Some Mohini Health & Hygiene (NSE:MHHL) Shareholders Have Copped A Big 60% Share Price Drop

Even the best stock pickers will make plenty of bad investments. And there's no doubt that Mohini Health & Hygiene Limited (NSE:MHHL) stock has had a really bad year. The share price has slid 60% in that time. We wouldn't rush to judgement on Mohini Health & Hygiene because we don't have a long term history to look at. Furthermore, it's down 30% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Mohini Health & Hygiene

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Mohini Health & Hygiene share price fell, it actually saw its earnings per share (EPS) improve by 47%. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

In contrast, the 12% drop in revenue is a real concern. If the market sees the weak revenue as jeopardising EPS, that could explain the lower share price.

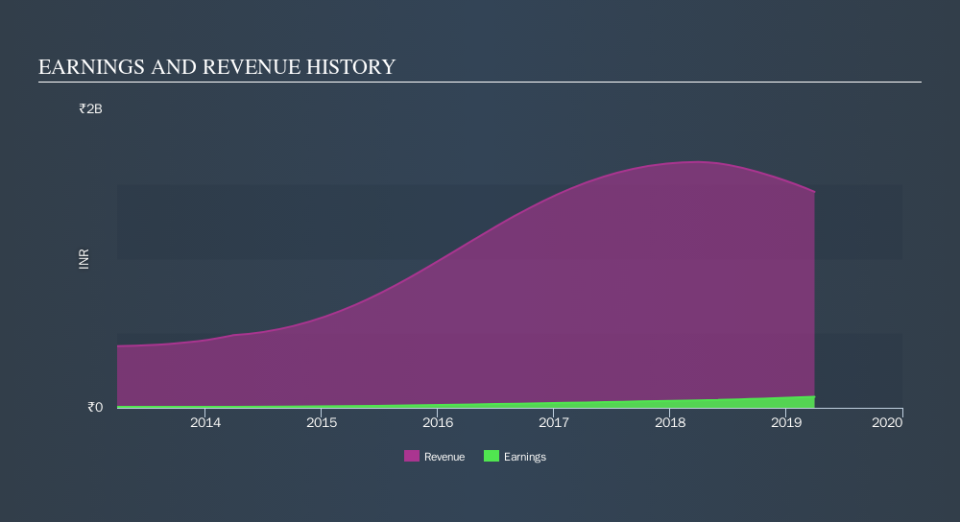

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Mohini Health & Hygiene stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We doubt Mohini Health & Hygiene shareholders are happy with the loss of 60% over twelve months. That falls short of the market, which lost 8.7%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 30% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before spending more time on Mohini Health & Hygiene it might be wise to click here to see if insiders have been buying or selling shares.

But note: Mohini Health & Hygiene may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.