Middle class couples in Kansas will save little in flat tax plan. Here's who will benefit.

A new flat income tax plan up for debate in the House would primarily benefit poorer and richer Kansans while leaving middle class taxpayers with little savings.

Under the House Republican tax plan, a middle class married couple could save about $1 on their income taxes while poorer and richer Kansans could save hundreds of dollars.

The proposed 5.25% flat tax is part of a broader tax package in Senate Bill 169 crafted by the House Taxation Committee last week with pieces of proposals from Republicans and Democrats.

Eliminating the current progressive income tax framework has been a priority this session of Republican lawmakers and top lobbyists.

Kansas currently has three tax brackets. The first $15,000 for individuals and $30,000 for couples is taxed at 3.1%. The next $15,000 for individuals and $30,000 for couples is taxed at 5.2%. Any income above $30,000 for individuals and $60,000 for couples is taxed at 5.7%.

More:Kansas lawmakers hope tax cut plan will suit GOP legislators and Democratic governor

The Kansas Chamber had the first proposal, a 5% flat tax on both personal income and businesses with further tax cuts on banks and a provision for future cuts in the rate. That plan came with a cost of $3.4 billion over three years, which was almost immediately dismissed as a nonstarter for lawmakers.

The Senate followed with a 4.75% flat tax on personal income only, at a cost of $1.3 billion over three years. It passed 22-17.

The House started its plan at 4.97%, but moved to 5.25%, cutting the cost to $587 million over three years. The House was scheduled to debate its version on Tuesday, with a final vote possible later in the day or Wednesday.

How much would people save under a 5.25% flat tax?

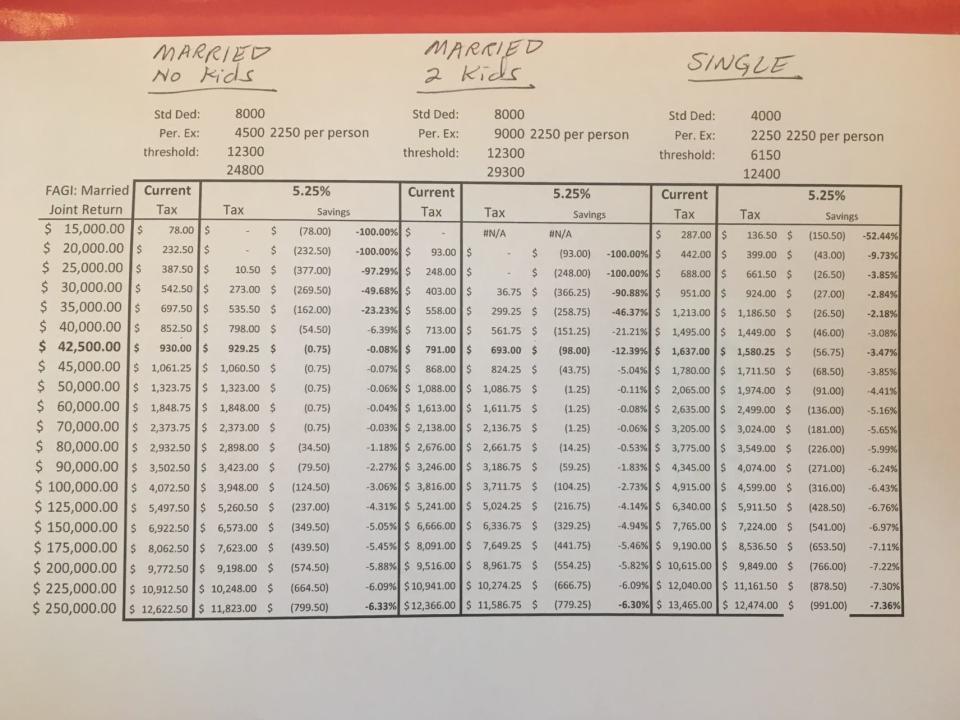

The Kansas Department of Revenue conducted an analysis of how various taxpayers would fair under a 5.25% flat tax when taking into consideration the standard deduction and the bill's exemptions. The exemptions of $6,150 are designed to prevent tax increases on lower income earners.

For a single taxpayer, the least benefit goes to people who earn $25,000 to $35,000 in federal adjusted gross income. They would save $26.50 in taxes a year, reducing their tax liability by about 3%.

People who earn $15,000 would see a substantive benefit, saving $150.5 on their tax bill, or about 52% of what they currently pay.

Tax benefits would increase for higher income earners. At $60,000, the savings are $136, or 5% of the tax liability. At $90,000, the savings are $226, or 6% of what they currently pay. At $150,000, the savings are 7%, or $541.

For a married couple filing jointly with no children, the least benefit goes to those with an income between $42,500 and $70,000. They would save 75 cents a year, amounting to less than 0.1% of their tax bill. For a couple with two children, families with an income between $50,000 and $70,000 would save $1.25.

Couples without children with an income of $25,000 would see about 97% of their tax bill eliminated, saving $377. If a couple with the same income level had two children, their entire $248 current tax liability would be eliminated.

At $80,000, a childless couple would save $34.50. A couple with two children would save $14.25.

At $100,000, a childless couple would save $124.50. A couple with two children would save $104.25.

At $150,000, a childless couple would save $349.50. A couple with two children would save $329.25.

At $250,000, a childless couple would save $799.50. A couple with two children would save $779.25.

This article originally appeared on Topeka Capital-Journal: New Kansas flat income tax plan has little benefit for middle class