You May Have Been Looking At Immobiliere Dassault SA (EPA:IMDA) All Wrong

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Immobiliere Dassault SA is a €451m small-cap, real estate investment trust (REIT) based in Paris, France. REITs own and operate income-generating property and adhere to a different set of regulations. This impacts how IMDA’s business operates and also how we should analyse its stock. I’ll take you through some of the key metrics you should use in order to properly assess IMDA.

Check out our latest analysis for Immobiliere Dassault

A common financial term REIT investors should know is Funds from Operations, or FFO for short, which is a REIT’s main source of income from its portfolio of property, such as rent. FFO is a cleaner and more representative figure of how much IMDA actually makes from its day-to-day operations, compared to net income, which can be affected by one-off activities or non-cash items such as depreciation. For IMDA, its FFO of €9.1m makes up 61% of its gross profit, which means the majority of its earnings are high-quality and recurring.

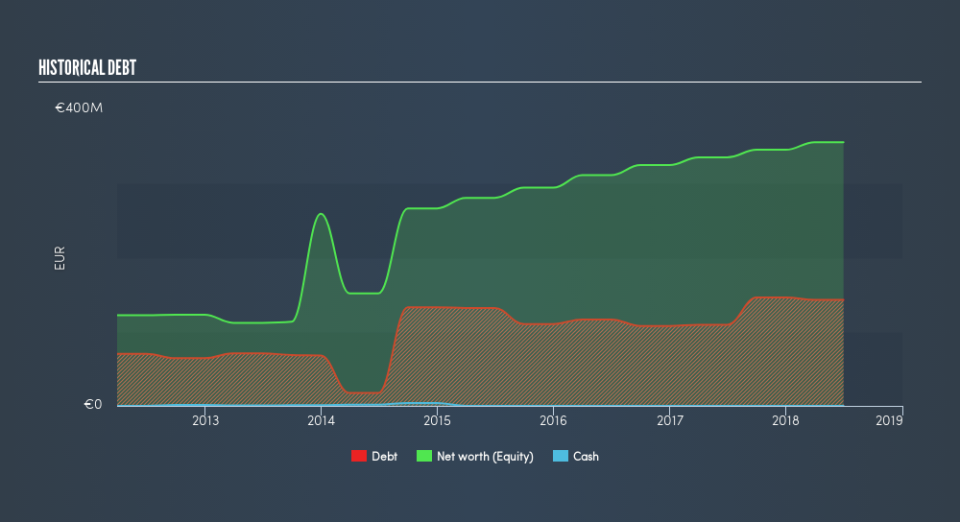

In order to understand whether IMDA has a healthy balance sheet, we have to look at a metric called FFO-to-total debt. This tells us how long it will take IMDA to pay off its debt using its income from its main business activities, and gives us an insight into IMDA’s ability to service its borrowings. With a ratio of 6.2%, the credit rating agency Standard & Poor would consider this as aggressive risk. This would take IMDA 16.05 years to pay off using just operating income, which is a long time, and risk increases with time. But realistically, companies have many levers to pull in order to pay back their debt, beyond operating income alone.

Next, interest coverage ratio shows how many times IMDA’s earnings can cover its annual interest payments. Usually the ratio is calculated using EBIT, but for REITs, it’s better to use FFO divided by net interest. This is similar to the above concept, but looks at the nearer-term obligations. With an interest coverage ratio of 16.5x, its safe to say IMDA is producing more than enough funds to cover its upcoming payments.

In terms of valuing IMDA, FFO can also be used as a form of relative valuation. Instead of the P/E ratio, P/FFO is used instead, which is very common for REIT stocks. IMDA’s price-to-FFO is 49.55x, compared to the long-term industry average of 16.5x, meaning that it is highly overvalued.

Next Steps:

In this article, I’ve taken a look at Funds from Operations using various metrics, but it is certainly not sufficient to derive an investment decision based on this value alone. Immobiliere Dassault can bring about diversification for your portfolio, but before you decide to invest, take a look at the other aspects you must consider before investing:

Future Outlook: What are well-informed industry analysts predicting for IMDA’s future growth? Take a look at our free research report of analyst consensus for IMDA’s outlook.

Valuation: What is IMDA worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether IMDA is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.