28.

Statewide, the Group 3 reassessment for this year was based on reviewing 85,904 sales over the last three years, the release states. Any decrease in value fully kicks in for the 2024 tax year. Any increase in value will be phased-in over the next three years.

Each assessment notice includes information about the department's Homeowners' and Homestead Tax Credits, the release states.

Washington County and its municipalities have a 5% cap on the taxable assessment increase for owner-occupied properties, according to the department.

For a list of caps on taxable assessment increases for counties and their municipalities, go to https://dat.maryland.gov/realproperty/Documents/Homestead_Percent_Caps.pdf.

Population shifts: Eastern Shore, Southern and Western Maryland attract residents departing metro areas

Where were the most increases in residential assessed value?

Somerset, Worcester, Garrett, Washington and Wicomico counties ranked as the top five when it came to 2024 reassessments for residential properties in Group 3, according to department data.

Somerset County experienced the biggest jump in reassessed residential value, 51.4%, since Group 3 was reviewed three years ago.

The rest of the top 10 for residential properties were:

Worcester County: 47.7%

Garrett County: 47.2%

Washington County: 40.3%

Wicomico County: 37.5%

Frederick County: 33.9%

Allegany County: 32.6%

Caroline County: 31.3%

Charles County: 28.3%

St. Mary's County: 27.3%

In Washington County, Group 3 includes Williamsport, Clear Spring, Hancock, Sharpsburg, Keedysville and Rohrersville.

In Wicomico County, Group 3 is the western side of the county, including Sharptown, Mardela Springs, Hebron, Quantico, Nanticoke, Bivalve and areas of Salisbury north of the Wicomico River and west of U.S. 13.

In Worcester County, Group 3 is most of Ocean City.

In Somerset County, Group 3 is the northern end of the county including Princess Anne, the Deal Island Historic District, Eden, Mount Vernon, Oriole and Dames Quarter.

Talbot County had the smallest increase, 18.4%, in residential assessment value growth for Group 3.

For the latest reassessment, statewide, 96.6% of the 667,967 residential properties evaluated experienced an increase in value, according to state data.

Of the 767,226 residential and commercial properties reviewed in Group 3, 89.6% increased in value.

This article originally appeared on The Herald-Mail: Western Md., Lower Shore have biggest jumps in assessed home values