Microchips: Billions in subsidies — with strings attached

The smartest insight and analysis, from all perspectives, rounded up from around the web:

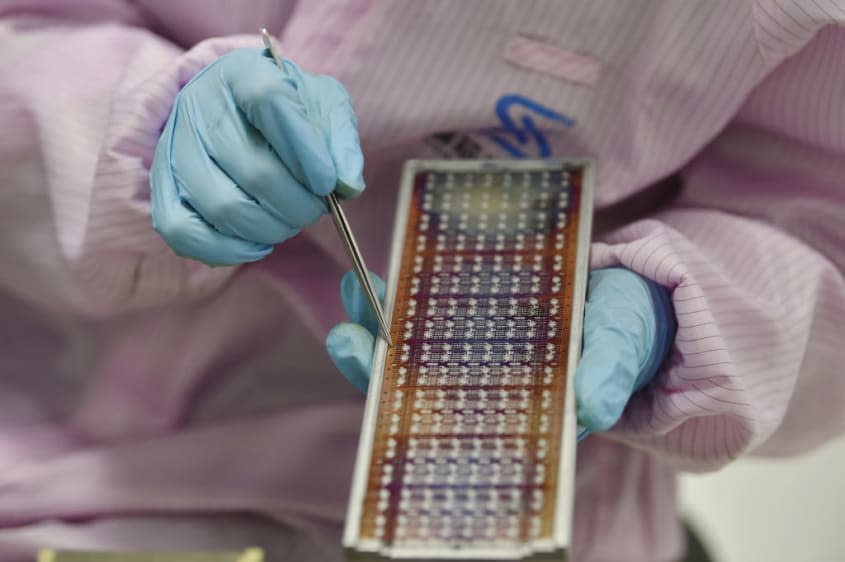

The Biden administration this week launched a much-anticipated $52 billion CHIPS Act with an "aggressive" series of rules that seek "to bend the behavior of corporate America," said Jim Tankersley and Ana Swanson in The New York Times. The legislation was passed last year, with bipartisan support, in hopes of reducing U.S. reliance on foreign plants for crucial components that are now essential in everything from computers to cars. The promised subsidies, though, will come with significant conditions. Companies that take the money will have to share a portion of their "upside" with the federal government, and preference will go to companies that avoid stock buybacks. Other requirements include new labor standards, and the provision of "high-quality" child care. "Championed by liberals," the rules may "set a fraught precedent for attaching policy strings to federal funding."

Even before the CHIPS Act program kicked into gear, said Yuka Hayashi and Asa Fitch in The Wall Street Journal, it had "triggered an investment boom" in the U.S. Foreign and domestic chipmakers have already announced more than 40 projects worth nearly $200 billion. The law combines $39 billion in direct subsidies for building chip plants with tax incentives, as well as research and workforce training, with the goal of creating at least two "leading-edge" semiconductor manufacturing clusters in the U.S. We currently have just 10 percent of the world's chip production and none of the world's most advanced factories.

What the U.S. is aiming for here is a "manufacturing moon shot," said Rana Foroohar in the Financial Times. The country's education system isn't set up for modern manufacturing, and to achieve its goals, the U.S. will need to "triple the number of college graduates in semiconductor-related fields" over the next decade. Dealing with an American workforce has already been one of the biggest challenges for TSMC, the world's most important chipmaker, said John Liu and Paul Mozur in The New York Times. Taiwan-based TSMC has committed to building a $40 billion plant in Arizona, but has already been plagued by "managerial challenges." Inside TSMC there are complaints that the project has yielded "very little benefit," with labor expenses, permits, and other costs "at least four times" higher than in Taiwan. "Political considerations" might have "forced" the semiconductor giant to set up a plant in Arizona in 2020, amid the "deepening battle between the United States and China." But at TSMC, "doubts are mounting," and some insiders now call the U.S. plant a "bad business decision."

"Government subsidies are never free," said The Wall Street Journal in an editorial, and manufacturers are just finding out the price here. The CHIPS Act is filled with the "social policy that was in the failed Build Back Better bill." It's littered with bureaucratic shibboleths, demanding, for instance, that chipmakers craft "child-care plans in tandem with community stakeholders." And if chipmakers manage to turn a profit, they will have to give the government its cut. These requirements "will do nothing to bolster national security, the ostensible purpose of the subsidies." But they do give the U.S. a chance to test the kind of government-managed industrial policy that has failed everywhere else.

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

You may also like

Biden unlikely to attend coronation of King Charles III, White House sources say

Camila Alves McConaughey describes 'chaos' on flight that 'dropped almost 4,000 feet'

Philippines says it spotted Chinese naval ship near disputed island