Miami renters are staying put due to COVID-19. Out-of-towners are taking their place

Restaurants, small businesses and movie theaters aren’t the only things the COVID-19 pandemic brought to an abrupt halt in March.

The residential rental market around the U.S. has taken a massive hit due to the coronavirus outbreak, with millions of people opting to stay in place in their current home or apartment — and interrupting the natural progression of moving to a bigger place or becoming homeowners.

But in Miami-Dade, that stagnancy has opened the door for a slew of out-of-towners looking to rent a market-rate, non-luxury apartment and partake of the South Florida lifestyle, made possible by the growth of working remotely.

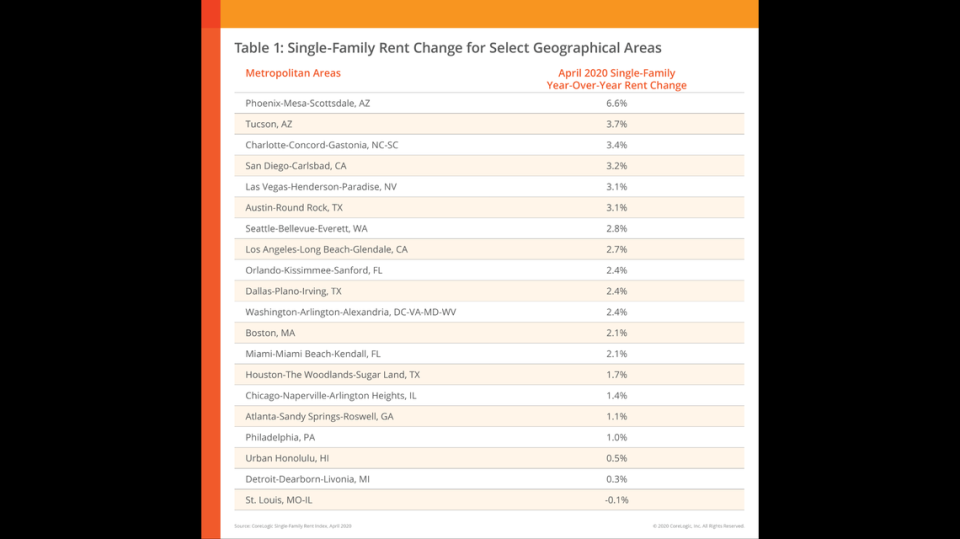

The lack of movement has kept rents flat across the U.S. According to the analytics firm CoreLogic, the rent for single-family homes in 20 major metros grew only 2.4 percent year-over-year in April 2020. That’s the lowest increase since November 2010, when the country was still recovering from the recession.

In the Miami-Miami Beach-Kendall area, single-family home rent prices grew 2.1 percent, an increase from the 1.25 percent growth in April 2019, according to CoreLogic. But the region still fell far short of rent growth in 19 other metro markets, such as Phoenix (6.6 percent), Tucson (3.7 percent) and Charlotte (3.4 percent).

The CoreLogic data also show that the single-family rent growth in Miami was fueled primarily by the high-end market (properties with rents 125 percent higher than the regional median of $1,750), where prices have risen steadily since November 2019.

“As the pandemic-induced recession took hold in April, the single-family rent index posted its lowest growth rate in over nine years,” said Molly Boesel, principal economist at CoreLogic. “While disruptions in the economy affect all parts of the housing market, the impact can often be seen in the rental market sooner than the for-sale market.”

Another sign of stagnancy in the local rental market: the number of new leases signed.

According to Dan Castillo, a real estate broker at ProsperRealty Group, a total of 2,931 rental closings of single-family homes and apartments were reported by the Miami Multiple Listing (MLS) service from May 15-June 15 — a drop of 27 percent over the same period last year, when 4,010 new rentals closed.

The MLS data also show the median rent price went down from $1,950 to $1,875 year-over-year, while the days on market went up from 35 to 41 days.

“Instead of moving out, a lot of people are renewing their leases due to the economic uncertainty over the virus,” Castillo said. “Also, the loss of employment for many people means they could not upgrade when their current lease expired and decided to stay put.”

Out-of-town renters

The pandemic hasn’t had quite as severe of an impact on home sales. According to the most recent figures from the Miami Association of Realtors, the number of single-family homes and condos under contract in Miami-Dade County has risen from a low of 255 the week of March 23 to a current 716 as of June 14 — one indicator that the sales market is stabilizing after the COVID-19 slump.

Hard data showing the COVID-19 impact on the local rental market isn’t available yet. But local brokers and experts say the stay-put trend has opened a window for domestic out-of-towners who are relocating to Miami and aren’t ready to buy yet.

Elsa Jimenez, a real estate agent for the Kendall-basedNXT LVL Realty, said she has seen a 20% increase over the last month in the number of clients relocating from another state and looking to rent an apartment or single-family home.

“Most of them are professionals moving here because of job relocation, whether it’s the Coast Guard or a doctor coming to the University of Miami,” she said. “The younger people want to live in Edgewater and the families are interested in Coral Gables. I have a married couple coming down on Sunday from New York to look at a unit, and they want to rent it right away.”

This recent wave of out-of-town renters is different from the influx of high-worth investors and CEOs who started flocking to South Florida two years ago from states such as New York, New Jersey, California and Illinois to avoid paying high real estate taxes after the Tax Cuts and Jobs Act of 2017 limited how much they could deduct from their tax returns.

Christopher Zoller, a broker associate with Berkshire Hathaway HomeServices EWM Realty, said it’s not a coincidence that many of those states have also been hot zones for the COVID-19 virus.

“They are showing up in droves,” said Zoller, who has seen a 25% increase of out-of-towners looking to rent in Miami-Dade compared to last year. “They are fleeing high density, high-rise locations. They are learning to work from home or they can work from common spaces.”

According to Zoller, the out-of-towners tend to be between the ages of 25-35, either single or married without children, employed by a company outside of Miami-Dade.

The downside, Zoller said, is that many of these new renters aren’t necessarily interested in signing a full-year lease. Because the peak rental cycle in Miami-Dade runs from June to August, a six-month lease in July, for example, would mean the unit would be vacant in January — a dead zone for new rental activity.

“They want to put their toe in the water and see if they like living in Miami,” Zoller said. “They are looking for our lifestyle and can save money here. Many of them also intend to buy and want to get a feel for the city first, so they don’t want to sign on to a full year.”

Zoller said that hesitation to commit gives locals an edge over the outsiders when they are competing for the same rental property, because having a local job is more attractive to a landlord over someone who works remotely for an out-of-state company.

The move-arounders

Another unexpected consequence of the COVID-19 lockdown: a migration of renters away from the tall, sleek multifamily buildings in Miami’s urban core and toward less populated areas such as Doral.

Enrique Teran, founder of the Doral-based Avanti Way Realty, said that out of the 295 leases his company handled in the month of May, 140 were new renters, 75 were renewals and 80 of them were people who left the downtown Miami area.

“They’re afraid of being in these dense areas because of the virus,” Teran said. “They would rather live in a building that is not so high-end than deal with elevators and busy lobbies. Also, the opportunity to work from home allows them to move further away from their office.”

But for every local who is leaving the urban core until the virus blows over, an out-of-towner is ready to take his or her place.

Rick Mirza, CEO and founder of the private equity firm Daulat, said one of his employees, a 28-year-old Miami native, just relocated back to South Florida after only a year with the California-based company, opting to open a satellite office for the firm in South Florida.

“He told me he had saved money while he was [in California] and had a plan to buy a home, but when he got to Miami he realized he couldn’t qualify for a mortgage, because he wants to buy a house with a pool and a two-car garage,” Mirza said. “Mind you, this is someone who makes $350,000 a year.”

So instead, the employee rented a furnished two-bedroom apartment at an amenity-rich new building in downtown Miami for $3,200 a month.

“There are far better deals on rentals right now,” said Mirza, whose firm has been tracking changes in the real estate market caused by COVID-19. “The trend that we’ve seen since back in the recession from 2010 is that prices will adjust automatically and the inventory itself will determine whether it’s going to be a primarily renter’s market or if things will even out. But the people who are moving [to Miami] now are taking advantage of the lifestyle there, and being able to rent is something they can afford. And everyone who is renting now is a potential home buyer in the future.”