Meta Stock Rallies Big on Earnings: Time to Buy?

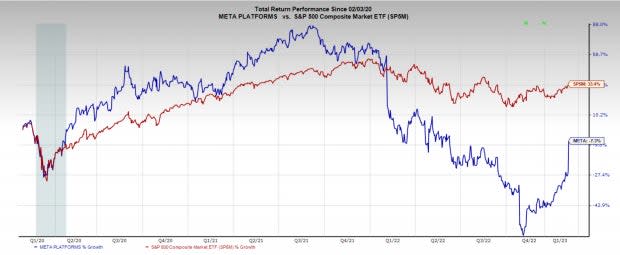

After getting completely battered in 2022 it appears Meta Platforms META stock is making a big comeback this year.

Meta stock took investors for a ride over the last 18 months. Meta was down -77% off its highs as recently as October 2022, only to rally back over 100% off those lows.

Quarterly results came back solid, but the market seems to think they are great as Meta stock is up 25% following the earnings release.

Q4 Revenue of $32.2 billion beat expectations of $31.7 billion

Q4 Earnings of $1.76 per share missed expectations of $2.20 per share

Announced $40 billion buyback plan

Facebook DAUs of 2 billion beat expectations of 1.98 billion

Family of Apps DAUs 2.96 billion beat expectations 2.92 billion

Reality Labs (VR/AR) operating loss of -$4.28 billion vs -$3.99 billion

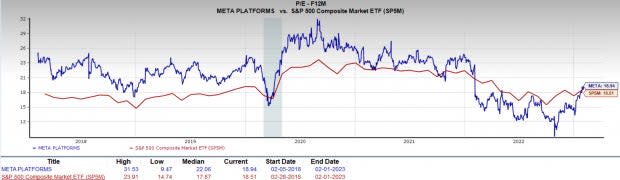

Image Source: Zacks Investment Research

Good or Great?

On the face of it, Meta’s earnings are mixed, although clearly the market seems to think they are very bullish. While revenue beat, earnings missed by a -20% margin. There was also an additional $200 million spent on Meta’s VR/AR arm Reality Labs that investors weren’t expecting.

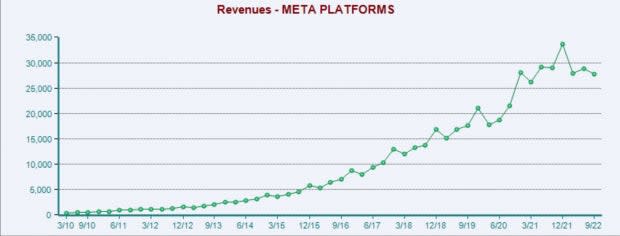

Also worth mentioning, is that compared to Q4 2021, sales are slightly down. Q4 2021 sales were $33.7 billion vs. 32.2 billion. Have Meta’s sales peaked?

Finally, Meta offered some mixed guidance. While they reassured investors, by guiding 2023 expenditures down to $89-$95 billion from $94-$100 billion, the sales guidance wasn’t as positive. Q1 FY23 sales are now forecasted at $26-$28.5 billion, which would be a QoQ decline of -14% and about flat YoY.

Image Source: Zacks Investment Research

Alternatively, a pickup in total daily active users is extremely reassuring, as many investors are wondering how much more capacity there is for growth on Meta’s platforms. Additionally, the $40 billion stock buyback program seems well timed as Meta’s valuation was below 10x forward earnings at one point. It also shows dedication to shareholders.

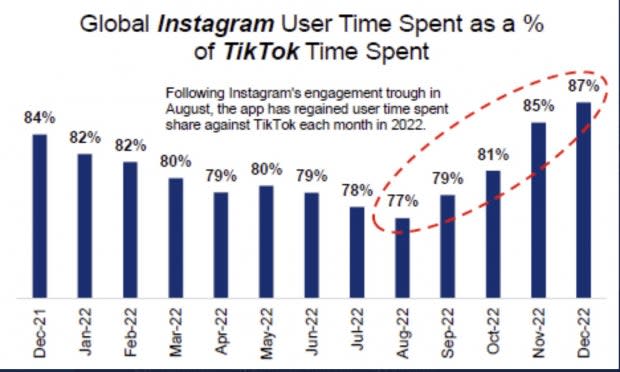

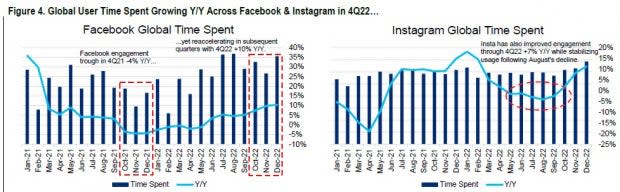

Another bullish catalyst for Meta would be the ban of Tik Tok, which seems all but assured at this point. Amazingly though, Meta has been successful in fighting back against the viral Chinese video app. Since finding a trough in November 2021 it looks like Instagram and Facebook usage is moving higher. Even more encouraging is the chart below showing global Instagram time used relative to Tik Tok.

Image Source: BofA Global Research

Image Source: BofA Global Research

A final point for the bulls was the huge improvement the ad business saw. Meta’s ad impressions jumped 23% alongside a -22% decrease in the cost of advertisements, which is an awesome development for advertisers using the platform.

Conclusion

While the earnings miss is a concern, META is a very compelling stock at this point. More than anything it is very reasonably priced, although that cheapness is disappearing quickly as the stock has rallied significantly.

Image Source: Zacks Investment Research

There are not many businesses in the world that can say nearly half of the world population uses their products daily, but Meta can. There are not many stocks that have fallen so far out, and back in favor as Meta. Yet its massive user base, and suite of products speak for itself. While investments into the metaverse are questionable, without them Meta is a cash generating machine.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meta Platforms, Inc. (META) : Free Stock Analysis Report