'The Million-Dollar Taxpayers Club': Take a look at the highest-taxed Palm Beach estates

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Palm Beach has nearly two dozen homeowners who have been billed at least $1 million in local property taxes for 2023, according to a new analysis by the Palm Beach Daily News of the just-finalized tax rolls.

A staggering 23 residential taxpayers have found a spot in what the Palm Beach Daily News has dubbed “The Million-Dollar Taxpayers Club,” according to the tax rolls certified in October. (The full list is at the end of this article.)

Those tax bills are a direct response to the unexpected consequences of the coronavirus pandemic, which created a jet-fueled real estate market in uber-wealthy Palm Beach that sent sale prices and home values soaring over the past 3½ years. A similar upward trajectory applies to the town’s property taxes, which are directly tied to home values.

In pre-pandemic 2019, by comparison, just seven Palm Beach property owners found themselves billed for more than $1 million in property taxes — and that was a record-setting number at the time.

But some things haven’t changed on the latest list of the top taxpayers.

Once again, hedge-fund manager Ken Griffin of Citadel LLC and Citadel Securities dominates — by far — the highest-taxed list. It’s been the same story since he began assembling his Palm Beach estate in 2012, eventually spending more than $500 million on adjacent properties, according to the latest Palm Beach Daily News’ estimates.

This year, Griffin’s mostly vacant estate of about 27 ocean-to-lake acres on the South End has generated a combined tax bill of $10.12 million for the 2023 tax rolls. His estate’s overall market value was listed as $725.82 million.

Griffin, who lives in Miami, has raised the bar each year since he began buying land in Palm Beach.

FROM THE 2019 ARCHIVES: Fifty-nine Palm Beach owners billed at least $500,000 in local property taxes for 2019, a new record

Palm Beach County Property Appraiser Dorothy Jacks, whose office prepares the tax rolls, said she is becoming more and more accustomed to seeing Palm Beach real estate values set new records.

“I happily say that nothing surprises me in the Palm Beach real estate market anymore. Palm Beach is a special place, possibly unique in the country, possibly in the world,” Jacks said. “People (in Palm Beach) are willing to pay for their piece of paradise.”

In addition to the Palm Beach property owners who were billed at least $1 million in the new tax rolls, 10 others are facing bills between $900,000 and $1 million. And another 13 saw their properties generate bills of between $800,000 and $900,000.

In all, 104 Palm Beach taxpayers were mailed bills for $500,000 or more, the Daily News’ analysis found. In 2019, just 59 property owners were in that tax category.

The Palm Beach couple who ranked second on the taxpayer list are leveraged-buyout tycoon Nelson Peltz — chairman of the board of the Wendy’s fast-food chain — and his wife, Claudia. They were billed $3.07 million for their 13-acre oceanfront property, a North End estate they began assembling in 1987.

In third place — with a bill of $2.46 million — are investment manager Lewis Sanders and his wife, Alice, who completed their oceanfront mansion in 2021 on a lot they had owned since 2005.

MAR-A-LAGO MISTAKE: Oops! Eric Trump denies Mar-a-Lago sold for $422 million; Zillow admits listing error

And where does former President Donald Trump and his Mar-a-Lago Club rank on the list? He is among the 20 other top taxpayers in town whose bills total between $1 million and $2 million.

Trump’s Palm Beach bills — for his club, three adjacent private houses and an adjacent vacant parcel — tallied at $1.25 million in the new tax rolls, land the former president in 13th place on the list.

Mar-a-Lago's assessed value has become the stuff of controversy, thanks to a civil-court case playing out in New York. A judge there has said Trump consistently misled banks, insurance companies and other entities by vastly overvaluing his properties, including his private club in Palm Beach.

Trump, on the other hand, has variously claimed Mar-a-Lago is worth a minimum of $420 million and maybe as much as $1.5 billion, thanks to its historic mansion-turned-clubhouse on 17-and-a-half acres of ocean-to-lake land.

The judge based his valuation of the club on valuations — assigned by the Palm Beach County Property Appraiser — that are the starting point for determining any property’s taxes. The court looked at a range of the club’s valuations, from $18 million in 2011 to $27.6 million in 2021.

The property appraisers’ staff determined the club’s values using a standard formula called the “income approach,” a process dictated by longstanding deed restrictions that prevent Mar-a-Lago from being redeveloped or used for any purpose other than a private club, Chief Appraiser Cecil Jackson in Jacks’ office has told the Palm Beach Daily News. The club’s appraised value is then “capitalized” from its net income, as reported to the county appraiser in confidential documents.

This year, the income approach yielded an appraised value of $37 million for The Mar-a-Lago Club, according to the tax rolls. The club’s tax bill came in at a little less than $600,000.

JUST HOW VALUABLE IS MAR-A-LAGO? How much is Trump’s Mar-a-Lago worth? It depends on who you’re asking

In addition to Trump, other well-known names in The Million-Dollar Taxpayers Club include radio shock jock Howard Stern, fashion designer Tommy Hilfiger and Philadelphia Phillies principal owner John S. Middleton.

Yet even with such big-dollar tax bills, Palm Beach specifically and Florida in general continue to appeal to residents of states where the tax picture is far harsher, especially in the wake of the tax-reform package passed by Congress in late 2017, which eliminated the federal deduction for state and local taxes. Florida residents also benefit, comparatively, from the lack of a state income tax, a relatively low sales tax and the state’s limited tax on intangible property.

Palm Beach officials, meanwhile, actually lowered the town’s own tax rate this year by about 3% from 2022. In September, the Town Council set that rate at about $2.61 per $1,000 of a property’s taxable value.

But the town's portion makes up only a little more than 17% of each taxpayer’s total bill, which this year has an overall rate of $15.01 per $1,000 of a property’s assessed value after factoring in exemptions or tax caps for which a property owner might be eligible.

Other taxes are set by Palm Beach County and the School District of Palm Beach County, along with five other taxing authorities and districts. The tax revenue helps pay for town and county government services, schools, the South Florida Water Management District, the Children's Services Council and services provided by other taxing authorities.

As they have done consistently over the past several years, town officials set Palm Beach’s tax rate so that property owners with homestead exemptions would see no increase in their tax bills. Homestead exemptions are granted to residents who declare their homes to be their primary residences by meeting certain criteria.

Under Florida law, the assessed value that’s used to figure taxes for homesteaded properties typically can increase no more than 3% a year. The state statute also caps annual valuation increases at 10% percent for properties without homestead exemptions.

The vast majority of the taxpayers in The Million-Dollar Taxpayers Club, however, did not homestead their estates in the new tax rolls. Just six are taking a homestead exemption, records show.

The actual tax rate applied to the properties doesn't include assessments for solid waste removal and an ongoing town-run project to bury utility lines in Palm Beach. But the latter assessments are included in the final tax figures used to compile the Pam Beach Daily News’ list of taxpayers with the highest bills.

County Tax Collector Anne M. Gannon mailed the bills during the last week of October.

Look who's in 'The Million-Dollar Taxpayers Club'

Here’s the list of Palm Beach estate owners who have been billed at least $1 million in Palm Beach County property taxes for 2023. Total market values are based on the property appraiser’s evaluation for each property on Jan. 1, 2023. The list is presented in descending order of the tax bills.

1. Kenneth C. Griffin, hedge-fund manager

Tax: $10.12 million

1265 S. Ocean Blvd. (includes adjacent 1247 S. Ocean Blvd.; 1285 S. Ocean Blvd.; 1295 S. Ocean Blvd. and a vacant lot; and 1330 S. Ocean Blvd.; all owned through limited liability companies)

Total Market Value: $725.82 million

Taxable Value: $629.75 million

2. Nelson Peltz, leveraged-buyout mogul, and wife Claudia

Tax: $3.07 million

548 N. County Road (includes 542 N. County Road and a non-addressed property; all owned by and with homestead exemptions in the Peltzes’ names)

Total Market Value: $333.9 million

Taxable Value (with homestead exemptions): $147.8 million

3. Lewis Sanders, investment manager, and wife Alice

Tax: $2.45 million

615 N. County Road (owned by the Sanderses in their names)

Total Market Value: $173.99 million

Taxable Value: $153.2 million

4. Steven Schonfeld, hedge-fund manager, and wife Brooke

Tax: $1.81 million

1415 S. Ocean Blvd. (owned through a trust; homesteaded in Brooke Schonfeld’s name)

Total Market Value: $207.81 million

Taxable Value (with homestead exemption): $119.6 million

5. Scott Shleifer, private-equity specialist, and wife Elena

Tax: $1.72 million

535 N. County Road (includes a house at 210 Tangier Ave.; owned through a trust and a limited liability company; 535 N. County Road is homesteaded in the name of 535 NCR Land Trust)

Total Market Value: $116.86 million

Taxable Value: $112.81 million

6. John Paulson, hedge-fund manager

Tax: $1.71 million

1840 S. Ocean Blvd. (owned through a trust; homesteaded in Paulson’s name)

Total Market Value: $113.69 million

Taxable Value (with homestead exemption): $113.64 million

7. Henry Kravis, businessman and investor, and wife Marie-Josée Drouin

Tax: $1.62 million

700 N. Lake Way (owned through a limited liability company)

Total Market Value: $107.02 million

Taxable Value: $107.02 million

8. Linda Saville and homebuilder husband Paul

Tax: $1.6 million

515 N. County Road (owned through a trust; homesteaded in Linda Saville’s name)

Total Market Value: $123.89 million

Taxable Value (with homestead exemption): $106.24 million

9. Stephen Schwarzman, private-equity specialist, and wife Christine

Tax: $1.55 million

1768 S. Ocean Blvd. (includes adjacent lot at 1800 S. Ocean Blvd.; each owned through a limited liability company)

Total Market Value: $129.9 million

Taxable Value: $81.87 million

10. 1341 South Ocean Boulevard Trust

Tax: $1.45 million

1341 S. Ocean Blvd. (owned through a trust, with attorney Ronald S. Kochman as trustee)

Total Market Value: $98.62 million

Taxable Value (with homestead exemption): $96.3 million

11. Howard Stern, radio shock jock and television host, and wife Beth Ostrosky

Tax: $1.38 million

601 N. County Road (owned through a limited liability company)

Total Market Value: $109.24 million

Taxable Value: $77.84 million

12. Susie Phipps Cochran, artist

Tax: $1.33 million

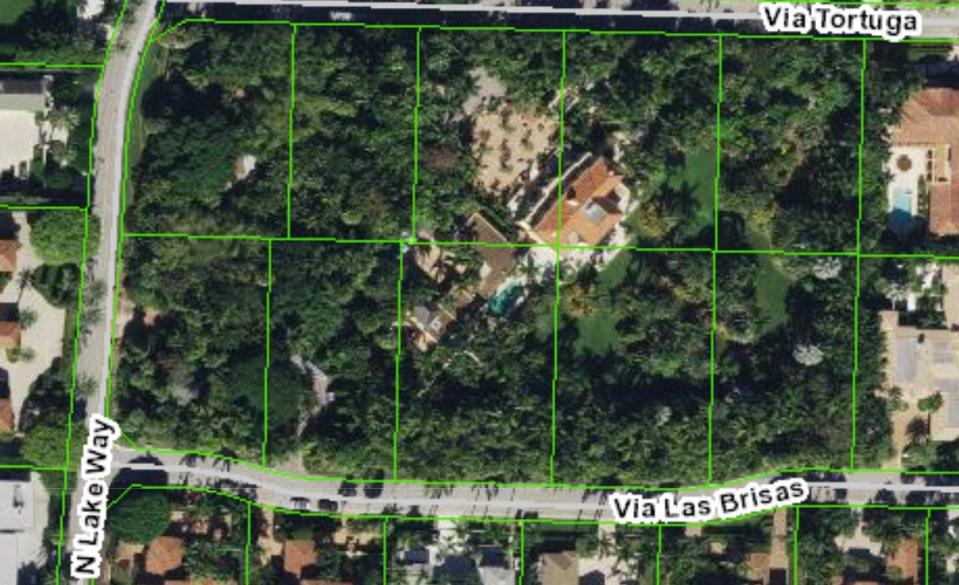

441 N. Lake Way (comprises 10 adjacent properties in Phipps Estates; owned through a corporation)

Total Market Value: $119.98 million

Taxable Value: $64.16 million

13. Donald Trump, former president and real estate investor, and Melania Trump, former first lady

Tax: $1.25 million

1100 S. Ocean Blvd. (The Mar-a-Lago Club, plus adjacent houses at 1094 S. Ocean Blvd., 124 Woodbridge Road and 1125 S. Ocean Blvd., including a non-addressed parcel on South Ocean Boulevard; owned by a corporation and limited liability companies)

Total Market Value: $89.27 million

Taxable Value: $69.46 million

14. Julia Koch, widow of industrialist and Koch Industries co-chief David Koch, and family

150 S. Ocean Blvd. (owned through a trust)

Tax: $1.22 million

Total Market Value: $116.71 million

Taxable Value: $53.75 million

15. Tommy Hilfiger and wife Dee Ocleppo Hilfiger, fashion designers

1930 S. Ocean Blvd.

Tax: $1.17 million

19 S. Ocean Blvd. (owned through a trust)

Total Market Value: $78.4 million

Taxable Value (with homestead exemption): $77.72 million

16. 10 Tarpon Island LLC

Tax: $1.16 million

10 Tarpon Isle (owned by a limited liability company managed by developer Todd Michael Glaser with investors Jonathan Fryd and Scott Robins)

Total Market Value: $76.91 million

Taxable Value: $76.91 million

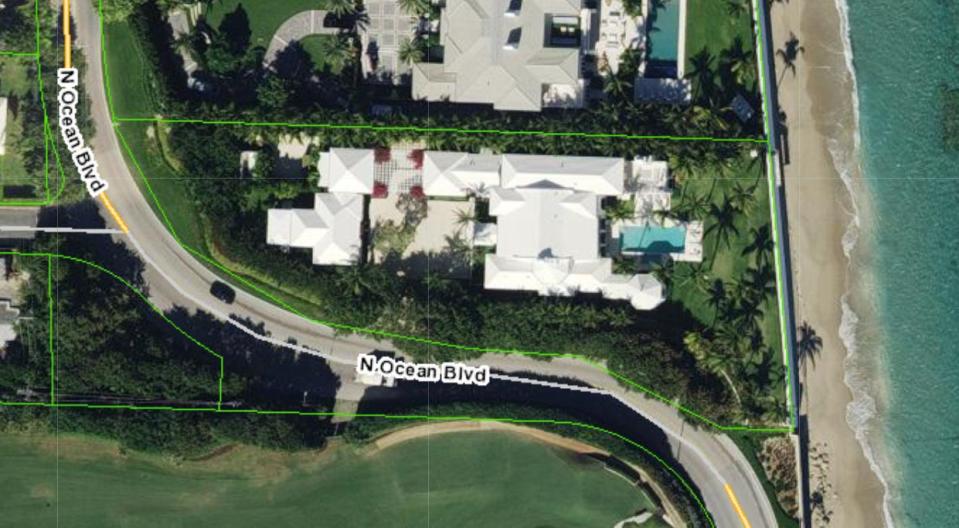

17. 901 NOPB Trust

Tax: $1.12 million

901 N. Ocean Blvd. (owned by trust, with attorney Paul A. Krasker as trustee)

Total Market Value: $74.31 million

Taxable Value: $74.31 million

18. Oceanside Palms Estate Corp.

Tax: $1.11 million

641 N. County Road (owned by a corporation, for which attorney Mario Gazzola serves as president)

Total Market Value: $84.05 million

Taxable Value: $65.4 million

19. Barbara Picower, widow of investor Jeffry M. Picower

Tax: $1.08 million

1410 S. Ocean Blvd. (owned by Barbara Picower in her name)

Total Market Value: $81.19 million

Taxable Value: $64.35 million

20. John S. Middleton, businessman and Philadelphia Phillies principal owner, and wife Leigh

Tax: $1.07 million

947 N. Ocean Blvd. (owned by a limited liability company)

Total Market Value: $94.41 million

Taxable Value: $53.72 million

21. Lamia Jacobs, businesswoman and former oil trader, and logistics-specialist husband Bradley

Tax: $1.03 million

100 Emerald Beach Way (owned through a limited liability company controlled by Lamia Jacobs)

Total Market Value: $82.04 million

Taxable Value: $58.18 million

22. Thompson Dean, private-equity specialist, and wife Caroline

Tax: $1.02 million

1485 S. Ocean Blvd. (owned by and with homestead exemptions in the Thompsons’ names)

Total Market Value: $67.84 million

Taxable Value (with homestead exemptions): $67.79 million

23. Paul Tudor Jones II, hedge-fund manager, and wife Sonia

Tax: $1.01 million

1300 S. Ocean Blvd. (owned by and with a homestead exemption in Paul Tudor Jones II’s name)

Total Market Value: $159.97 million

Taxable Value (with homestead exemption): $67.38 million

How we compiled our list of highest-taxed estates in Palm Beach

The list of Palm Beach estates with 2023 tax bills of more than $1 million was compiled by the Palm Beach Daily News from data posted on the Palm Beach County Tax Collector and Property Appraiser’s websites and other sources, including previous reporting by the Daily News. Total market values are based on the property appraiser’s evaluation for each property on Jan. 1, 2023.

Some estates comprise multiple parcels that are taxed separately in the county’s tax rolls. In those cases, the amount of the tax listed is the total for the properties involved. The list only includes such an estate if the separate parcels are adjacent or very near each other. Otherwise, the list does not include taxpayers who simply own more than one property in Palm Beach.

Every effort has been made to provide the names of owners whose identities are cloaked in public records behind corporate entities or trusts. Ownership information is drawn from property records, courthouse records and other resources. Properties with homestead exemptions also have been noted.

Tax bills were mailed during the last week of October and have a due date of March 31, 2024. County property owners are eligible for a discount if they pay their bills in full by the end of February. Those who pay before the end of November earn a 4% discount, which drops by 1% each month through February.

Property owners had until mid-September to file a dispute regarding the assigned valuation of their properties.

If you think we missed a Palm Beach estate with a total tax bill of $1 million or more, email dhofheinz@pbdailynews.com.

*

To view a photo slide show of the highest-taxed Palm Beach estates, click on the photo gallery at the top of this page.

*

Darrell Hofheinz is a USA TODAY Network of Florida journalist who writes about Palm Beach real estate in his weekly “Beyond the Hedges” column. He welcomes tips about real estate news on the island. Email dhofheinz@pbdailynews.com, call 561-820-3831 or tweet @PBDN_Hofheinz. Help support our journalism. Subscribe today.

This article originally appeared on Palm Beach Daily News: 23 Palm Beach estates' property-tax bills top $1M. Take a look.