Mexico Inflation Slows Again, Signaling End to Interest Rate Hikes Is Near

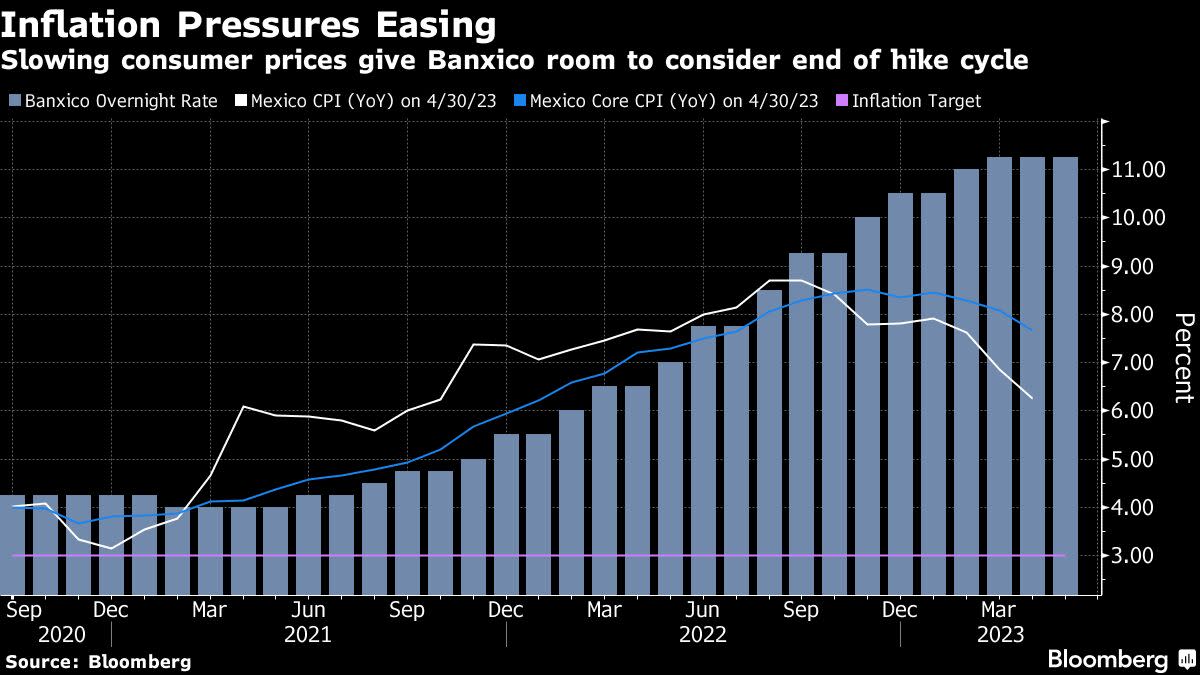

(Bloomberg) -- Mexico’s annual inflation slowed for the third straight month in April, boosting chances that the central bank ends its record tightening cycle at next week’s policy meeting.

Most Read from Bloomberg

Steve Schwarzman Holds Off Giving Money to DeSantis After Meeting Him

Vanguard’s Trillion-Dollar Man Leads a Fixed-Income Revolution

George Santos Faces Criminal Charges by US Justice Department

Consumer prices rose 6.25% from a year earlier, down from 6.85% recorded in March, the national statistics institute reported Tuesday. The data point was just above the 6.22% median estimate by economists in a Bloomberg survey.

Core inflation, which excludes volatile items like food and fuel, was 7.67% on an annual basis, below both the previous measure of 8.09% and the median estimate of 7.69%.

Mexico’s central bank, known as Banxico, has hiked interest rates by 725 basis points since June 2021, and has remained more aggressive than Latin America’s other inflation-targeting monetary authorities in recent months. Policymakers, however, will discuss ending the increases at the bank’s May 18 meeting, Governor Victoria Rodriguez Ceja told lawmakers in late April.

Read More: Banxico Will Discuss Halting Rate Hike Cycle, Governor Says (2)

Banxico is likely to pause its tightening this month “given the broad stability of inflation expectations, FOMC policy signals, slight progress on the core and services inflation front and the already quite restrictive monetary stance,” said Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc.

Central bankers voted unanimously to raise borrowing costs by a quarter of a percentage point at their last meeting in March, pushing the key rate to a record 11.25% after a bigger-than-expected increase of 50 basis points in February.

What Bloomberg Economics Says

“We still see Banxico hiking rates by 25 basis points on May 18. It could be a close call — the April inflation data give policymakers an opportunity to hold. A lower May print should confirm the downtrend for policymakers and allow them to hold rates thereafter.”

—Felipe Hernandez, Latin America economist

—Click here for full report

On the month, consumer prices fell 0.02% from March, while core inflation eased to 0.39% from 0.52% previously, according to the statistics agency.

A decline in electricity tariffs in the northern part of the country and easing agriculture price pressures contributed to the lower headline inflation print in April, according to Pamela Diaz Loubet, a Mexico economist at BNP Paribas.

“The trajectory of the decline in inflation is a process that seems to be slow, because it is not devoid of risks,” she said. “We have to be alert for a slow convergence process that could lead to greater inflationary persistence.”

Economists expect inflation in Latin America’s second-largest economy to finish 2023 at 5.02%, according to a Citibanamex survey published last week, down from a forecast of 5.13% in April. They see interest rates at 11.25% at year-end and expect the economy to grow 1.9%, up from 1.6% in late April.

Mexico’s central bank targets annual inflation at 3%.

The decline in April’s headline inflation is set to give Banxico more freedom to determine its next move during the May policy meeting. While another rate hike is no longer a certainty, a final increase in borrowing costs is “still more likely than not,” according to Jason Tuvey, Deputy Chief Emerging Markets Economist at Capital Economics.

--With assistance from Rafael Gayol.

(Updates to add economists’ comments starting in fifth paragraph)

Most Read from Bloomberg Businessweek

AI Drug Discovery Is a $50 Billion Opportunity for Big Pharma

Even $500 Million a Year From Google Isn’t Enough to Save Firefox

©2023 Bloomberg L.P.