New analysis confirms Medicare for All would cost a fortune

This post has been updated to clarify the cost of Senator Warren’s proposed plan.

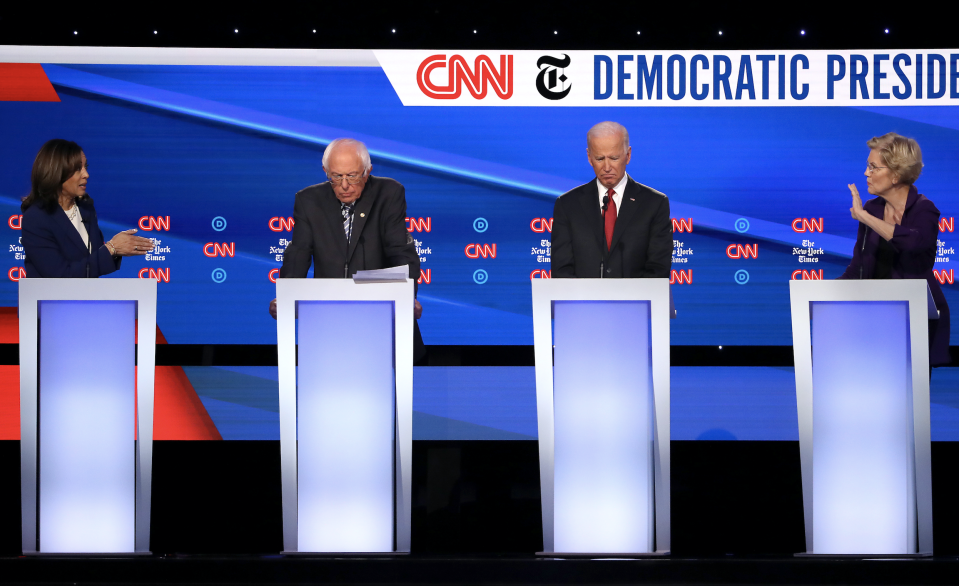

The question of how to pay Medicare for All has been a source of debate among Democratic presidential candidates. Out of those 24 Democratic presidential candidates, 14 of them support some version of the initiative.

Senator Elizabeth Warren (D-MA) recently released a plan that would cost $20.5 trillion in new federal spending over 10 years, and offset the cost with a wealth tax and other mandates. The plan from Senator Bernie Sanders (I-VT) would cost an estimated $33 trillion over 10 years, though his team argues that the changes would actually save money over time. Former Vice President Joe Biden’s plan has been dubbed Obamacare 2.0. Senator Kamala Harris (D-CA) released a Medicare for All plan that would give Americans the option to either purchase Medicare plans from private companies or buy government-administrated Medicare plans. Another Democratic candidate, South Bend Mayor Pete Buttigieg, distanced himself from Medicare for All.

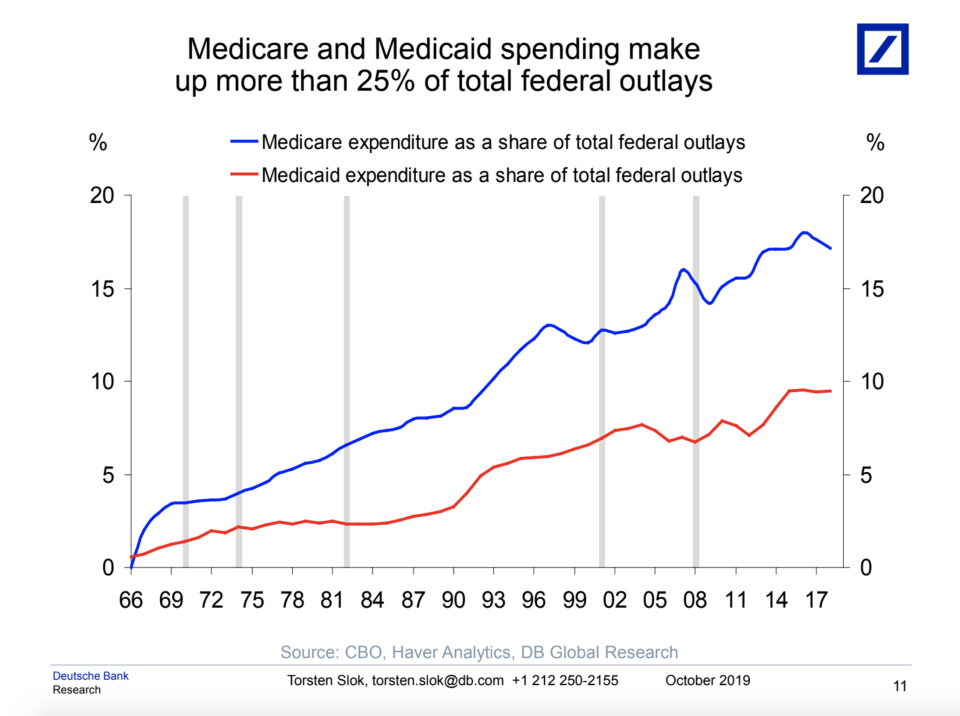

The Committee for a Responsible Federal Budget (CRFB) released its analysis on legitimate sources to finance a hypothetical Medicare for All program, with costs projected to tally up to $30 trillion over a decade (similar to projections from the Urban Institute).

The report from CRFB — an independent, non-profit, bipartisan public policy organization — featured a list of options for paying for Medicare for All that included increased taxes, reductions in federal spending, higher GDP in national debt, and a combination of approaches.

“By most estimates, Medicare for All would cost the federal government about $30 trillion over the next decade,” the report stated. “How this cost is financed would have considerable distributional, economic, and policy implications.”

A payroll tax ‘would constrict the economy by about 3.5%’

One of the proposals is a 32% payroll tax, divided evenly between workers and employers, that would apply to all wages. The report estimates that this would raise roughly $30 trillion over a decade. The same amount, though, could be generated through a 23% payroll tax on the employee side or a 48% tax on the employer side. According to CRFB, “the 32% payroll tax would raise the total payroll tax rate on most wage income to above 47% and the rate for high-wage earners to nearly 36%.”

The downside? The U.S. would be sacrificing economic growth.

“We basically think that 32% payroll tax would constrict the economy by about 3.5%, and reduce the number of hours worked by the equivalent of 9 million workers, 6.5%,” Marc Goldwein, senior policy director for CRFB and one of the researchers involved in the report, told Yahoo Finance. “There would be an economic effect, and someone could argue the economic effect is worth it so we make sure everyone can have health care.”

Big promises from Democratic candidates are part of the problem, according to Goldwein.

“Not just that we’re going to have public coverage for everybody, but that it’s going to cover every dollar of every medical incident,” the senior policy director for CRFB explained. “There are very few other countries that do that. That actually is much more expensive.”

He continued: “The Medicare for All we’ve been talking about in the public sphere, it’s more expensive than a theoretical Medicare for All needs to be because we’ve made these promises. It’s also clear that if we backed off of some of those, the costs of the program declines significantly.”

‘You can get the cost of Medicare for All cut in half’

Another suggestion is a 25% income surtax on adjusted gross income above the standard deduction, which would raise roughly $30 trillion over 10 years. A 42% federal value-added tax (VAT) is another option, along with a required mandatory public premium of about $7,500 per capita. These premiums, which equals $12,000 per individual not on public insurance, could be adjusted based on income and paid by employers.

Yet another option highlighted by CRFB includes doubling all individual and corporate income tax rates. The analysis notes, though, that “this differs from the income surtax in a number of ways, especially because it would represent a much smaller tax increase for lower-income taxpayers.” For those in the bottom bracket, their income tax rate would increase to 20%, the top rate would be 74%, capital gains would be 47.6%, and corporate tax would be 42%.

Goldwein said that the payroll tax is “the most straightforward” option. However, he did note that the most feasible is “a combination approach with a scaled back Medicare for All.”

“If you incorporate some amount of cost sharing and if you don’t cover non-core medical services like dental and vision, you can get the cost of Medicare for All cut in half,” he told Yahoo Finance. “And if you were to make the other reforms to Medicare for All on the provider side, you can cut even more.”

He continued: “I don’t think anyone’s going to want to propose a 32% payroll tax or 25% income surtax. I think they’d propose a somewhat smaller payroll tax combined with some other options.”

‘Military reductions could help’

CRFB also noted that non-health federal spending could be reduced by 80%, although CRFB notes that this could not be done on a short timeline. Currently, the federal government is projected to spend $16 trillion on health care over the next 10 years and $6 trillion on interest costs.

Lindsay Koshgarian, program director for the National Priorities Project at the Institute for Policy Studies, proposed cutting the military budget by more than $300 billion in order to finance Medicare for All.

“There’s lots of ways to cut costs that wouldn’t affect the quality of our national security,” Koshgarian told Yahoo Finance. “We identify tens of billions of dollars just through cutting needless bureaucratic waste.”

“You really need to look at what we’re using these things for,” she added. “We have, for instance, tens of thousands of troops in Germany and that is a holdover from World War Two. A lot of these bases that we have around the world are where established our presence and then we never leave. Of course, people cite security justifications for having those bases but no other country on earth has anywhere near the number of foreign military installations that we do.”

However, Goldwein disagreed with Koshgarian’s assessment, stating that it wouldn’t be enough.

“Military reductions could help,” he said. “They could generate more money — I certainly think we’re spending too much on the military. But even cutting the military budget by 80% and cutting Social Security by 80%, and every single other [non-health spending] by 80% would just barely be enough to pay for Medicare for All.”

‘It’s going to be very disruptive’

Dr. Ken Thorpe, a professor of health policy at Emory University, doesn’t even think Medicare for All is the solution. With it, he said “there’s no question” there would be job losses in hospitals and in health insurance.

“The thorn with this is that numbers are big, so disruptive in terms of what people pay,” he told Yahoo Finance. “It’s going to be very disruptive.”

“There are other ways to do it that are much less disruptive — building on the Affordable Care Act and increasing subsidies, reinstating some of the protections that stabilize premiums,” Thorpe said. “You can get 98-99% coverage just building on what we already have for a fraction of the cost.”

MUFG Chief Financial Economist Chris Rupkey doesn’t think the public would be in favor of Medicare for All if they understood the cost involved with it.

“Uncle Sam doesn’t have enough money in the till to finance such an expansion of Medicare to the general population,” he told Yahoo Finance. “Payroll taxes are already 6.2%. Federal deficit spending for additional programs will bankrupt the country. We simply cannot afford it with federal debt-to-GDP ratios over 100% if one accounts properly for Social Security benefit promises we have made.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

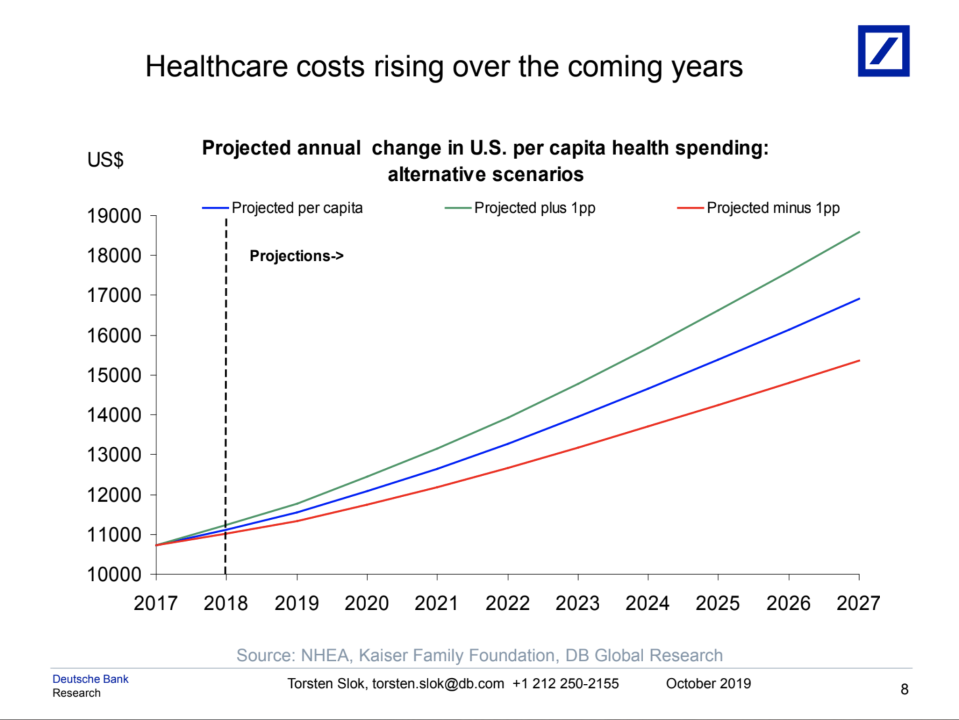

Economist: Medicare costs need to be brought 'under control' before expansion

'Everyone’s health insurance is more expensive' as more Americans manage chronic diseases

Millions of Americans with employer health care are still spending a fortune

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.