As Middletown prepares a proposal for a new school, a look at what it will cost taxpayers

MIDDLETOWN – The School Building Committee’s proposal to build a new combined junior-senior high school on the campus of the existing Gaudet Middle School, which has been endorsed by both the Town Council and the School Committee, would require the most significant property tax rate hike in decades.

Town Administrator Shawn Brown prepared a document and gave a presentation to the School Building Committee on Wednesday, Feb. 1 on the anticipated property tax impact of a proposed $190 million bond issue for the construction of a new combined junior-senior high school. He will deliver a similar presentation to the Town Council and the general public on Monday, Feb. 6. At that Town Council meeting, members of the public will also have the opportunity to ask questions and offer comment about the proposal.

Middletown schools:What's the plan for building new Middletown schools? Picture gets clearer

The town anticipates up to 52% of the bond eventually being reimbursed by the state, and Middletown Public Affairs officer Matt Sheley told The Daily News local lawmakers are looking into legislation to potentially increase that reimbursement rate to 60%. State Sen. Lou Dipalma confirmed the General Assembly is exploring possible legislation regarding state reimbursement rates and said he would have more information after some key meetings on Feb. 6.

Also on the docket of the Feb. 6 Middletown Town Council is a resolution “memorializing” the state General Assembly to enact legislation authorizing the issuance of $190 million in general obligation bonds on a 30-year amortization term to finance the new school project. Amemorializing resolution is a non-binding statement. It is a statement of intent or value that is not a law.

Consultants on the project presented at the Jan. 25 special Town Council meeting both 25-year and 30-year term amortization options to finance the project, with each scenario affecting the town and its taxpayers in slightly different ways. On a 25-year term, the town would make higher annual payments but would save approximately $20 million in interest over the lifetime of the bond.

How much would the school bond raise property taxes in Middletown?

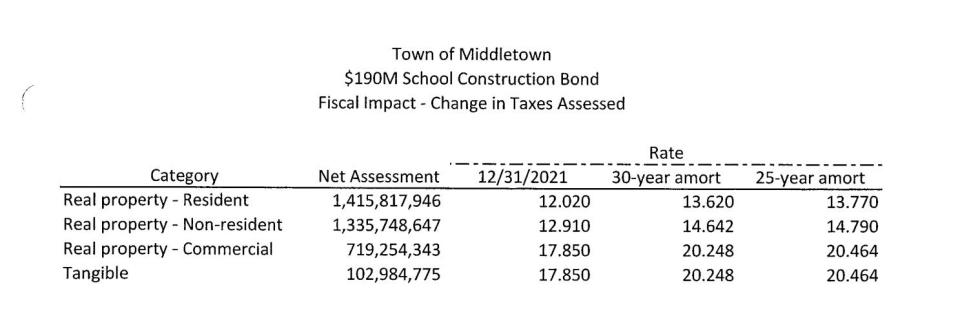

Middletown property owners pay different tax rates depending on the type of property they own, i.e. commercial versus residential, as well as their residency status. Residential property owners who are full-time residents of Rhode Island currently pay $12.02 per $1,000 of assessed value on a quarterly basis, meaning the owner of a home assessed at $300,000 currently pays $3,606 per year in property tax divided into four payments of $901.50.

If this bond is approved at a 30-year amortization, the residential property tax rate will increase to $13.62 per $1,000 of assessed value, meaning the owner of that $300,000 home would see their tax bill increase to $4,086 divided into four payments of $1,021.50.

Zane Wolfang can be reached at zwolfang@gannett.com

This article originally appeared on Newport Daily News: Middletown taxpayers to pay more for bond for new middle-high school