Meet a first-generation Gen-Zer with $60,000 in student debt who says it's 'hard to be excited' about Biden's new plans for relief: 'There's just no clear messaging'

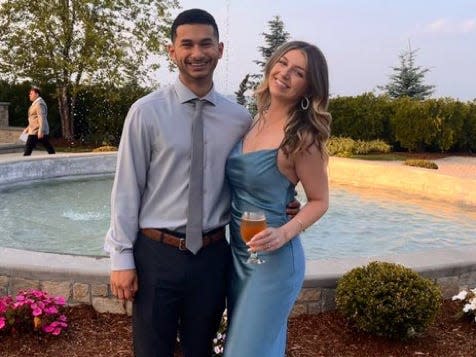

Olivia Bissanti, 23, has $60,000 in federal and private student debt.

After the Supreme Court struck down Biden's relief, she's worried about repayment going forward.

She said she doesn't think Biden's new plan for relief is enough to help borrowers.

Olivia Bissanti, 23, hasn't started paying off her federal student-loan balance yet because of the pandemic-cra payment pause — but she's kept making payments on her private loans since shortly after graduating.

And she's worried about what borrowers are in for in just a few months.

As a first-generation college student, Bissanti was the first in her family to achieve a higher education and navigate the financial system that comes along with it. To pay for her undergraduate degree, Bissanti said she "took out pretty much the entirety of my education cost through loans, public and private" — and she now holds about $22,760 in federal student loans and $37,000 in private student loans, according to documents reviewed by Insider.

Six months after graduating from college in 2021, Bissanti started making payments on her private student loans.

"I treat it like a utility," Bissanti told Insider. "I've been working since the week I graduated college. I was doing social work for a little while for a nonprofit and I was being paid $17 an hour, which is typical for nonprofits, but I think it's important to mention because I was required to have a degree for that position. But that was the starting rate."

She now works as a grant writer with a slightly higher salary, but she said "it's tough with expenses plus rent." And that could get even more difficult once federal student-loan payments resume in October.

At the end of June, the Supreme Court struck down President Joe Biden's plan to cancel up to $20,000 in student debt for federal borrowers. The court's majority said the president overreached his authority using the HEROES Act of 2003, which allows the Education Secretary to waive or modify student-loan balances in connection with a national emergency.

Even without the broad relief, the Education Department is still preparing to resume federal student-loan payments in October after an over three-year pause, with interest beginning to accrue again on borrowers' balances in September. The department announced a 12-month "on-ramp" period after payments resume to ensure borrowers who miss payments are not reported to credit agencies, but interest will still accrue during that time. And on Friday, it said it will be canceling $39 billion in student debt for over 800,000 borrowers in the coming days who have made qualifying payments toward income-driven repayment plans.

But the lack of clarity surrounding what relief will come next for borrowers — and how long they'll have to make payments without loan forgiveness — is frustrating Bissanti. Biden announced plans to use the Higher Education Act of 1965 to get relief to borrowers, which does not require a national emergency to provide relief, but his administration says the timeline is uncertain and could take months.

"I had some apprehension about Biden's first plan for relief," she said. "And sure enough, that's exactly what happened. It did go all the way to the Supreme Court and was deemed ineligible. So it's been a roller coaster, and it's really frustrating. It's hard to be excited anymore."

'No clarity on what repayment is going to look like'

Along with the "on-ramp" period, the Education Department also announced at the end of June that it finalized its new income-driven repayment plan — known as the SAVE plan — which would cut undergraduate borrowers' monthly payments in half. Bissanti said she anticipates she will enroll in that plan, but she "has no idea what my monthly payment will be."

"I would say I'm nervous," Bissanti said. "There's just no clear messaging, and there's no clarity on what repayment is going to look like. So it's something I try and push to the back of my mind because if I focus on it, it just freaks me out."

And beyond repayment, the lack of clarity surrounding when — and which — borrowers will get relief through the Higher Education Act adds onto Bissanti's concerns. Bharat Ramamurti, the deputy director of the National Economic Council, said during a press briefing following the Supreme Court decision that "one of the things about the rulemaking process is that we can't actually prejudge its outcome. Part of how we do this process is that we initiate it, we put a proposal on the table, we work with stakeholders to get their input. That ends up shaping the scope of the proposal."

While Biden's administration has acknowledged the process to implement the new plan under the Higher Education Act will take time, and it could be months until borrowers know if they qualify, Bissanti said that's not a good enough answer for her.

"Saying 'we need time' might be enough for Biden and his wishes to get reelected and keeping people's hopes alive, but for people like myself, I just don't even know what October looks like," Bissanti said.

Student-loan companies are expected to notify student-loan borrowers of what their payment will be at least 21 days before it is due, and in the meantime, borrowers can enroll in the SAVE plan. But prepping for repayment is just about all borrowers can do right now as they await updates from the Education Department on any additional measures for relief.

"I want to recognize that I feel very lucky to have a career right after school. But I worry for people like myself who might get laid off," Bissanti said. "The economy's in a downward spiral and people who have had a hard time finding a job, and six months after they graduated, they had to pony up like $800 a month to pay off a degree that promises to get you a really good paying job."

Read the original article on Business Insider