On The Money — Biden meets with Powell, turns focus to inflation

- Oops!Something went wrong.Please try again later.

The White House is launching a full-court press on inflation featuring a meeting with the Federal Reserve chair. We’ll also look at the president’s plan to bring down prices and the odds of recession.

But first, check out BTS’ appearance at the White House.

Welcome to On The Money, your nightly guide to everything affecting your bills, bank account and bottom line. For The Hill, we’re Sylvan Lane, Aris Folley and Karl Evers-Hillstrom. Someone forward you this newsletter? Subscribe here.

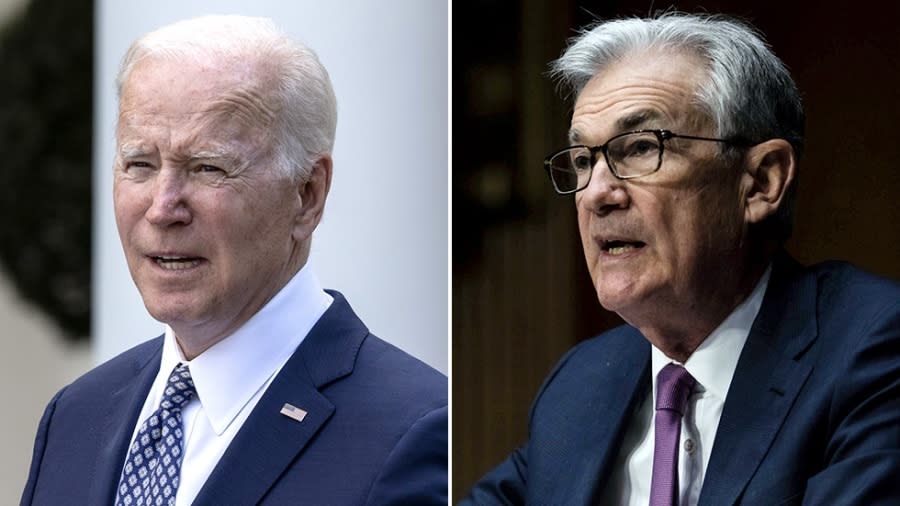

Biden urges respect for Fed in meeting with Powell

President Biden met with Federal Reserve Chair Jerome Powell at the White House on Tuesday and urged respect for the Federal Reserve Board amid high inflation.

“My plan is to address inflation, starts with a simple proposition: respect the Fed, respect the Fed’s independence, which I have done and will continue to do,” Biden said in the Oval Office.

Ahead of the meeting, Biden laid out a plan in a Wall Street Journal op-ed to fight inflation levels that are topping 8 percent annually and reaching nearly 40-year highs.

The gist of the plan is to get out of the way while the Fed raises interest rates to bolster the purchasing power of the dollar while supporting damaged supply chains to make sure that demand for goods doesn’t outpace their supply.

The plan also talks about bringing down demand by continuing to reduce the federal deficit, which is projected to fall by $1.7 trillion this year, something the White House is happy to show off as a win.

Biden called addressing inflation his top priority in the meeting, which also included Treasury Secretary Janet Yellen and National Economic Council Director Brian Deese.

“Chair Powell and other members of the Fed have noted at this moment they have been laser focused on addressing inflation like I am and with a larger complement of board members now confirmed,” Biden said.

The Hill’s Alex Gangitano and Tobias Burns have more on the meeting here.

FIVE FOR FIGHTING INFLATION

Five takeaways from Biden’s inflation plan

The goal for both Biden and the Fed is a “soft landing” — meaning a drop in prices for American consumers without a drop in overall economic growth. Whether or not they can thread this needle, Biden is emphasizing aspects of the recovery from the pandemic that further his economic agenda. Here are a few of the key takeaways from his plan:

Biden needs the labor market to cool and is depending on the Fed: Unemployment is now at 3.6 percent, which has led to growth in nominal wages, up well over 5 percent since last year. But economists say that without higher unemployment rates, or what they call a “looser” labor market, it will be difficult for consumer prices to come down

Biden talks a lot about deficit cuts: While economists say that deficit reduction is a way to lower demand for goods and thereby decrease inflation, greater revenues are still only a theoretical fix at this point since they require approval from Congress.

Biden wants to do something on housing: People are worried about finding a place to live and are seeing rents and home prices rise. Mortgage rates on the standard 30-year fixed rate mortgage have gone above 5 percent for the first time since 2011 and the share of homes owned by commercial property companies, or professional landlords, is on the rise.

Read the other takeaways here from The Hill’s Tobias Burns.

EVEN ODDS

Top Moody’s economist puts ‘even odds’ on recession in next two years

The chief economist for Moody’s Analytics on Tuesday said there was a one-in-three chance of an economic recession this year and “even odds” within two years.

“I would put the odds of a recession beginning in the next 12 months at about one in three, and probably close to even odds over the next couple of years,” Mark Zandi, chief economist at Moody’s Analytics, said Tuesday on C-SPAN.

Economists have offered various views on the likelihood that the Federal Reserve’s efforts to fight inflation will result in a recession, with the Fed itself conceding that a “soft landing” could be difficult, though is still possible.

Analyses from other economists, including Larry Summers, a Harvard Kennedy School professor and former U.S. Treasury secretary, mirror Zandi’s predictions about a looming recession.

The Hill’s Hannah Schoenbaum has more here.

ENERGY WAR

Russia expands Europe gas supply cutoffs

Russia is cutting off additional supplies of natural gas to Europe — this time impacting countries including Germany — as the continent moves ahead with its own ban on Russian oil.

Russian company Gazprom said in Telegram posts on Tuesday that it would cut off gas supplied under a contract with Shell to Germany and under a contract with Danish company Ørsted and Dutch company GasTerra BV.

The companies all said in statements that they would purchase gas from elsewhere. Shell spokesperson Curtis Smith said via email that the company has “access to a diverse portfolio of gas from which we will continue to supply our customers in Europe.”

The announcements represent an escalation in an ongoing energy battle between Russia and Europe as the European Union and its allies continue to sanction Russia over its invasion of Ukraine.

The situation has spiked global oil prices, increasing the cost of gas in the U.S. and around the world.

The Hill’s Rachel Frazin has more here.

Good to Know

Americans’ confidence in the economy has plummeted to a new low, hitting likely the lowest confidence since the end of the Great Recession in early 2009, according to a new Gallup poll released on Tuesday.

Gallup’s Economic Confidence Index (ECI) measured -45 in May, which is down from -39 in each of the past two months.

Here’s what else we have our eye on:

Almost 60 percent of borrowers with loans from the Department of Education did not make any payments on their loans during a freeze officials instituted in response to the COVID-19 pandemic.

A top aide to Sen. Bernie Sanders (I-Vt.) on Tuesday called Sen. Joe Manchin (D-W.Va.) a “phony” after the West Virginia senator called for action to lower drug prices.

That’s it for today. Thanks for reading and check out The Hill’s Finance page for the latest news and coverage. We’ll see you tomorrow.

For the latest news, weather, sports, and streaming video, head to The Hill.