Bloomberg's new plan to crack down on Wall Street includes a financial transaction tax

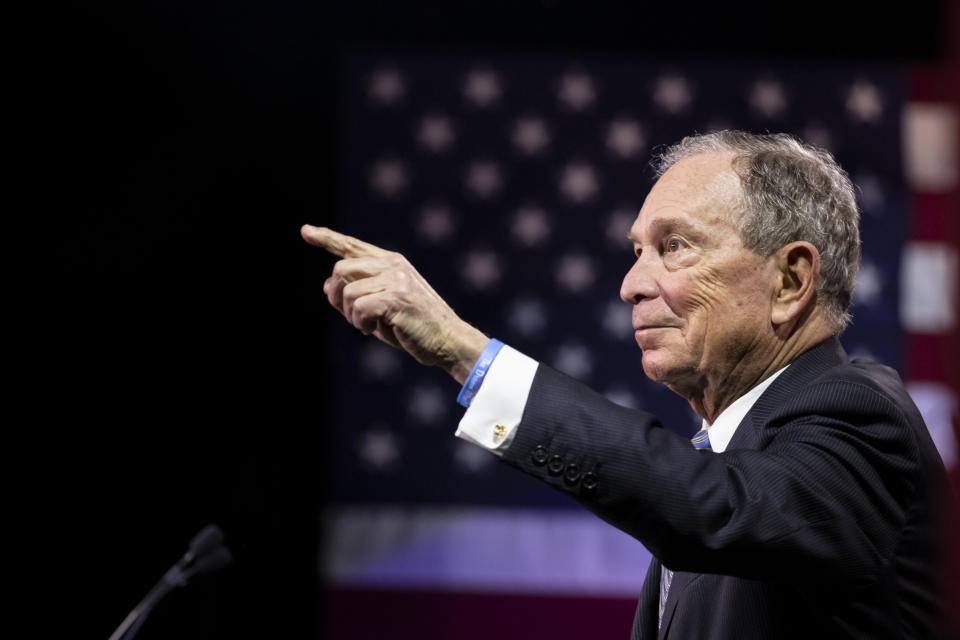

Democratic presidential candidate Mike Bloomberg unveiled a plan on Tuesday to crack down on Wall Street. Some of his proposals include a 0.1% financial transaction tax, merging mortgage finance giants Fannie Mae & Freddie Mac, and creating a new team within the Department of Justice to target corporate crimes.

“The financial system isn’t working the way it should for most Americans,” Bloomberg said in a statement. “The stock market is at an all-time high, but almost all of the gains are going to a small number of people, and our economy is still vulnerable to another shock like the 2008 financial crisis that devastated families and communities all over the country.”

Bloomberg has been campaigning as a more moderate alternative to candidates like Sen. Elizabeth Warren (D-MA) and Sen. Bernie Sanders (I-VT) and has been courting business leaders and Wall Street executives — who will likely cringe at the idea of a financial transaction tax. But the more progressive wing of the party has championed even tougher regulations and taxes on Wall Street on the wealthiest Americans.

Bloomberg’s financial transaction tax would be phased in gradually, starting at 0.02% to “monitor and minimize unintended consequences.” Isaac Boltansky of Compass Point Research said he’s bearish about the prospects of financial transaction tax, even “in a Democratic sweep scenario.”

“The FTT concept has become a political pot of gold that candidates can use to pay for student debt cancellation or health care while on the campaign trail, but we struggle to see the rhetoric turning into reality given a combination of political and practical considerations,” Boltansky wrote in a note.

Erica York, an economist with the Tax Foundation, told Yahoo Finance financial transaction taxes are not an effective way to raise revenue and would tax the same economic activity multiple times.

“An FTT would result in a less efficient capital market and would reduce economic output and asset prices, burdening not just the wealthy, but all taxpayers. FTTs like the one proposed by Bloomberg are unprecedented in their comprehensiveness, so the U.S. might see substantially greater damage to the health of its financial system than seen in foreign countries,” York said.

The Investment Company Institute called the financial transaction tax a “retirement tax.”

“Even though it sounds small, it would cost American families billions of dollars a year, including those saving in IRAs and 401ks for retirement and 529 accounts for their children’s education. It’s not worth the high cost to American savers,” said an ICI spokesperson.

Bloomberg’s plan aims to strengthen the Consumer Financial Protection Bureau — Warren’s brainchild — which Bloomberg says President Donald Trump has worked to undermine. The Trump administration argues it is reforming a bureau that it believes is, at least in part, unconstitutional.

Bloomberg wants to restore rules to rein in payday lending and preserve customers’ right to sue, while expanding the bureau’s jurisdiction to include auto lending and credit reporting.

The former New York City mayor also wants to strengthen banking regulations like Volcker rule and toughen stress tests for the largest financial institutions.

“President Obama made important progress strengthening our financial system and protecting consumers — but President Trump has spent the last three years gutting those safeguards, while giving a huge tax cut to the wealthiest people,” Bloomberg said.

The proposal comes just days after the Associated Press unearthed comments Bloomberg made in 2008, in which he seemed to blame the end of a discriminatory housing practice known as redlining for the financial crisis. Critics quickly attacked the former mayor for his comments. Warren called out Bloomberg while speaking at an event in Arlington, Virginia.

“That crisis would not have been averted if the banks had been able to be bigger racists. And anyone who thinks that should not be the leader of our party,” Warren said.

Bloomberg will face his Democratic rivals on the debate stage for the first time Wednesday night, after qualifying at the last minute with a new poll from NPR, PBS Newshour, and Marist that showed him in second place behind Sanders.

Jessica Smith is a reporter for Yahoo Finance based in Washington, D.C. Follow her on Twitter at @JessicaASmith8.

Read more: