MD, CEO & Executive Director Bodanapu Ganesh Krishna Just Bought Shares In Cyient Limited (NSE:CYIENT)

Even if it's not a huge purchase, we think it was good to see that Bodanapu Ganesh Krishna, the MD, CEO & Executive Director of Cyient Limited (NSE:CYIENT) recently shelled out ₹3.9m to buy stock, at ₹388 per share. That might not be a big purchase but it only increased their holding by 0.5%, and could be interpreted as a good sign.

View our latest analysis for Cyient

The Last 12 Months Of Insider Transactions At Cyient

Over the last year, we can see that the biggest insider purchase was by Founder & Executive Chairman Bodanapu Venkat Rama Reddy for ₹16m worth of shares, at about ₹465 per share. That means that even when the share price was higher than ₹392 (the recent price), an insider wanted to purchase shares. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

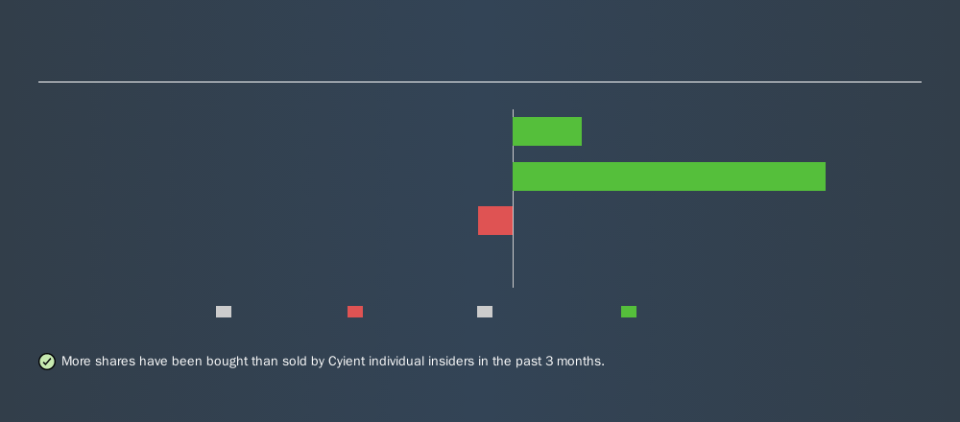

Over the last year, we can see that insiders have bought 110000 shares worth ₹50m. But they sold 10000 for ₹65.7. Overall, Cyient insiders were net buyers last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Cyient is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Cyient Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 5.7% of Cyient shares, worth about ₹2.5b. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About Cyient Insiders?

It's certainly positive to see the recent insider purchases. And an analysis of the transactions over the last year also gives us confidence. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about Cyient. That's what I like to see! Of course, the future is what matters most. So if you are interested in Cyient, you should check out this free report on analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.