Merck's (NYSE:MRK) Balance Sheet Can Easily Handle Acquisitions like Acceleron Pharma (NASDAQ: XLRN)

This article first appeared on Simply Wall St News.

After a brief breakout, Merck & Co., Inc.(NYSE: MRK) stock failed to establish a new high, rejecting the US$88 level set before the 2020 pandemic. As the company completes an US$11b tender offer for Acceleron Pharma, we'll take a look into the state of their balance sheet.

Check out our latest analysis for Merck.

Although history rarely repeats, it does rhyme. One of the notable signs of the late bull market has been elevated merger & acquisition activity, which has been nothing but a blowout in 2021.

Despite opposition from a significant shareholder, Avoro Capital Advisors, Merck has been able to complete a tender offer for Acceleron Pharma (NASDAQ: XLRN) at US$180 / share, in a deal worth US$11b.

Although yet unprofitable, Acceleron has interesting products in the pipeline, including sotatercept, a drug for the treatment of pulmonary arterial hypertension (PAH) that Merck sees as a US$7.5b market by 2026.

Meanwhile, the company received the FDA approval for anti-PD-1 therapy Keytruda as adjuvant therapy for high-risk renal cell carcinoma (RCC) patients. In the phase 3 KEYNOTE-564 trial, the drug ut the risk of disease reoccurrence or death by 32%. This development could bring over US$1b in new sales.

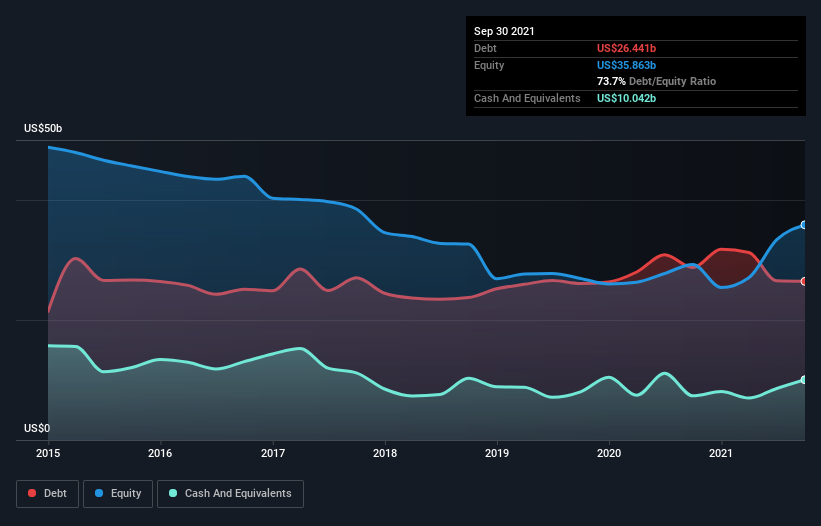

Examining Merck's Debt

As you can see below, Merck had US$26.4b of debt in September 2021, down from US$28.7b a year prior. However, it does have US$10.0b in cash, offsetting this, leading to net debt of about US$16.4b.

A Look At Merck's Liabilities

Checking the latest balance sheet data, we can see that Merck had liabilities of US$23.7b due within 12 months and liabilities of US$33.9b due beyond that. On the other hand, it had cash of US$10.0b and US$10.6b worth of receivables due within a year. So it has liabilities totaling US$37.0b more than its cash and near-term receivables combined. Of course, Merck has a market capitalization of US$203.8b, so these liabilities are probably manageable.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Merck's net debt is only 0.78 times its EBITDA. And its EBIT covers its interest expense a whopping 23.2 times over. So we're pretty relaxed about its super-conservative use of debt. On top of that, Merck grew its EBIT by 42% over the last twelve months, and that growth will make it easier to handle its debt. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the future profitability of the business will decide if Merck can strengthen its balance sheet over time. So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

Furthermore, it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Merck recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This hard cash means it can reduce its debt when it wants to.

Conclusion

Merck's impressive interest cover implies it has the upper hand on its debt. Although we're observing the aggressive merger & acquisition activity through the lens of historical risks, we're optimistic that Merck can easily afford these expansions.

And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Zooming out, Merck seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, it can also bring a higher return on equity when used wisely.

When analyzing debt levels, the balance sheet is the prominent place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Merck you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com