Milwaukee's new sales tax is wrongly affecting some of its suburbs. Here's what to know.

The new Milwaukee city sales tax is showing up on the bills of some suburban residents, and now state and local officials are trying to fix it.

Suburban residents who share ZIP codes with the city of Milwaukee have reported being erroneously billed or charged the new 2% city tax, which went into effect Jan. 1, raising the sales tax from 5.9% to 7.9%. Milwaukee County's sales and use tax increased Jan. 1 from 0.5% to 0.9%, resulting in a total sales tax of 5.9%.

Members of the Intergovernmental Cooperation Council, a Milwaukee County coalition of leaders from the 19 municipalities in the county, discussed the tax issue Monday with a representative of the Wisconsin Department of Revenue.

Why is the tax appearing in the suburbs?

The Department of Revenue started alerting retailers in October about the sales tax change coming to the city of Milwaukee Jan. 1, encouraging businesses to look up the sales tax rate that corresponds with their property.

But residents and local leaders alike in Milwaukee County municipalities have been surprised to see some retailers charge them with the Milwaukee's city tax, despite making the purchase in their suburb's jurisdiction.

Glendale residents, for example, reached out to Mayor Bryan Kennedy Jan. 4 after noticing Netflix had apparently charged them with the Milwaukee sales tax in its most recent billing cycle. Most of Glendale lies in the 53209 ZIP code, which includes a piece of the city of Milwaukee and part of Brown Deer.

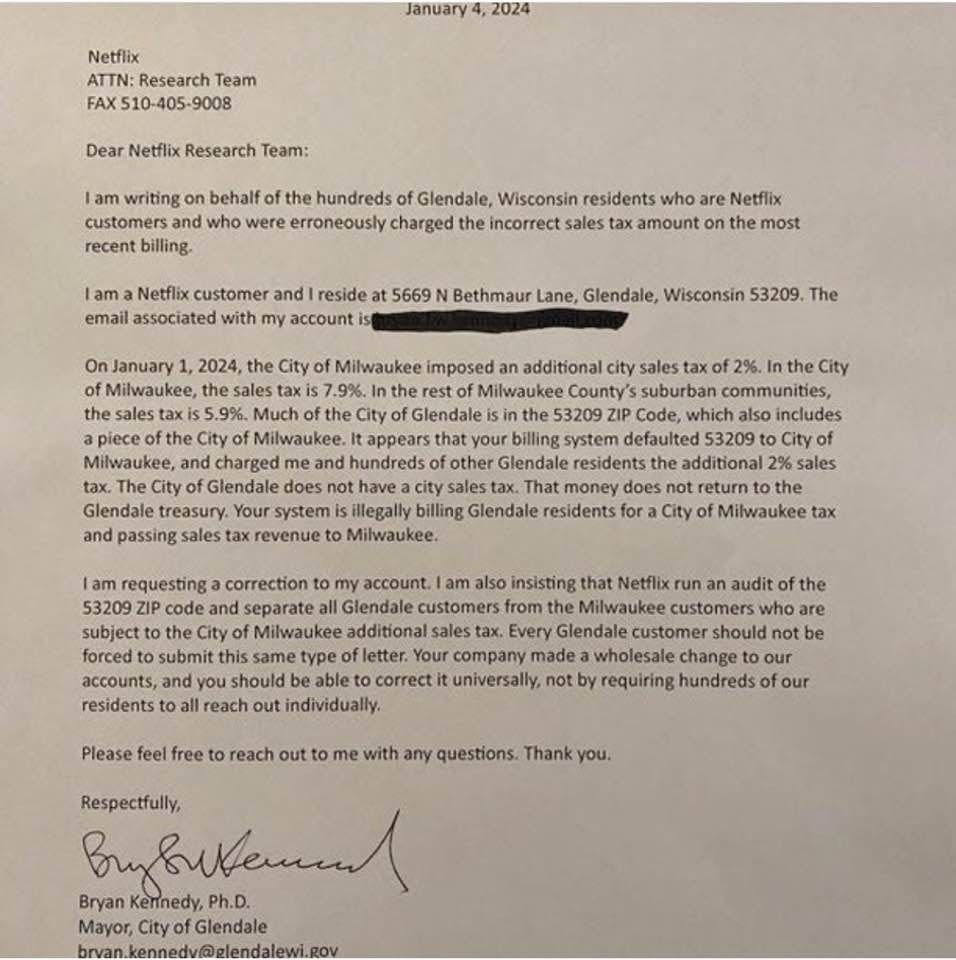

In a letter sent to Netflix's Research Team Jan. 4, Kennedy called for the subscription streaming service to investigate and correct the error on residents' accounts.

Although the City of Milwaukee's sales tax is now 7.9%, the sales tax for the rest of Milwaukee County's suburban communities, including Glendale, remains at 5.9%, he said in the letter.

While the overcharge for Netflix subscriptions may cost a few dollars a year, when added up amongst thousands of people in contiguous communities, the errors could cost residents a significant amount of money, Kennedy said.

Although in his letter, Kennedy said Netflix's error is "passing sales tax revenue to Milwaukee," Maria Guerra Lapacek, deputy secretary of the Wisconsin Department of Revenue, said that's not the case.

Any money found in a DOR audit not refunded to buyers will go to the state, not the city of Milwaukee, per Wisconsin state statute, she said.

Guerra Lapacek told ICC members that anyone who has been charged sales tax incorrectly should request a refund from the retailer.

Glendale and Netflix were "the tip of an iceberg," according to Kennedy, who reported hearing from other companies in other municipalities who told him their systems have been defaulting to Milwaukee's 7.9% sales tax.

Kennedy asked Guerra Lapacek how properties in his and other municipalities that border the city, like some on Capitol Drive, can know they're charging the correct sales tax.

"Typically, if the entrance to that retail location is in Glendale, that's a Glendale property," Guerra Lapacek said, adding that the DOR frequently works with businesses one on one to explain the sales tax rate their property should charge.

It's not only places right next to Milwaukee's border that have seen issues, according to Kennedy. He said businesses well within suburban municipalities' boundaries, including the Trader Joe's at Bayshore Mall, have charged the city's 7.9% sales tax.

A representative with Trader Joe's told the Journal Sentinel Tuesday they were not aware of the tax issue and could not comment.

Guerra Lapacek told ICC members some of the businesses billing erroneously may use third-party vendors to do sales tax calculation consulting and programming. In some cases, those vendors may not have the correct municipality listed for the business address.

The DOR doesn't know all third-party vendors businesses hire, but department representatives presented the sales tax changes in the fall to most tax practitioners in Wisconsin, like accounting and law firms, according to Patty Mayers, communications director with the DOR.

"We will continue to work with tax practitioners and retailers, so they can inform their third-party partners to make these changes," Mayer said in an email.

Michael Neitzke, mayor of the city of Greenfield, said municipal leaders in Milwaukee County have known since last summer when the tax increase passed that the issue of how sales tax is collected and how ZIP codes are arranged in Milwaukee County would adversely impact some municipalities.

Like Kennedy, Neitzke sees this as a larger issue, but his bone to pick is with what he calls an archaic postal code system and with companies that exclude smaller municipalities in their data. Even Apple and Google Maps misattribute locations in Greenfield to Milwaukee, he said.

In the ICC meeting, Neitzke showed members a packet he put together that included a history of ZIP codes in Milwaukee County and examples of times his personal address was listed by businesses and the post office as Milwaukee despite his residence being Greenfield.

“I don’t live in Milwaukee, Wisconsin. I am the mayor of Greenfield," he said. "I can’t live in Milwaukee.”

What is the Wisconsin Department of Revenue doing about erroneous Milwaukee sales tax payments?

Guerra Lapacek told the ICC the DOR has heard from Netflix that the streaming company will correct the over-taxing issue. She also said the DOR will provide ICC members with clear messaging to share in municipality newsletters and on websites to alert residents of the tax changes and how to ask for a refund when incorrectly taxed.

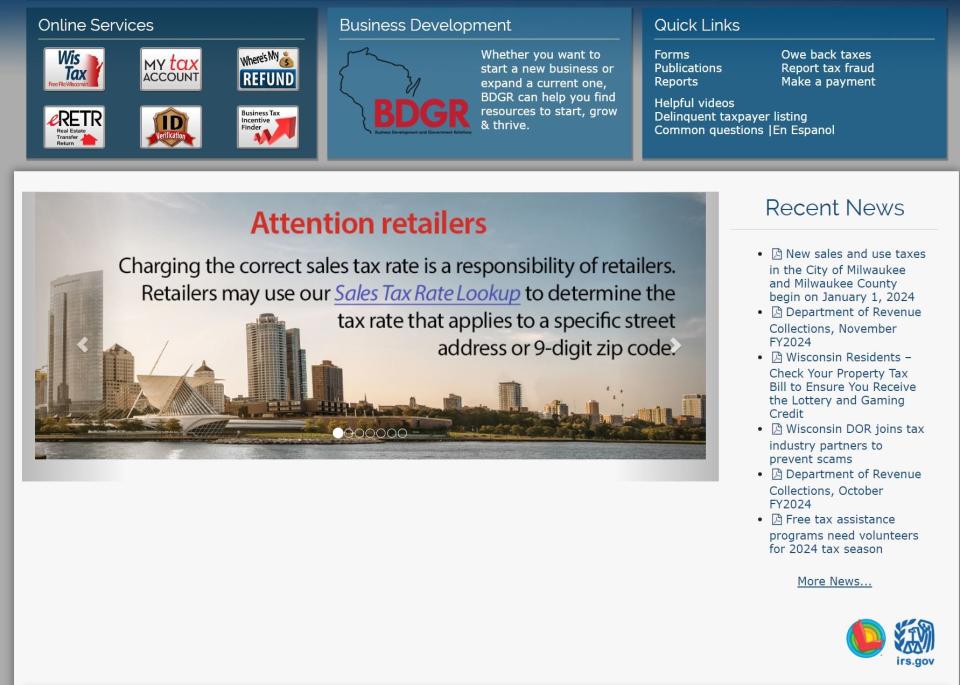

To determine the tax rate that applies to a certain street address or 9-digit ZIP code, businesses and residents should use the DOR’s Sales Tax Rate Lookup. As of the start of January, retailers and purchasers must use a street address with a 5-digit ZIP code to determine the proper jurisdiction and tax rate for a transaction, according to the DOR.

What are suburb municipalities doing about it?

At its regular meeting Jan. 8, the Glendale Common Council passed a resolution halting the collection of Milwaukee's sales tax in Glendale and calling upon the Department of Revenue to identify and refund those taxes.

Glendale wasn't the first suburb to pass such a resolution. In anticipation of the new tax, Greenfield’s Common Council passed a resolution Dec. 5 that halts any Milwaukee sales taxes and called upon the City of Milwaukee to take up the “burden that results in the collection of improperly and illegally collected sales taxes,” according to the resolution.

Neitzke also directed Greenfield's city attorney to prepare an injunction in the event that any Greenfield residents get charged for Milwaukee’s sales tax.

“I knew this was coming," Neitzke said. "Other cities knew this was coming. I don't know what a court will do with the injunction. But it just has to be figured out."

How to file a claim/get your money back

If you were erroneously charged the Milwaukee sales tax, DOR representatives say you should ask the retailer for a refund. You can also contact the DOR's Sales and Use Tax Section by phone at 608-266-2776 or online by using the form at DORSalesandUse@wisconsin.gov.

Use the DOR’s Sales Tax Rate Lookup to determine the tax rate that applies to a certain business by typing in the street address or 9-digit ZIP code.

Contact reporter Bridget Fogarty at bfogarty@gannett.com.

Contact Claudia Levens at clevens@gannett.com. Follow her on X at @levensc13.

This article originally appeared on Milwaukee Journal Sentinel: Milwaukee's new sales tax is being charged in places outside the city