Miami woman pleads guilty to COVID loan fraud, leasing Bentley with illicit funds

At the height of the pandemic, Daniela Rendon pretended to be a Miami real estate developer who desperately needed relief loans from the federal government to stay afloat, according to prosecutors.

But rather than spend the money on business expenses, Rendon used the COVID-19 loans to lease a 2021 Bentley Bentayga (sales price, $181,000), rent a Biscayne Bay apartment, pay for cosmetic dermatology procedures and refinish her designer shoes, prosecutors say.

On Tuesday, Rendon, 31, pleaded guilty to wire fraud in Miami federal court and now faces up to 20 years in prison, according to her plea agreement.

Rendon fabricated records for her business, Rendon PA, saying it collected about $92 million in revenues, to qualify for pandemic relief from the Paycheck Protection Program and Economic Injury Disaster Loan Program, according to an indictment and other court documents. Both programs are run by the Small Business Administration, which guaranteed loans approved by banks under the CARES Act approved by Congress in 2020.

But in reality, Rendon was a sales associate for A3 Development LLC, which paid her company, Rendon PA, $2,000 on a biweekly basis over a year before the pandemic struck in March 2020, according to a factual statement filed with her plea agreement.

In total, Rendon received $381,000 in “fraudulent funds” from the government loan relief programs during the pandemic, according to prosecutors with the U.S. Attorney’s Office.

Under the CARES Act, the federal government doled out about $813 billion in loans through private lenders and the SBA to support ailing businesses during the pandemic. The relief programs became targets for fraudulent activity because the loans were guaranteed and then forgiven by the SBA as long as the funds were properly used for overhead, mainly payroll for employees.

Rendon is among thousands of people in South Florida and other parts of the country who have been accused of exploiting the SBA’s relief programs for businesses that faced hardship during the COVID-19 pandemic between 2020 and 2022. South Florida, with the dubious distinction of being a financial fraud capital, became a hub for hundreds of people accused of exploiting the SBA’s loan programs, federal authorities say.

Among the worst offenders in South Florida:

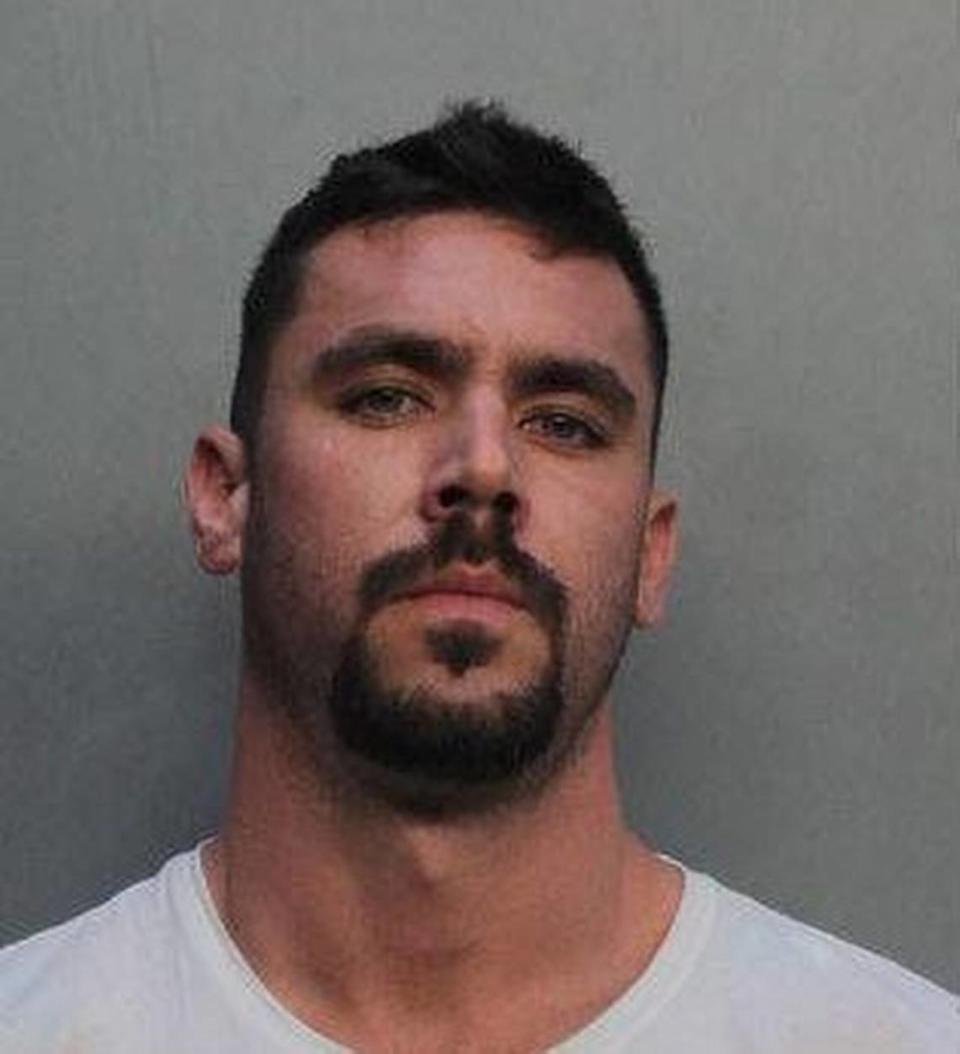

Back in 2020, David T. Hines received $3.4 million in COVID-19 relief loans from the SBA’s program for his supposedly ailing South Florida moving business. One of his first purchases: a super-luxury Lamborghini Huracán Evo.

The Italian-made sports car — purchased for $318,000 — was not on the list of permissible expenses, needless to say. Hines also spent thousands of dollars on dating websites, jewelry and clothes, along with stays at high-end hotels such as the Fontainebleau and Setai on Miami Beach. Hines pleaded guilty to wire fraud and was sentenced to more than six years in prison.

In November, Andre Lorquet, who pretended to be a certified tax preparer, was charged with falsely claiming that a handful of businesses were struggling during the pandemic. The Miami man pleaded guilty in January to money laundering and aggravated identity theft charges. Lorque ended up receiving $4.4 million from the SBA’s loan programs for himself and others, according to court records. He also went on a shopping spree, buying a Tesla Plaid, a Porsche Panamera GTS and other exotic vehicles, records show.

In December, a Miami man charged with swindling more than $2 million from the SBA’s loan program was found guilty of nine counts of wire fraud, money laundering and aggravated identity theft. In March, Valesky Barosy was sentenced to six years in prison.

On social media, showed off his high-end purchases, including photos of himself in a Lamborghini Huracán EVO and private jet. He also used the fraudulently obtained funds to buy Rolex and Hublot watches, as well as designer clothing from Louis Vuitton, Gucci and Chanel.