Some mm2 Asia (SGX:1B0) Shareholders Are Down 48%

This week we saw the mm2 Asia Ltd. (SGX:1B0) share price climb by 18%. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 48% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for mm2 Asia

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, mm2 Asia actually saw its earnings per share (EPS) improve by 8.2% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

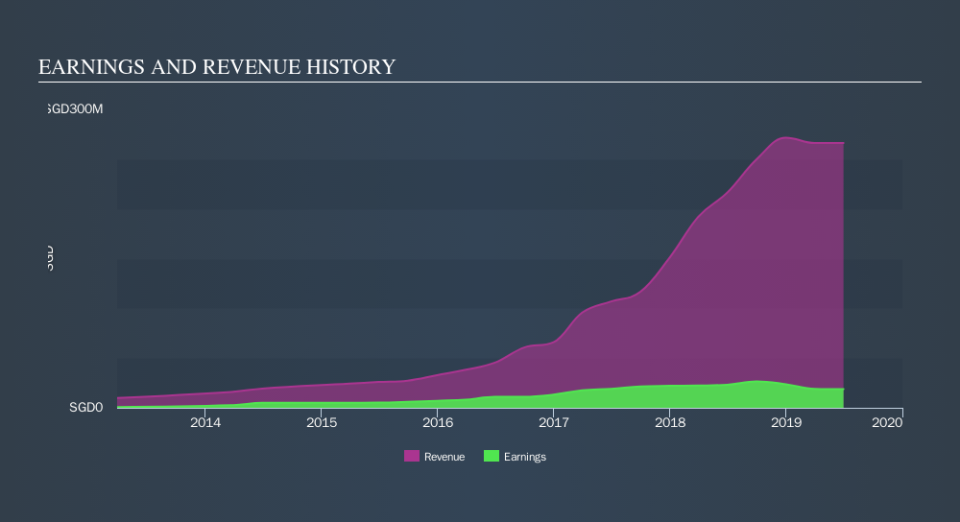

We note that, in three years, revenue has actually grown at a 53% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching mm2 Asia more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

mm2 Asia shareholders are down 43% for the year, but the broader market is up 4.3%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 19% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Is mm2 Asia cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.