Measure repealing fire district tax to go before San Bernardino County voters in June

Residents in San Bernardino County will see a second measure to repeal a fire district tax this year, only months after a similar initiative in November failed.

The County Board of Supervisors voted Tuesday unanimously to place the new measure on the upcoming June primary ballot.

Voters in unincorporated areas of the county — and some cities — will decide whether a fee levied on land parcels will stay in place or be thrown out. The same question was put to voters in November under Measure U which did not pass.

County supervisors approved the new tax that came with the expansion of Fire Protection Zone 5 (FP-5) in October 2018 after a hearing where they heard hours of public testimony — mostly in opposition to the new tax.

FP-5’s expansion annexed 19,073 square miles of unincorporated land into the zone along with the cities of San Bernardino, Needles, and Upland. The zone initially covered Helendale and Twentynine Palms.

With the expansion, an annual parcel fee of $157.26 was assessed on all parcels — vacant or not — with the ability to increase the fee up to 3% a year.

The tax now stands at $161.98 per parcel after county supervisors approved a 3% increase last year as recommended by the San Bernardino County Fire Protection District.

The fire district argued the tax was necessary to shore up a $29 million budget deficit and continue funding existing fire services which property taxes weren’t covering.

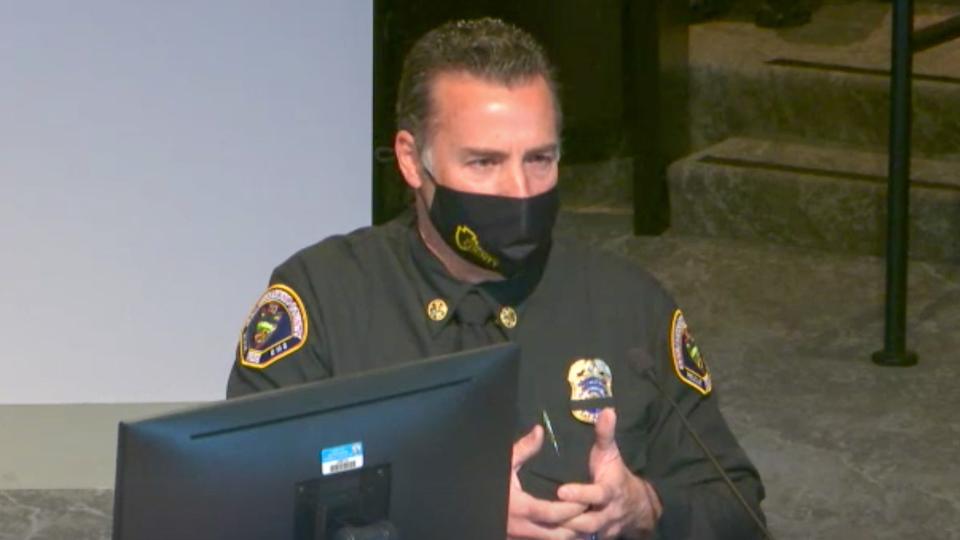

County Fire Chief Dan Munsey told supervisors this week the FP-5 tax revenue amounts to $42.7 million, or 18% of the fire department’s operating budget.

Without the tax, “somewhere between 15 to 17 fire stations would need to be closed districtwide,” or over 25% of all stations, he said.

The only full-time fire station in Twentynine Palms would be on that list, Munsey added. In addition, the number of first responders could be reduced by up to one-third, according to the district.

A protest process in 2018 scrutinized

Others, though, disagree with the tax and how it was implemented.

Before the supervisors approved the expansion in 2018, the county instituted a protest process and sent mailers to affected landowners.

The process required an election to determine the fate of FP-5 if 25% of landowners had mailed the forms back saying they opposed the expansion.

If more than 50% protested, the proposed expansion would have been withdrawn entirely. Instead, only about 3% of landowners responded, according to a tally at the supervisors’ meeting that year.

The nonprofit, Red Brennan Group, and other parties sued the county after its decision. They argued the tax should have been approved by a two-thirds vote of the electorate under Proposition 218 rules.

Proposition 218 requires a two-thirds vote when a local government imposes, extends, or increases any special tax.

A San Bernardino Superior Court judge disagreed with the group’s assertion that the tax was unconstitutional and denied an injunction that would’ve temporarily stopped the fee.

Judge Donald Alvarez cited earlier court decisions that ruled language in the California Constitution requiring a two-thirds vote on general or special taxes didn’t address those imposed in annexations.

After the decision, Tom Murphy, president of the Red Brennan Group, said there were two choices: Either a “change through the state legislature” or “an initiative petition directly to citizens.”

“We opted for the second choice,” he wrote in an email.

The group funded the petition effort to gather signatures for Measure U to repeal the tax. That measure failed in November, however, after 52% voted against it.

Murphy said the group also funded the effort behind the upcoming initiative and collected 12,070 signatures last year.

Of those signatures, 8,868 were verified by the county Registrar of Voters, officials said.

Daily Press reporter Martin Estacio may be reached at 760-955-5358 or MEstacio@VVDailyPress.com. Follow him on Twitter @DP_mestacio.

This article originally appeared on Victorville Daily Press: Measure repealing fire district tax to go before county voters in June