The Momo (NASDAQ:MOMO) Share Price Has Gained 175%, So Why Not Pay It Some Attention?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While Momo Inc. (NASDAQ:MOMO) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 19% in the last quarter. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 175% compared to three years ago. It's not uncommon to see a share price retrace a bit, after a big gain. The thing to consider is whether the underlying business is doing well enough to support the current price.

See our latest analysis for Momo

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

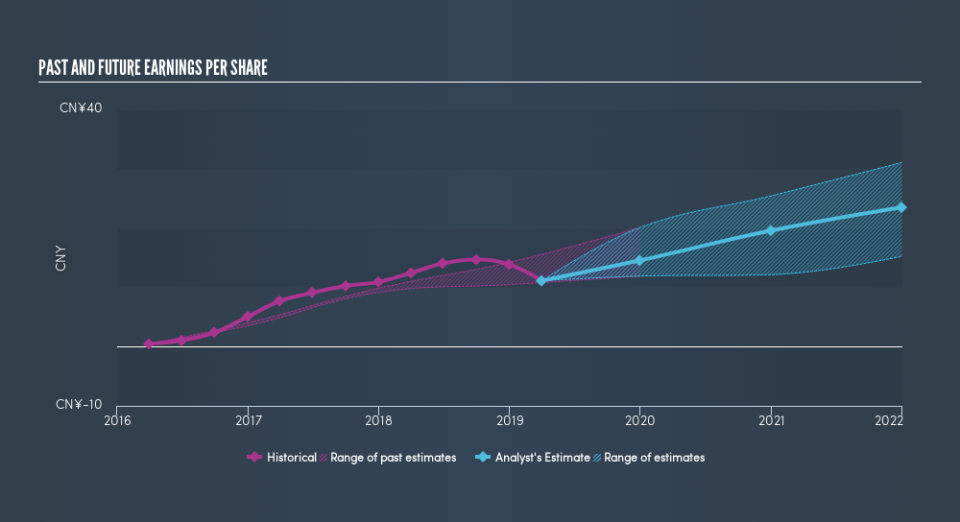

Momo was able to grow its EPS at 188% per year over three years, sending the share price higher. The average annual share price increase of 40% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Momo has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Momo's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Momo's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Momo hasn't been paying dividends, but its TSR of 179% exceeds its share price return of 175%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Over the last year, Momo shareholders took a loss of 39%. In contrast the market gained about 3.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 41% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before forming an opinion on Momo you might want to consider these 3 valuation metrics.

But note: Momo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.