Middle and low-income households struggling under Bidenomics | Opinion

- Oops!Something went wrong.Please try again later.

If you live in a middle- or low-income household, you are likely struggling and can feel that something is off in the economy. You would be right.

Since Biden took office, food prices have increased 20%. During this same time, according to the U.S. Energy Information Administration, gas prices skyrocketed 52.3%. Meanwhile, the Bureau of Labor Statistics reports that new car prices went up 21%. New car loans increased 14.7% and the average price of a used vehicle increased 33% as reported by Cargurus.com.

The National Association of Realtors paints an equally bleak picture in housing markets as sales prices increased 33% and mortgage payments rose 111%, more than doubling the monthly cost of shelter for home buyers − that is, if families can afford a home as the minimum income to qualify for a mortgage increased 100%.

Politicians trying to convince you that the economy is healthy will claim that since Biden took office in January 2021, we have had steady economic growth of 3% annually, as measured by gross domestic product (GDP); unemployment that has remained below 4%; and weekly earnings growth of 12.1% total for non-supervisory employees in the private sector.

Statistics don't describe everyday life of middle-class families

The alarming truth is that these numbers don’t describe everyday life for middle- and lower-class families.

While wages have increased 12.1% since Biden took office through last quarter, prices of goods and services increased 17.3%. Putting this in practical terms, this is like your household receiving a 4.2% raise each year while prices are increasing by 6%. You are losing ground.

How are middle-class consumers making ends meet? They’re borrowing, despite increasing interest rates. Credit card debt soared 34%. Auto debt increased 25.4%. Mortgage debt rose 18.3%, and other consumer loans increased 25.8%.

Producers feel the pinch, too. The prices they pay for commodities rose 29%, and their transportation costs increased 21%, forcing producers to increase the cost of goods to consumers.

Those aren’t the only burdens on the middle class.

Middle class squeezed by growing federal debt, inflation

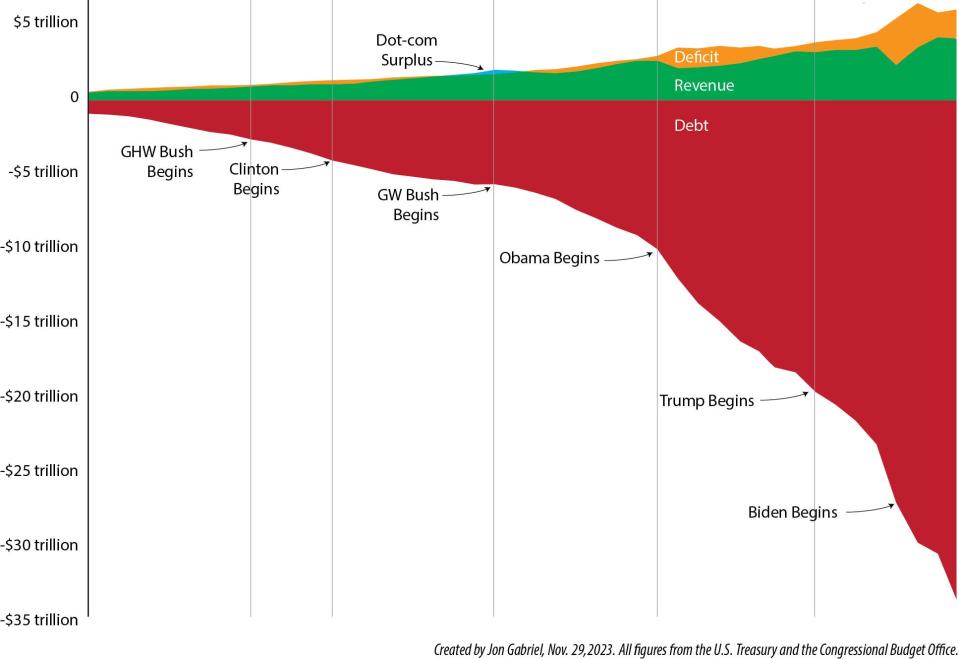

While prices have been skyrocketing, the federal government continues to take on more debt, increasing the debt burden by 20%. When Biden took office, the federal debt was $27.7 trillion and has risen to $33.2 trillion as of the third quarter in 2023.

In fact, federal debt has grown more than the economy since Biden entered the White House. From January 2021 through the third quarter of 2023, our economy increased its production of final goods and services by almost $5 trillion over 2020 baseline levels, but the federal government has accrued over $5.4 trillion in deficit spending. Typically, we take on debt to invest in production, with the expectation that production will grow more than the debt. We are still waiting to see that growth.

We’re at the highest debt level since World War II, as measured by debt-to-GDP ratios. Not only has our debt grown, but the yearly cost of that debt has grown due to higher interest rates.

Amassing debt is hardly a partisan issue as debt grew from $20 to $27.7 trillion during the Trump administration. However, the current debt load is stacked on top of substantial inflation and growing consumer debt, and make no mistake, middle- and lower-income workers will shoulder the costs of exorbitant government debt. They’ll eventually get squeezed by higher taxes, cuts in government benefits on which they depend, higher costs of goods and services from severe inflation, or some combination of all three.

We also have an ownership deficit.

The Bureau of Economic Analysis reports that the trade deficit for goods grew to $1.2 trillion in 2022, creating a double whammy for American households. American workers lose jobs when goods are produced overseas, and American consumers must spend their cash overseas to buy essential products, rather than buying in the U.S. Other nations and their citizens then take the money they have earned from us and use it to buy valuable American assets.

Foreign entities currently own $53,000 more in American assets per U.S. citizen than the U.S. owns in foreign assets, causing our citizens to have a negative net international investment position (NIIP) according to the International Monetary Fund. This is unique amongst developed nations that typically have a positive NIIP, such as Germany where it owns more assets abroad than foreigners own in Germany to the tune of $35,000 per citizen.

This means that when Germany, Japan, and other developed countries get into trouble with inflation or federal debt, they can sell assets internationally to make ends meet. American citizens also have the burden of significant inflation, large consumer debts, and crushing federal debt, but all we can claim internationally are mounting trade deficits and a debt of productive assets of $53,000 per person.

Wages haven't kept pace with rising costs

Focusing on growth in the economy, growth in wages, and low unemployment since Biden took office does not tell the full story: the middle class is hurting. Wages haven’t kept up with rising costs of food, gas, transportation, and housing, and consumer borrowing has increased to make ends meet.

The middle class faces high interest rates, increasing federal debt, large trade deficits that shift production and jobs overseas, and a greater debtor economy, with less of an ownership economy.

Next time you hear someone say our economy has recovered, ask yourself why the person isn’t telling the entire story. Is it any wonder, according to the Washington Examiner, that the Biden administration is bringing in misinformation "experts" to monitor news and social media in hopes of hiding negative economic facts, facts that tell the true stories of the hardships facing middle- and low-income families.

Charles Shor is the former president and CEO of Duro Bag and founder of the Charles L. Shor Foundation for Epilepsy Research. Unless otherwise indicated, all data is obtained from Federal Reserve Economic Data (FRED) at stlouisfed.org.

This article originally appeared on Cincinnati Enquirer: Bidenomics doesn't tell full story of hardships facing middle class