Meritor (MTOR) Beats on Q3 Earnings & Sales, Revises FY21 View

Meritor, Inc. MTOR posted adjusted earnings per share of 62 cents in third-quarter fiscal 2021 (ended Jun 30, 2021), handily beating the Zacks Consensus Estimate of 50 cents. Higher-than-anticipated adjusted EBITDA from the Commercial Truck & Trailer segment resulted in this outperformance.

The bottom line reversed the year-ago adjusted loss of 36 cents a share. Adjusted income from continuing operations was $45 million in the reported quarter as against the loss of $26 million recorded in the prior-year period.

Sales surged 98%, year over year, to $1,016 million in the fiscal third quarter. This year-over-year increase was primarily driven by higher global truck production in all markets. Moreover, the reported figure surpassed the Zacks Consensus Estimate of $965 million.

Adjusted EBITDA went up to $107 million from the year-earlier quarter’s $7 million. Adjusted EBITDA margin was 10.5% compared with the prior year’s 1.4%. This upside stemmed from higher sales volumes, partially negated by higher freight, steel and electrification costs.

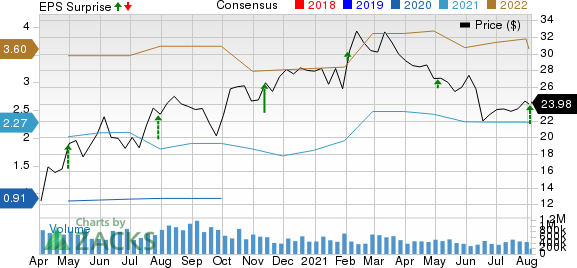

Meritor, Inc. Price, Consensus and EPS Surprise

Meritor, Inc. price-consensus-eps-surprise-chart | Meritor, Inc. Quote

Segment Results

For the June-end quarter, revenues in the Commercial Truck & Trailer segment amounted to $800 million, skyrocketing 138% year over year on higher global truck production in all markets. Moreover, the figure outpaced the Zacks Consensus Estimate of $697 million. The segment reported an adjusted EBITDA of $69 million, reversing the loss of $23 million witnessed in the year-ago quarter. The figure also surpassed the consensus mark of $54 million. The EBITDA margin came in at 8.6% during the quarter versus the -6.8% recorded in the prior-year quarter.

Quarterly revenues in the Aftermarket & Industrial segment totaled $258 million, up 27% from the year-ago level, on higher volumes across the segment. The revenue figure, however, lagged the Zacks Consensus Estimate of $274 million. The segment’s adjusted EBITDA was $36 million, up from the $31 million witnessed in the prior-year period. The figure, however, missed the consensus mark of $41.25 million. Also, EBITDA margin edged down 1.3%, year on year, to 14% during the April-June period, primarily on elevated freight costs, which more than muted conversion on higher sales.

Financial Position

In the reported quarter, Meritor’s cash and cash equivalents summed $138 million as of Jun 30, 2021, compared with $280 million as of Jun 30, 2020. Long-term debt was $1,011 million at the end of the fiscal third quarter, down from the $1,193 million as of Jun 30, 2020.

During the fiscal third quarter, Meritor’s cash provided from operating activities was $39 million, compared with the cash used for operating activities of $102 million witnessed in the year-ago quarter. Free cash flow for the fiscal third quarter was $18 million compared with the negative $114 million recorded in the same period last year. For the quarter ended Jun 30, 2021, capital expenditure was $21 million compared with the $12 million incurred in the year-ago quarter.

Fiscal 2021 Outlook

For fiscal 2021, Meritor projects sales to be $3.9 billion, up from the previous forecast of $3.65-$3.8 billion. The company projects adjusted earnings per share to be $2.45, up from the earlier guidance of $2.15-$2.3. Cash flow from operations and free cash flow are anticipated to be $210 million and $115 million, respectively, compared with the earlier projection of $205-$220 million and $110-$125 million.

Meritor, peers of which include Adient Plc ADNT, American Axle & Manufacturing Holdings AXL and Allison Transmission Holdings ALSN, currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

Meritor, Inc. (MTOR) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Adient PLC (ADNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research