Minneapolis Fed's Kashkari: Fed chair should 'say what he thinks we ought to do'

Minneapolis Fed President Neel Kashkari said Thursday that Federal Reserve Chairman Jerome Powell should be more forthcoming in his view on monetary policy, as the central bank faces a widening divergence of views among its members.

“My humble opinion is [Powell] should just say what he thinks we ought to do,” Kashkari told Yahoo Finance at the All Markets Summit event October 10. “We all have tremendous respect and admiration for Jerome Powell as a policymaker. And as our chairman, and if he wants to lead the committee in a direction I’m quite certain that he’ll have the support of the committee to follow him.”

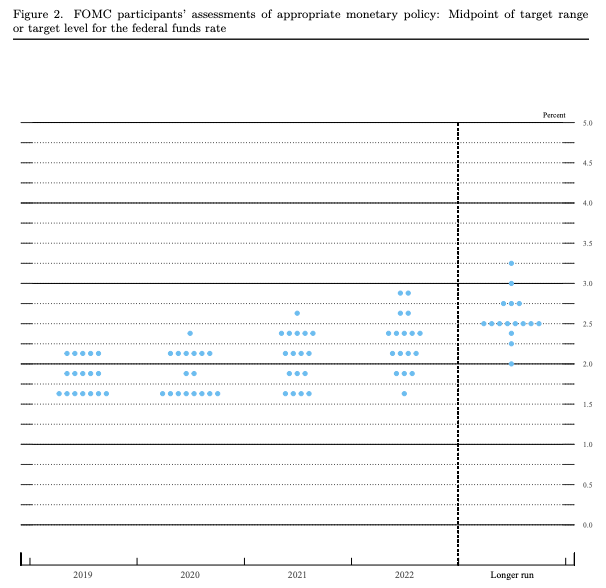

Kashkari said Powell has taken up the “real challenge” of representing the views of each of the 17 Federal Open Market Committee members without offering his own perspective. That range of views has never been larger under Powell. In the Fed’s last committee meeting, a record three members voted against the decision to cut rates by 25 basis points. One (St. Louis Fed’s James Bullard) called for a 50 basis point cut while two (Kansas City’s Esther George and Boston Fed’s Eric Rosengren) called for no change at all.

For his part, Kashkari has indicated he supported a 50 basis point cut in that meeting.

“I think it’d be easier for the chairman if he just said what he thinks instead of trying to represent what me and Eric Rosengren think when the two of us are on opposite sides,” Kashkari said.

As a reserve bank president Kashkari is a participant in the FOMC but not a voting member this year. Per the Fed’s rules, four reserve bank presidents rotate each year into a voting role. Each member is free to express their thoughts in meetings, but only voting members (Fed governors and the four designated Fed presidents) determine actual monetary policy decisions.

With a large divide on policy, Rosengren said some of these meetings can be “contentious.” Kashkari counters that he has never seen an FOMC meeting “get heated.”

“I think that we’re listening to each other,” Kashkari said. “There are a wide range of opinions, I’ve never seen them be contentious or heated in anyway but they are robust and vigorous discussions which is what you’d want.”

Kashkari said each FOMC member is given “two formal interventions” when discussing policy decisions, one on the economic outlook and the second on a specific policy recommendation.

Kashkari is one of the few Fed officials who actively communicates via Twitter. The Minneapolis Fed president not only shares photos of his newborn baby and commiserations over the Cleveland Browns, but also engages in discussions with Twitter users over Fed policy.

“In finance twitter, there are a lot of trolls,” Kashkari said. “I get my share of trolls who come after me regardless of what I say.”

The Fed has a “blackout” protocol that bars officials from speaking in the 11 days leading up to an FOMC meeting, meaning that Kashkari cannot tweet about Fed policy during that time. But other than that, Kashkari says the Fed has not cracked down on his Twitter account.

However, Kashkari said he’s been “encouraged” not to tweet before the statement comes out at 2 p.m. on the Wednesday of an FOMC meeting, even if it is unrelated to Fed policy. Kashkari said meetings sometimes end early and that if he tweets before 2 p.m. markets may notice that the Fed adjourned early.

“When we go into the meetings, all of our electronic devices are left in another room because we want to make sure that nobody can hack into those devices and listen in to our conversations,” Kashkari said.

Kashkari’s story underscores the tight lid the Fed has on leaks, which could disrupt financial markets.

The Fed’s next policy-setting meeting will take place Oct. 29-30.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Minneapolis Fed's Kashkari says rates are 'close to neutral' but 'slightly contractionary'

Dallas Fed's Kaplan: Yield curve was a 'reality check' for supporting earlier rate cuts

Central banks say negative interest rates have been 'effective'

Boston Fed's Rosengren: US economy 'consistent with staying where we are'

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.