Maverick Capital Cuts Humana, Amazon

- By Tiziano Frateschi

Lee Ainslie (Trades, Portfolio)'s Maverick Capital Ltd. sold shares of the following stocks during the fourth quarter, which ended on Dec. 31.

Humana

The Humana Inc. (HUM) holding was reduced by 57.01%, impacting the portfolio by -2.92%.

The U.S. private health insurer has a market cap of $49.29 billion and an enterprise value of $51.61 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 24.65% and return on assets of 9.59% are outperforming 68% of companies in the healthcare plans industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.67.

The largest guru shareholder of the company is Vanguard Health Care Fund (Trades, Portfolio) with 1.24% of outstanding shares, followed by Steve Mandel (Trades, Portfolio) with 1.17% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.74%.

Dollar Tree

The Dollar Tree Inc. (DLTR) holding was closed, impacting the portfolio by -2.54%.

The company, which operates discount stores in the U.S. and Canada, has a market cap of $23.27 billion and an enterprise value of $31.93 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 14.72% and return on assets of 476% are outperforming 67% of companies in the retail, defensive industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.11 is above the industry median of 0.4.

The largest guru shareholders of the company include Chuck Akre (Trades, Portfolio) with 1.92% of outstanding shares, Glenn Greenberg (Trades, Portfolio) with 0.41% and Simon's firm with 0.22%.

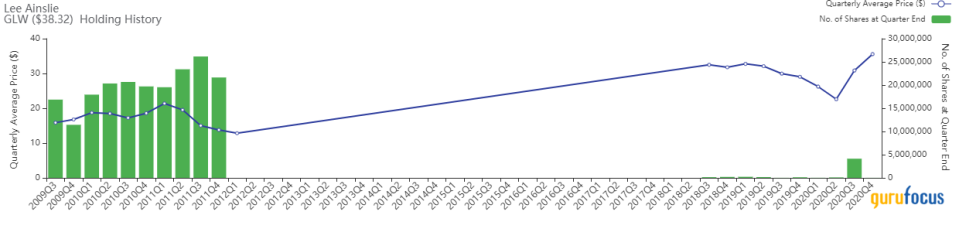

Corning

The firm trimmed its Corning Inc. (GLW) stake by 99.35%. The portfolio was impacted by -2.47%.

The company, which produces glass, ceramics and optical fiber, has a market cap of $29.20 billion and an enterprise value of $37.73 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 3.28% and return on assets of 1.76% are underperforming 57% of companies in the hardware industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.31 is below the industry median of 1.29.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 1.63% of outstanding shares, followed by Mairs and Power (Trades, Portfolio) with 0.23%.

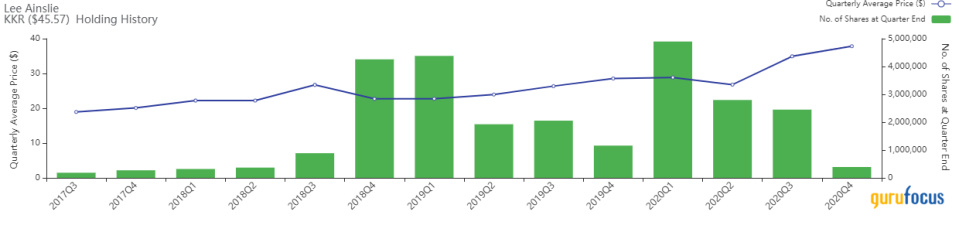

KKR & Co.

The firm reduced its KKR & Co. Inc. (KKR) stake by 84.09%. The portfolio was impacted by -1.31%.

The investment firm has a market cap of $26.09 billion and an enterprise value of $81.88 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 17.35% and return on assets of 3.04% are outperforming 67% of companies in the asset management industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.19.

The largest guru shareholder of the company is ValueAct Holdings LP (Trades, Portfolio) with 6.64% of outstanding shares, followed by Akre with 2.57% and Diamond Hill Capital (Trades, Portfolio) with 2.10%.

DuPont de Nemours

The firm trimmed its DuPont de Nemours Inc. (DD) stake by 19.92%. The portfolio was impacted by -1.25%.

The chemicals company has a market cap of $38.30 billion and an enterprise value of $58.13 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -7.62% return on assets of -4.25% are underperforming 88% of companies in the chemicals industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.12

The largest guru shareholder of the company is Barrow, Hanley, Mewhinney & Strauss with 1.39% of outstanding shares, followed by T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.80% and Mason Hawkins (Trades, Portfolio) with 0.48%.

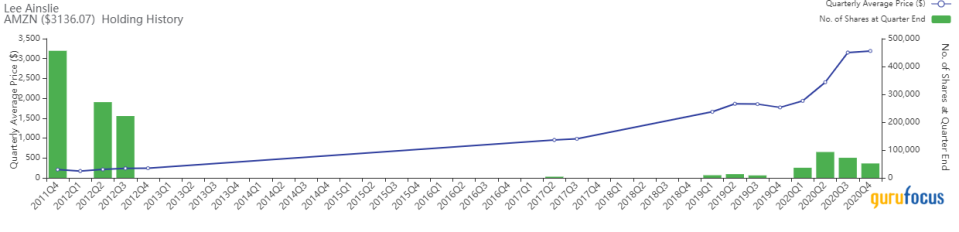

Amazon.com

The firm cut its Amazon.com Inc. (AMZN) stake by 28.07%. The portfolio was impacted by -1.18%.

The online retailer has a market cap of $1.59 trillion and an enterprise value of $1.60 trillion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 28.27% and return on assets of 8.15% are outperforming 86% of companies in the retail, cyclical industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 1.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 0.35% of outstanding shares, followed by Frank Sands (Trades, Portfolio) with 0.32% and Spiros Segalas (Trades, Portfolio) with 0.20%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Benjamin Graham on the Dangers of Momentum Investing

Seth Klarman on the Benefits of Dollar Cost Averaging

Warren Buffett on the Importance of Holding Cash

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.