Michigan releases key tax forms for those who were jobless last year

More than 1.2 million taxpayers who received jobless benefits in Michigan last year can now move forward and file their 2021 tax returns after a three-week delay involving key paperwork.

The Michigan Unemployment Insurance Agency said Tuesday that those who filed jobless claims in 2021 can now view or download their 1099-G tax statements through the Michigan Web Account Manager known as MiWAM.

Many people have been looking in the mail for their 1099-G forms and now the state is indicating that those forms could arrive soon.

UIA said it began mailing paper copies of the 1099-G this week — roughly three weeks after the paperwork would normally have been released. Those who don't want to wait for the mail can access the information online.

The agency posted the 1099-G tax forms to the accounts of all claimants, even those who did not opt to receive that information electronically.

Tax professionals have heard plenty from upset tax filers in recent weeks who faced delays in getting their tax refund cash. They could not file their tax returns early, thanks to this unusual delay involving 1099-G forms in Michigan.

The state UIA missed the typical Jan. 31 deadline and warned then that 1099-G forms would be sent toward the end of February.

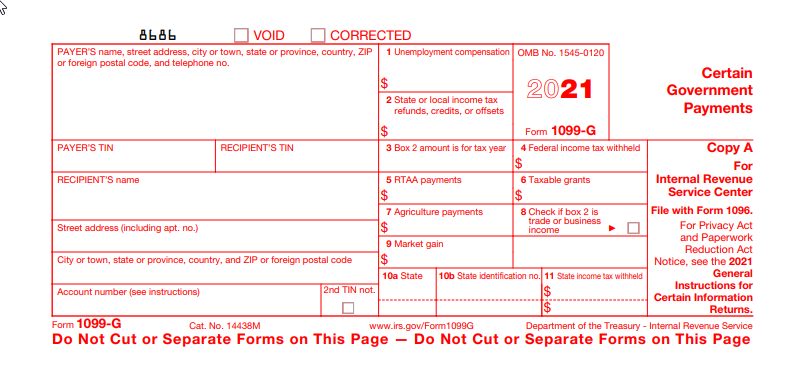

The 1099-G spells out how much a jobless worker received in unemployment benefits, as well as any income tax that might have been withheld the past year. The 1099-G or "Certain Government Payments" is a key piece of tax paperwork needed to file an accurate federal and state income tax return.

Unemployment compensation is treated as taxable income on the federal return and the Michigan income tax return.

More: Michigan jobless claimants won't get key tax form until end of February

More: 3 big issues could delay your tax refund in 2022: What to know

The state said additional processing time was necessary to ensure that information on the 1099-Gs was correct.

UIA said it had asked for and received an extension from the Internal Revenue Service for issuing the 1099-G forms this year. The state wanted more time to seek a resolution for a group of Michigan workers who received notices for overpayments and collection activity related to nonfraudulent claims filed during the pandemic.

The state offered the following steps for accessing the 1099-G electronically:

Log into MiWAM.

Click on the "I Want To" heading.

Click on the "1099-G" link.

Click on the 1099-G letter for the 2021 tax year.

For more information on how to download or read the form, go to UIA's Your 1099-G Tax Form webpage.

If you believe that your 1099-G is incorrect, the state says you may request a revised form by downloading and submitting Form UIA 1920, Request for Form 1099-G.

Taxpayers also are warned about potential fraud involving someone who used your ID information to claim unemployment benefits last year.

"If you received a 1099-G form, but did not apply for unemployment benefits last year, you may be the victim of identity theft," the state said.

"If you suspect that to be the case, click on the Report Fraud or Identity Theft link at Michigan.gov/UIA and fill out Form 6349, Statement of Identity Theft."

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: Michigan finally releases tax forms for those who were jobless in 2021