Milei Sets Up Argentina Privatizations for Airline, YPF

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- President Javier Milei took the first step to privatize state-run Argentine companies with a sweeping decree that opens the door for private business to take control of key sectors.

Most Read from Bloomberg

Bank of Russia Governor Says She Is Bracing for More Sanctions

Ethiopia Fails to Pay Coupon, Becoming Latest African Defaulter

Manchester United Saga Ends With $1.3 Billion Ratcliffe Deal

Milei — a libertarian who wants to shrink government and deregulate to flip the switch on Argentina’s crisis-prone economy — announced a slew of reforms Wednesday night that would allow tens of state-controlled firms, many of them money-losing, to be sold off.

“Repeal rules that impede the privatization of state companies,” Milei said in a televised message, listing the reforms in bullet points. He added that all state businesses would have their legal structure changed to fully clear the path to privatization.

Milei campaigned on this message, mentioning national airline Aerolineas Argentinas SA, rail networks, state media companies, and water and sewage company AySA as assets to be sold to private operators. He also said he’d target state-run oil driller and refiner YPF SA and energy company Enarsa after a “transition” period.

The only company Milei singled out in his announcement was Aerolineas, which the government has spent hundreds of millions of dollars a year to prop up. He said he’d authorized a handover of shares — likely to employees — and would at the same time free up Argentina’s uncompetitive air-travel market.

While Milei can seek to privatize companies by presidential decree, he’ll probably face pushback in congress, where his party is a minority, and may struggle to get enough votes to pass divestments through.

“I don’t see a scenario how this decree would be backed by congress,” said Paulo Farina, a partner at the Vis Viva consultancy firm in Buenos Aires. “It touches too many interests.”

With his privatization push, Milei mimics a similar policy pursued by ex-President Carlos Menem, the market-friendly leader of the 1990s who sold several strategic assets in an attempt to downsize government after a period of hyperinflation.

After a crippling crisis that peaked in late 2001, Argentina then opted to re-nationalize some companies in an era of leftist leaders. They took back AySa in 2006, Aerolineas in 2008 and YPF in 2012. Milei, intent on slashing public spending and subsidies, wants to undo all that.

“We’d take nearly a couple of years to privatize YPF,” Milei told Bloomberg News during the campaign. “Because the company has been destroyed and selling it today at market prices would be to give it away. We need it to manage the transition to putting the energy sector in order.”

YPF and other Argentine energy companies have struggled with heavy regulation to protect consumers from currency devaluations that drive inflation, curtailing their revenues and investments.

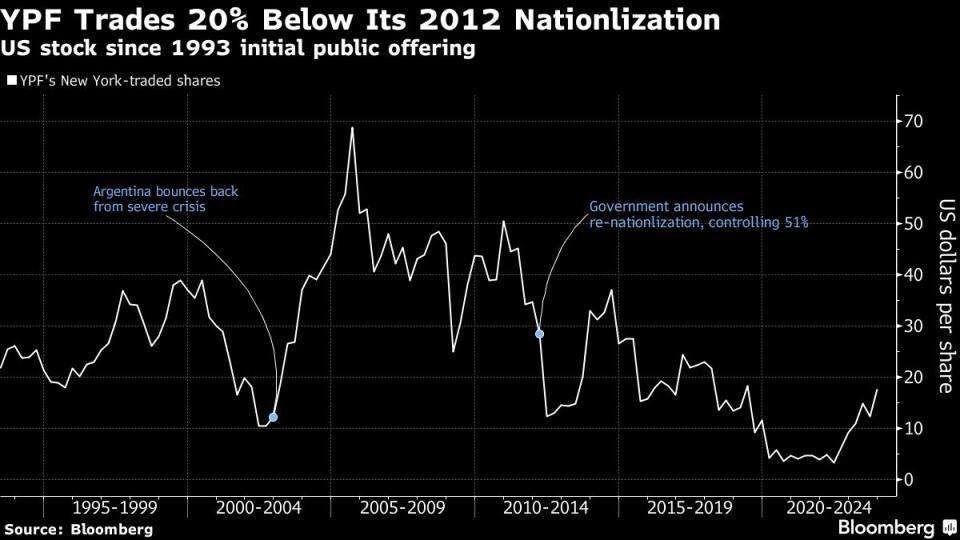

The state-run oil company’s New York-listed shares still trade about 20% lower than when the government seized it in April 2012, taking control from Spain’s Repsol SA — even after Milei’s electoral triumph last month produced big stock-market gains.

The stock jumped as much as 6.3% in early Thursday trading on Wall Street before paring back.

Complicating matters is a US court ruling earlier this year ordering Argentina to pay some $16 billion after it botched technical steps during the nationalization. The government has said it will appeal.

Nevertheless, YPF over the past decade has channeled its nationalistic role to successfully spearhead development of Argentina’s Patagonian shale riches, and it is leading plans for pipeline build-outs and liquefied natural gas exports.

Milei has tapped executives from the oil and steel empire of Argentine-Italian billionaire Paolo Rocca to lead YPF.

It may be harder to privatize YPF than some other companies since the 2012 nationalization law contains a clause requiring two thirds of congress to approve selling the government’s shares, rather than just a simple majority.

--With assistance from Juan Pablo Spinetto.

(Adds YPF share move in 13th paragraph.)

Most Read from Bloomberg Businessweek

What Dermatologists Really Think About Those Anti-Aging Products

What the Oldest Lab Rodents Are Teaching Humans About Staying Young

One Man’s Longevity Obsession Now Includes Fountain-of-Youth Injections

©2023 Bloomberg L.P.