Momo Options Bears in Overdrive as Stock Sinks

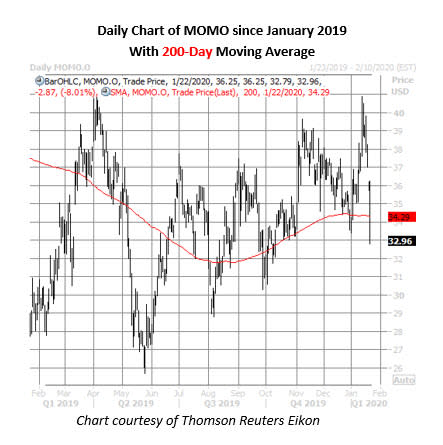

It's been a rough stretch for Momo Inc (NASDAQ:MOMO), with shares of the Beijing-based social media name pacing toward a fourth straight loss. This downside comes amid headwinds for Chinese stocks, which have struggled this week on fears of a coronavirus outbreak. Today, MOMO stock is down 8% at $32.96, breaching support atop its 200-day moving average.

This slide has sparked a rush of activity in MOMO's options pits, with roughly 19,200 puts and 9,200 calls on the tape -- six times what's typically seen, and volume pacing in the 99th annual percentile. The April 30 and 32 puts are most popular, and it looks like new positions are being purchased here. If this is the case, the goal is for Momo shares to sink below the strikes by April options expiration.

Today's put-skewed trading reflects a broader trend seen among Momo options traders. The security's front-month gamma-weighted Schaeffer's put/call open interest ratio (SOIR) sits at a top-heavy 1.35, meaning near-the-money puts outweigh calls among options expiring in the standard February series.

There are signs of growing skepticism seen elsewhere on Wall Street, too, with short interest spiking 20.5% in the latest reporting period. However, these pessimistic positions account for just 3% of MOMO's available float, meaning the bearish bandwagon is far from full.

Plus, all seven covering analysts maintain a "strong buy" rating on MOMO, and the average 12-month price target of $45.27 is a 37.2% premium to current trading levels. Should MOMO continue to slide, an extended short covering and/or a round of bear notes could exacerbate headwinds on the equity.