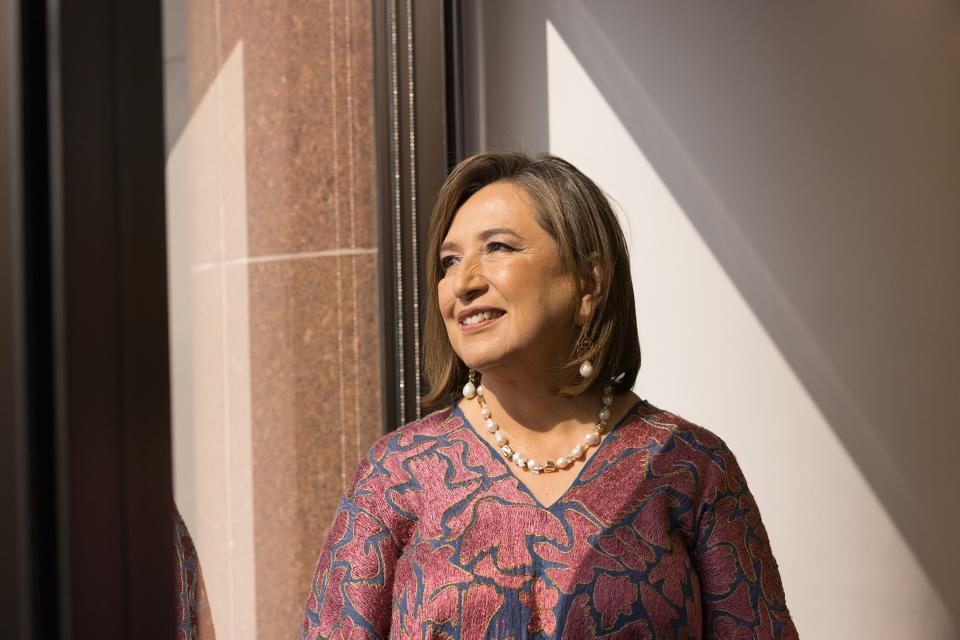

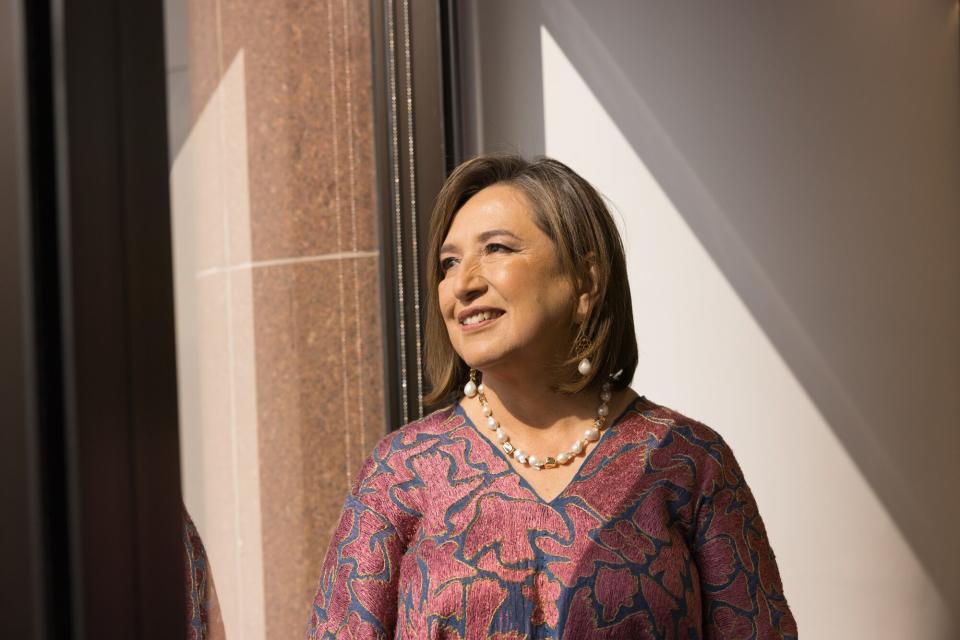

Mexico Presidential Candidate Galvez Wants Sweeping Energy Reforms

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Mexico’s main opposition presidential candidate Xochitl Galvez called for a sweeping reform of state oil firm Pemex, opening the energy sector to private investment and supercharging renewables.

In an interview in Bloomberg’s Mexico City bureau, Galvez didn’t commit to privatizing the company but said she respected Brazil’s Petrobras, which is publicly traded. Mexico doesn’t have the resources on its own to transform its energy sector and economy, and private investment should be welcomed to accelerate development responsibly, she said.

“We have a very serious problem, which is that state companies are terrible at managing Mexicans’ money and they’re terrible at being productive. So, yes, I do look toward the private sector,” she said, predicting that her political opponents would attack her. “But I don’t care, because I want to defend the planet.”

Lea nuestra nota en español.

Galvez faces former Mexico City Mayor Claudia Sheinbaum, the long-time protege of President Andres Manuel Lopez Obrador, in the election next June. While Lopez Obrador can’t run for reelection himself, his formidable popularity will make Galvez’s road to victory difficult. Sheinbaum, an environmental engineer, will grapple with the tricky task of continuing the president’s legacy while boosting her own green credentials.

Read more: AMLO’s Legacy Faces a Challenge Just as the World Shifts His Way

Galvez, a senator who is backed by a coalition of opposition parties and hopes to become the country’s first female president, said she’d like to reopen oil bidding rounds that the statist president stopped after taking office in 2018. At the same time, Galvez said she’s a champion of renewable energy, and that she would seek investment in hydrogen and solar energy, in a rollback of some of Lopez Obrador’s current policies.

“If you don’t have money for exploration, private investment will help,” said Galvez, an engineer who rose from poverty to found a successful consultancy focused on building efficiency. “For me Petrobras is a good model.”

While still controlled by the Brazilian government, Petroleo Brasileiro SA was listed in Sao Paulo in the 1990s, and minority shareholders are represented on its board. A mixed system where international oil companies are also operating in the country has helped Brazil develop its ultra-deepwater pre-salt reservoir, and it is now Latin America’s largest oil producer.

Energías Mexicanas

Galvez, 60, said she sees hydrogen and other clean energy sources as critical to Mexico’s development — to the degree that, rather than Petroleos Mexicanos, she quipped she’d like Pemex to be called Emex: Energías Mexicanas.

She attacked Lopez Obrador for throwing money at Pemex, the world’s most indebted oil company, and building a mega-refinery that suffered massive cost overruns and delays. At the same time, his government cut the knees off a thriving green energy market by weakening regulators’ independence, leading to fewer permits being granted for renewable projects, fuel imports and terminals. Many projects have been left in limbo or abandoned.

“You have to be very stupid to bet on fossil fuels, because beyond being expensive, it’s dirty, so with Mexico’s potential in green hydrogen, in renewables, public policy is in green energy — there’s no doubt,” said Galvez, who said Lopez Obrador’s moves had burned investors. “You came, opened solar or wind plants and then couldn’t connect them because the government had a tantrum and wanted to bet on fossil fuels.”

Mexico was one of the last countries in the world to open its energy market to private investment since oil is a longstanding political symbol of Mexico’s sovereignty. Until the 2013-2014 reforms, Pemex held a monopoly in the sector for more than three quarters of a century after the country expropriated foreign oil operations in 1938, an event that’s commemorated each year on March 18. The government takeover was a reaction to years of foreign exploitation of the nation’s resources, and sentiment still runs deep in the country that the company belongs to the people.

Critics argue that Mexico’s nationalist energy policies that have placed the burden on Pemex to develop most of Mexico’s oil territory represents a squandered opportunity, where a potent combination of soaring debt, mismanagement and failing projects have combined to drag down the state oil company. Crude output has declined almost every year since 2004, and production is now less than half of what it was then. Meanwhile, Pemex’s debt load has exploded to more than $110 billion, making it the world’s most-indebted oil producer.

What’s worse, Pemex is hemorrhaging money at a time when global rivals have been turning huge profits due to the oil price rally. It’s been kept on life support by AMLO, who sees energy independence as a lofty goal for the nation and has put more than $77 billion into Pemex capital injections, tax breaks and energy projects since 2019.

Read more: Pemex Gets Billions for Debt Payment in Mexico Draft Budget

A return to oil auctions and joint-ventures could mean that Pemex would get much-needed financial and technical support to develop more profitable fields. Pemex has focused on developing onshore and shallow-water prospects instead of riskier, and more promising, deep-water fields that could boost its reserves over the long term. The company doesn’t have the liquidity, the technology and the engineering know-how to take on those projects.

Petrobras Model

Many of Pemex’s critics would like to see the company go the way of Brazil’s Petrobras, which regularly partners with others in the private sector. Petrobras also made the decision to sell off non-core assets, enabling it to focus on the job of drilling. By contrast, under AMLO, much of Pemex’s resources have been funneled into its loss-making refinery business, and the construction of a new plant in Dos Bocas that cost more than double its original price tag and has only just begun making fuel. Pemex also purchased Royal Dutch Shell Plc’s stake in the Deer Park refinery in Texas.

Despite Lopez Obrador’s policies, there is a small group of private producers that got exploration rights during the previous government. They produced 104,309 barrels of crude a day in July, 6.4% of Mexico’s total oil production.

Galvez said she would use oil drilled with outside investors’ help for the petrochemical industry rather than electricity, which she would produce with renewables. Lopez Obrador canceled oil auctions in a bid to reverse the country’s landmark 2013 to 2014 energy reforms that had lured the world’s biggest drillers, including Exxon Mobil Corp. and Shell.

“These companies have a lot of technology that Pemex doesn’t have — Pemex doesn’t have money for exploration,” she said. “Also, oil is too valuable to be burned to produce electricity, oil should be used for the petrochemical industry, which has been very abandoned.”

A return to oil auctions would be a welcome change for international oil companies, which in recent years have returned many oil blocks to the state since they could not make the investments scalable under the nationalist administration.

Galvez has the backing of what had been Mexico’s three most powerful political parties before Lopez Obrador’s Morena party rose to power. While one of her supporters is the conservative PAN, she described herself as “center-left.”

To gain the support of the allied parties, she surged through a crowded field using eye-catching stunts and an earthy, relatable communication style. In polling, she currently lags a fair way behind Sheinbaum, who will enjoy the ruling Morena party’s daunting resources and infrastructure, including two-thirds of the country’s governorships.

Read more: Mexico Poised to Elect 1st Female Leader After AMLO Party Pick

--With assistance from Amy Stillman, Cyntia Barrera Diaz and Andrea Navarro.

Most Read from Bloomberg Businessweek

Huawei’s Surprise Phone Gives Ammo to Biden Doubters on China

Lyme Disease Has Exploded, and a New Vaccine Is (Almost) Here

©2023 Bloomberg L.P.