Michael Price's Top 5 Trades of the 4th Quarter

- By Graham Griffin

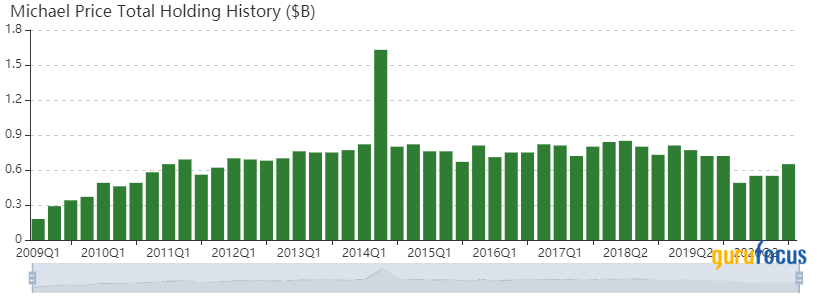

Michael Price (Trades, Portfolio), founder of MFP Investors LLC, has revealed his portfolio for the fourth quarter of 2020. The top trades of the quarter include reductions in top holdings Dolby Laboratories Inc. (NYSE:DLB) and Intel Corp. (NASDAQ:INTC), a new buy into W.R. Grace & Co. (NYSE:GRA) and an addition to his Twitter Inc. (NYSE:TWTR) holding. The guru also sold out of FirstEnergy Corp. (NYSE:FE) during the quarter.

The guru's New York-based hedge fund, which he founded in 1998, utilizes a value-based investing style to find out-of-favor small caps that trade at an attractive valuation. Price has been known to take an activist approach to his investments as well, seeking to improve profitability and unlock value.

Portfolio overview

At the end of the quarter, Price's portfolio contained 117 stocks, with nine new holdings. It was valued at $649 million and has seen a turnover rate of 7%. Top holdings at the end of the quarter were Intel, S&W Seed Company (NASDAQ:SANW), Bunge Ltd. (NYSE:BG), Dolby Laboratories and CIT Group Inc. (NYSE:CIT).

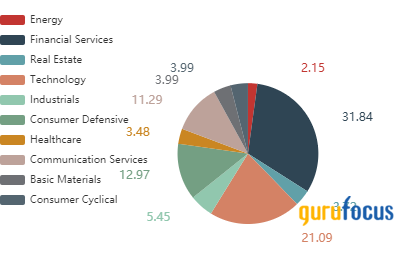

By weight, the top three sectors represented are financial services (31.84%), technology (21.09%) and consumer defensive (12.97%).

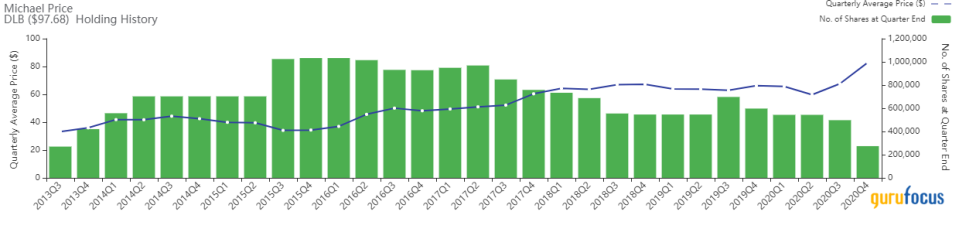

Dolby Laboratories

Price slashed his Dolby Laboratories (NYSE:DLB) holding by 44.99% with the sale of 223,780 shares. During the quarter, the stock traded at an average price of $82.86 per share. Overall, the sale had an impact of -2.69% on the portfolio and GuruFocus estimates the total gain of the holding at 82.56%.

Dolby Laboratories develops audio and surround sound for cinema, broadcast, home audio systems, in-car entertainment systems, DVD players, games, televisions and personal computers. The company generates three-fourths of its revenue from licensing its technology to consumer electronics manufacturers around the world. The rest of revenue comes from equipment sales to professional producers and audio engineering services.

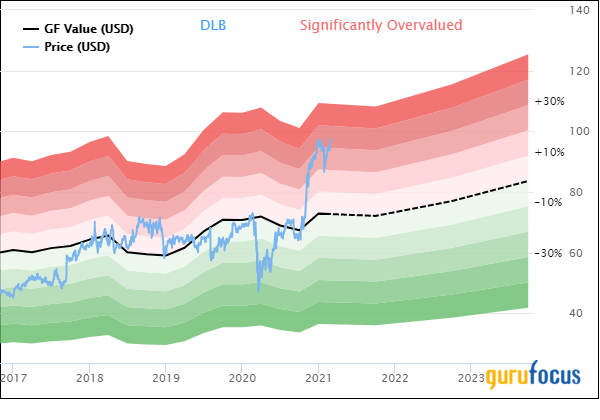

On Feb. 25, the stock was trading at $97.67 per share with a market cap of $9.92 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

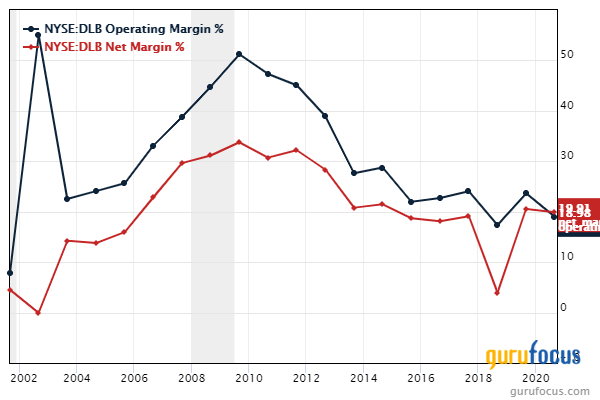

GuruFocus gives the company a financial strength rating of 8 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 3 out of 10. There is currently one severe warning sign issued for a declining operating margin percentage. Despite the warning sign, the company boasts both operating margin and net margin percentages that exceed more than 93% of competitors.

Intel

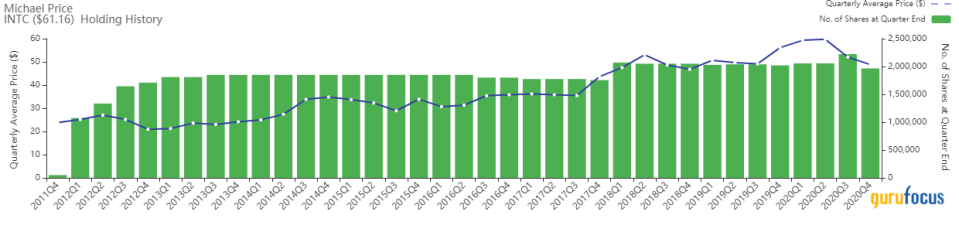

The fourth quarter also saw Price slim down his Intel (NASDAQ:INTC) holding by 11.55%. He sold 256,600 shares that traded at an average price of $48.78 during the quarter. GuruFocus estimates the total gain of the holding at 92.45% and the sale had an overall impact of -2.41% on the portfolio.

Intel is one of the world's largest chipmakers. It designs and manufactures microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors. It was the prime proponent of Moore's law for advances in semiconductor manufacturing, though the company has recently faced manufacturing delays. Intel has been active on the merger and acquisitions front, acquiring Altera, Mobileye, Movidius and Habana Labs in order to assist its efforts in non-PC arenas.

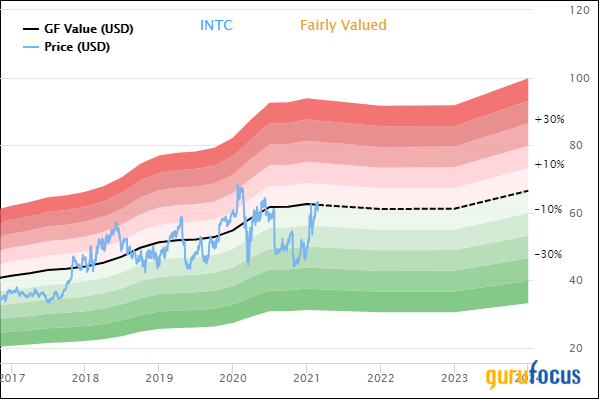

As of Feb. 25, the stock was trading at $61.21 per share with a market cap of $248.70 billion. The GF Value Line shows the stock trading at fair value.

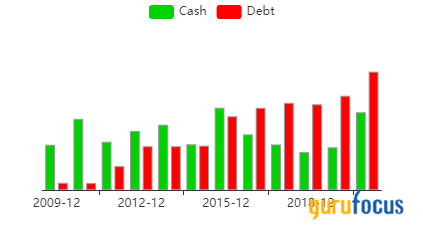

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 7 out of 10. There is currently one severe warning sign issued for a declining gross margin percentage. The company's cash-to-debt ratio of 0.66 places it lower than 68.58% of the semiconductor industry as debt levels have risen in recent years.

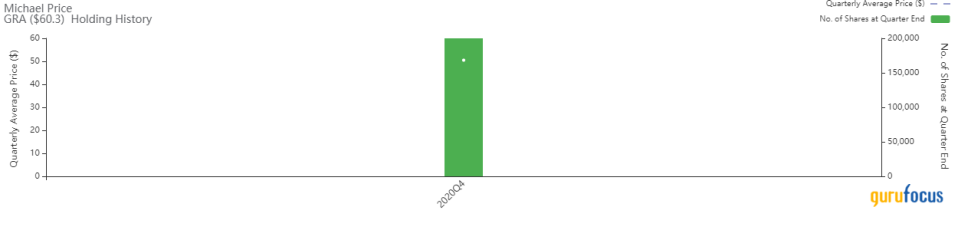

W.R. Grace

The biggest new buy of the quarter came from a new holding established in W.R. Grace & Co. (NYSE:GRA). The guru bought 200,000 shares that traded at an average price of $50.50 per share during the quarter. The purchase had a 1.69% impact on the portfolio and the holding has already gained an estimated total of 19.41%.

W.R. Grace, through its subsidiaries, makes and sells chemicals and silica-based materials used in refining, pharma, chemical manufacturing, coating and various chemical process applications. The company has two reportable business segments: Grace catalysts technologies and Grace material technologies. Most of the company's revenue is generated by the Grace catalysts technologies segment from the sale of oil refining catalysts and catalysts used in petrochemical, refining and other chemical manufacturing applications, and more than half of the revenue is earned in North America and Europe, the Middle East and Africa.

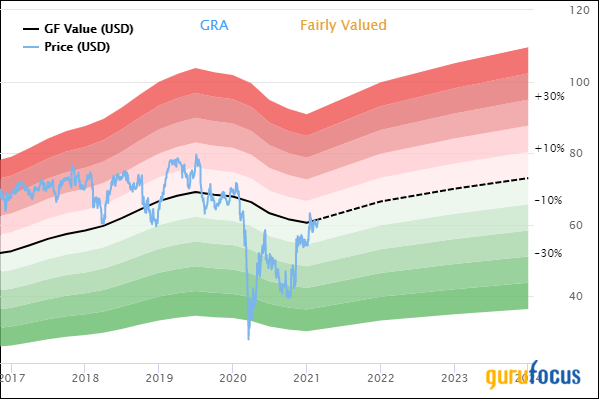

The stock was trading at $59.96 per share with a market cap of $3.98 billion on Feb. 25. The shares are trading at fair value according to the GF Value Line.

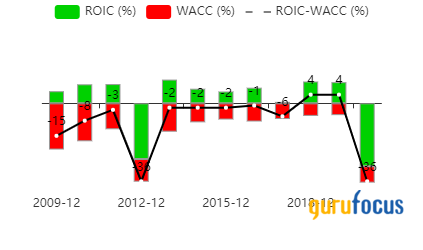

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 6 out of 10. There are currently three severe warning signs issued for declining gross margins, poor financial strength and an Altman Z-Score of 1.56 placing the company in the distress column. The weighted average cost of capital far exceeds the company's return on invested capital, indicating value will be destroyed as the company grows.

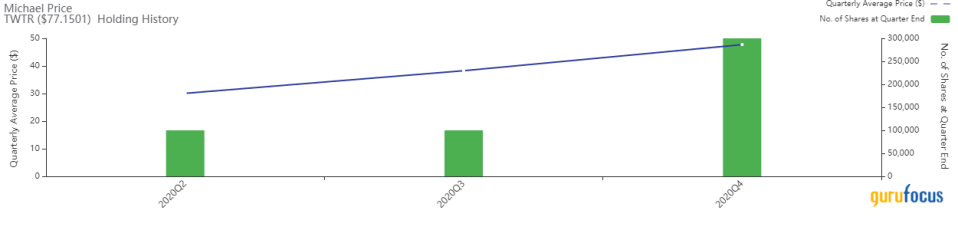

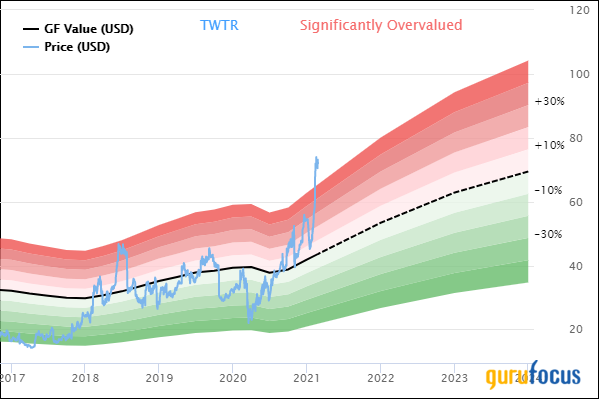

Price boosted relative newcomer to the portfolio Twitter (NYSE:TWTR) by 200% with the purchase of 200,000 shares. The shares traded at an average price of $47.74 during the quarter. Overall, the purchase had a 1.67% impact on the portfolio and GuruFocus estimates the total gain of the holding at 84.35%.

Twitter is an open distribution platform for and a conversational platform around short-form text (a maximum of 280 characters), image and video content. Its users can create different social networks based on their interests, thereby creating an interest graph. Many prominent celebrities and public figures have Twitter accounts. Twitter generates revenue from advertising (90%) and licensing the user data that it compiles (10%).

On Feb. 25, the stock was trading at $76.46 per share with a market cap of $61.54 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rank of 3 out of 10. There are currently two severe warning signs issued for assets growing faster than revenue and a low Piotroski F-Score. The company saw a major decrease in cash flows and a negative net income coming out of 2020.

FirstEnergy

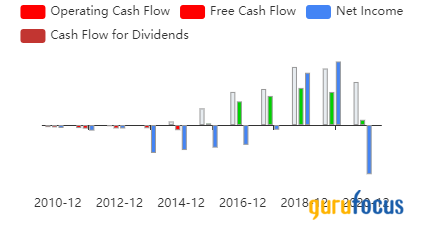

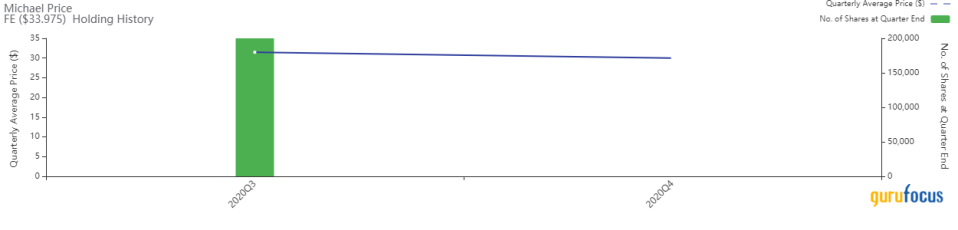

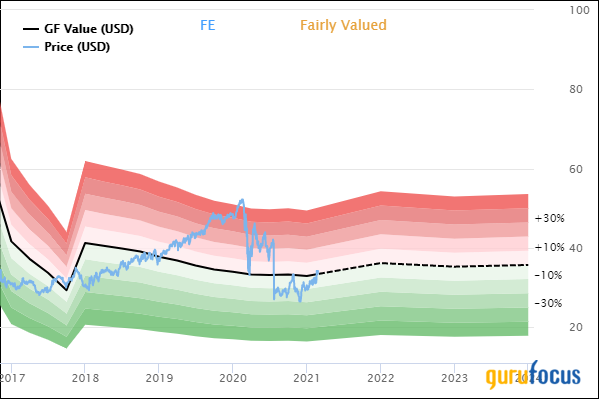

The guru sold out of FirstEnergy (NYSE:FE) to round out his top five trades. The 200,000 shares that were purchased in the third quarter of 2020 were sold at an average price of $29.99 per share. The sale had an impact of -1.04% on the portfolio overall and GuruFocus estimates the guru lost 4.70% on the holding overall.

FirstEnergy is one of the largest investor-owned utilities in the United States with 10 distribution utilities serving 6 million customers in six mid-Atlantic and Midwestern states. FirstEnergy also owns and operates one of the nation's largest transmission systems with more than 24,500 miles of lines.

As of Feb. 25, the stock was trading at $33.90 per share with a market cap of $18.41 billion. The shares are trading at fair value according to the GF Value Line.

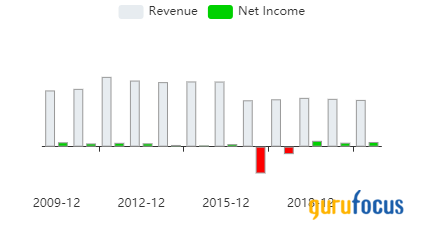

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 4 out of 10. There are currently four severe warning signs issued, including poor financial strength and declining revenue per share. Revenue fell off after 2015, but the company has seen higher net income since 2018.

Disclosure: Author owns no stocks mentioned.

Read more here:

Value Investing Live Recap: David Marcus

Steven Cohen's Top 4th-Quarter Trades

Jim Simons' Firm's Top Trades of the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.