Merck (NYSE:MRK) Can Take More Debt to Boost the COVID-19 research

At the start of the Covid-19 pandemic, Merck & Co., Inc. (NYSE:MRK) was one of the companies with high expectations. Yet, as one of the largest vaccine makers in the world, they failed to deliver, falling behind the competitors in Moderna, Pfizer, and Johnson & Johnson.

Unsurprisingly, the stock remained in a range, not moving more than 10-12% in either direction. Now, Merck is looking to redeem itself by pursuing a more user-friendly COVID-19 treatment in pill form.

Recently, the Department of Health and Human Services announced a US$1.2b purchase of Molnupiravir, an oral treatment for multiple RNA viruses currently in Phase 3 clinical trial, on a condition of FDA approval.

Needless to say, drug development and trial is a costly and risky endeavor. Therefore we will examine Merck's debt to gauge the potential risks.

Why Does Debt Bring Risk?

While many companies use it, debt only becomes a real problem when they can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price to get debt under control. Looking at Merck's history, we can see that shareholders have not been diluted in the past year.

Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Merck.

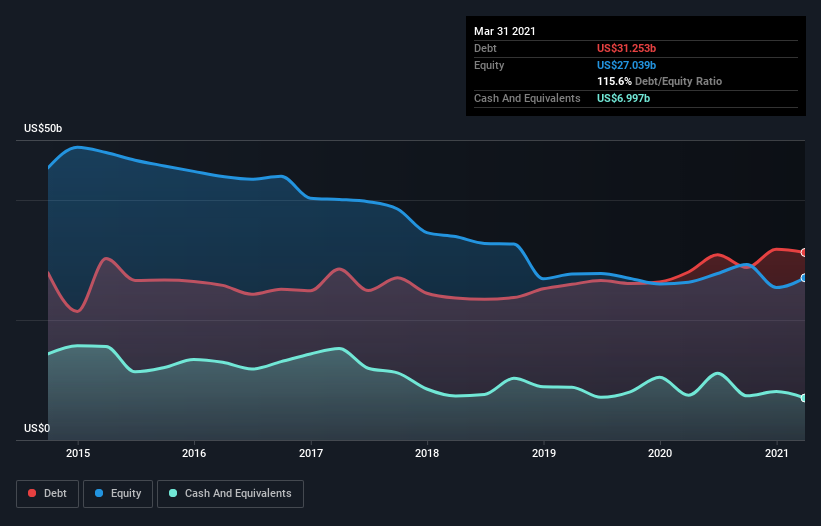

A Look at Merck's Debt

As you can see below, at the end of March 2021, Merck had US$29.6b of debt, up from US$28.0b a year ago. Click the image for more detail. On the flip side, it has US$7.00b in cash leading to net debt of about US$22.6b.

A Look At Merck's Liabilities

Zooming in on the latest balance sheet data, we can see that Merck had liabilities of US$26.4b due within 12 months and liabilities of US$37.4b due beyond that. Offsetting these obligations, it had cash of US$7.00b as well as receivables valued at US$8.69b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$48.1b.

While this might seem like a lot, it is actually not that much since Merck has a huge market capitalization of US$196.3b, and so it could probably strengthen its balance sheet by raising capital if it needed to.

To size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Merck's net debt is only 1.2 times its EBITDA. And its EBIT easily covers its interest expense, being 19.5 times the size. But the other side of the story is that Merck saw its EBIT decline by 4.9% over the last year. If earnings continue to decline at that rate, the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analyzing debt. But it is future earnings that will determine Merck's ability to maintain a healthy balance sheet in the future. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt, so we always check how much of that EBIT is translated into free cash flow. Over the most recent 3 years, Merck recorded free cash flow worth 55% of its EBIT, which is around normal, given free cash flow excludes interest and tax.

One of the strong points for investors is a reliable dividend that currently yields 3.4%. Merck remains committed to dividend growth and stability, as noted in the Q1 2021 presentation.

Merck's Dividend History, Source: Investor Presentation April 2021

A Search for Redemption and Growth

When it comes to the balance sheet, the standout positive for Merck was that it could cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its EBIT growth rate makes us a little nervous about its debt.

Considering this range of data points, we think Merck is in a good position to manage its debt levels, and if needed, use new debt to boost the efforts of developing the first COVID-19 antiviral pill. After all, a solution that prevents hospitalization instead of speeding it up would be a significant step toward stopping the virus.

There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Merck , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com