Mason Hawkins Sells Alphabet, General Electric

Mason Hawkins (Trades, Portfolio)'s Southeastern Asset Management sold shares of the following stocks during the third quarter.

Allergan PLC

During the quarter, the firm closed its Allergan PLC (NYSE:AGN) stake. The portfolio was impacted by -3.54%.

The specialty pharmaceutical manufacturer has a market cap of $60.28 billion and an enterprise value of $78.82 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -14.67% and return on assets of -9.32% are underperforming 67% of companies in the Drug Manufacturers industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.2 is below the industry median of 1.16.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.10% of outstanding shares, followed by Daniel Loeb (Trades, Portfolio)'s Third Point with 1.08% and John Paulson (Trades, Portfolio) with 0.88%.

Liberty Formula One Group

The investment firm trimmed its Liberty Formula One Group (NASDAQ:FWONK) holding by 56.29%. The portfolio was impacted by -0.77%.

The company, which operates in the media, communications and entertainment businesses, has a market cap of $10.01 billion and an enterprise value of $14.92 billion.

GuruFocus gives the company a profitability and growth rating of 2 out of 10. The return on equity of -6.73% and return on assets of -3.26% are underperforming 71% of companies in the diversified media industry. Its financial strength is rated 3.8 out of 10 with a cash-debt ratio of 0.08.

The largest guru shareholder of the company is Ruane Cunniff (Trades, Portfolio) with 5.23% of outstanding shares, followed by Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors with 4.33% and Diamond Hill Capital (Trades, Portfolio) with 1.08%.

PotlatchDeltic Corp.

The PotlatchDeltic Corp. (NASDAQ:PCH) position was reduced by 14.49%, impacting the portfolio by -0.43%.

The company, which conducts a real estate sales and development business, has a market cap of $2.93 billion and an enterprise value of $3.60 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 3.68% and return on assets of 2.0% are underperforming 71% of companies in the REITs industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.12 doubles the industry median of 0.06.

The largest guru shareholder of the company is Southeastern with 5.89% of outstanding shares, followed by the Simons' firm with 3.92%, NWQ Managers (Trades, Portfolio) with 0.56% and Ken Fisher (Trades, Portfolio) with 0.30%.

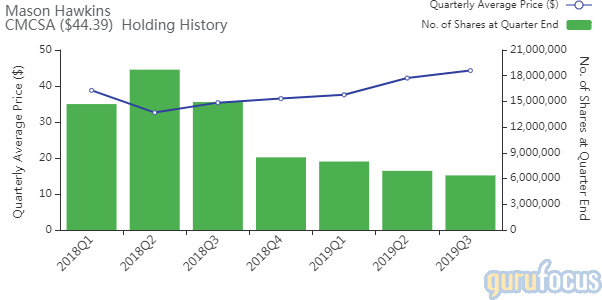

Comcast Corp.

The firm cut its Comcast Corp. (NASDAQ:CMCSA) position by 7.77%. The trade had an impact of -0.37% on the portfolio.

The American cable operator has a market cap of $202.71 billion and an enterprise value of $301.11 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 16.63% and return on assets of 5.08% are outperforming 70% of companies in the diversified media industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.86.

The largest guru shareholder of the company is Dodge & Cox with 1.27% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.50% and First Eagle Investment (Trades, Portfolio) with 0.48%.

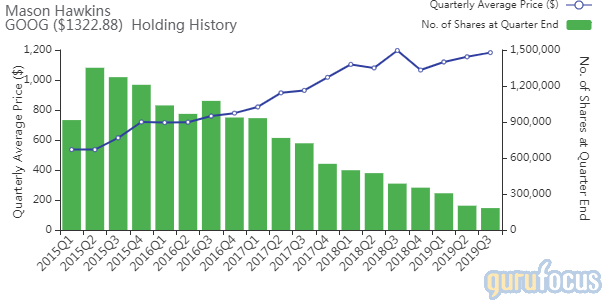

Alphabet Inc.

Hawkins' firm trimmed the Alphabet Inc. (NASDAQ:GOOG) holding by 9.89%. The portfolio was impacted by -0.35%.

The company, which operates in the media, communications and entertainment businesses, has a market cap of $920 billion and an enterprise value of $811 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 17.76% and return on assets of 13.37% are underperforming 71% of companies in the diversified media industry. Its financial strength is rated 9 out of 10, with a cash-debt ratio of 8.81 that is outperforming 56% of its competitors.

Another notable guru shareholder of the company is Dodge & Cox with 0.45% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.29% and Al Gore (Trades, Portfolio) with 0.17%.

CenturyLink Inc.

The CenturyLink Inc. (NYSE:CTL) stake was reduced by 1.66%. The portfolio was impacted by -0.24%.

One of the largest landline phone companies in the United States, it has a market cap of $16.32 billion and an enterprise value of $51.81 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.27.

Hawkins' firm is the largest guru shareholder of the company with 6.76% of outstanding shares, followed by Prem Watsa (Trades, Portfolio) with 0.22% and T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.19%.

General Electric Co.

The General Electric Co. (NYSE:GE) holding was reduced by 2.5%. The portfolio was impacted by -0.21%.

The company operates in several segments, including transportation, power and renewable energy. It has a market cap of $99.65 billion and an enterprise value of $121 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -16.74% and return on assets of -1.64% are underperforming 80% of companies in the cyclical retail industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.79 is above the industry median of 0.89.

The largest guru shareholder of the company is Barrow, Hanley, Mewhinney & Strauss with 1.22 % of outstanding shares, followed by HOTCHKIS & WILEY with 1.21% and Richard Pzena (Trades, Portfolio)'s Pzena Investment Management with 0.19%.

Disclosure: I do not own any stocks mentioned.

Read more here:

8 Stocks Donald Smith Continues to Buy

Largest Insider Trades of the Week

Ruane, Cunniff & Goldfarb Trims Mastercard, Amazon

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.