Mike Ashley's Sports Direct report a 160% rise in pre-tax profit

Sports Direct (SPD.L), owned by billionaire Mike Ashley, reported a 160% rise in pre-tax profits to £193.4m ($258.8m) for the six months to 27 October.

In its interim results statement, the retailing giant said that the huge pre-tax profits rise was significantly helped by the sale and leaseback of the Shirebrook distribution centre. It also said an improvement in its premium House of Fraser unit and its European retail business pushed results up further.

Meanwhile, its outlook looked rosy as the retailer said it was working on a resolution to a €674m bill from Belgium's tax authority, which it revealed in July, but that it would ultimately not lead to "material liabilities."

It also addressed the political machinations happening in Britain without directly citing them — the recent general election and Brexit.

“We are hoping that the political waters will be calmer in the coming months which will allow us to move out of this period of market unpredictability. This will enable us to plan appropriately for the future which is critically important,” Sports Direct said in a statement.

“Despite ongoing challenges, we believe we are getting into a good place, building a solid foundation of elevation and efficiency which will lead to sustainable growth and a successful future.”

Back in July this year, Mike Ashley said buying House of Fraser may have been a mistake as his group had problems integrating the House of Fraser department store business, after Sports Direct purchased out of administration for £90m in August 2018.

However, the group said in this round of results that:

“We are starting to see the green shoots of recovery as we continue to integrate the business into the Group. We are bringing new disciplines, experience and skills to bear which is helping the turnaround. Our Frasers strategy is to create a superior shopping experience for the consumer which will be led by the original Frasers. In the coming months and years, Frasers will prove to be a vital and successful part of the Group.”

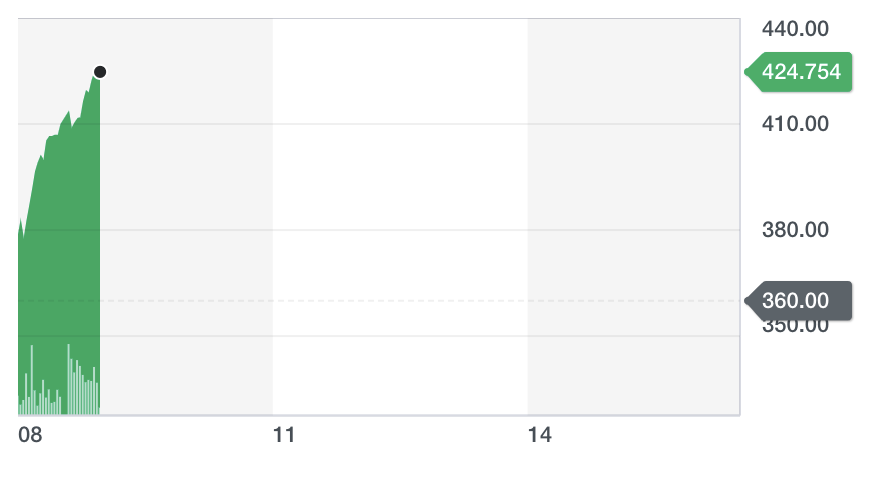

And investor are liking the turnaround — shares are up over 12%: